Assessing Luckin Coffee (OTCPK:LKNC.Y) Stock’s Valuation After Its 1-Year 49% Rebound

Luckin Coffee (OTCPK:LKNC.Y) has quietly turned into a long term comeback story, with the stock up roughly 49% over the past year even after a choppy past 3 months.

See our latest analysis for Luckin Coffee.

Even with an 8.75% 1 day share price return lifting the stock back to $34.8, the 30 day and 90 day share price returns are still negative. However, the 1 year total shareholder return of 49.1% suggests the longer term momentum story remains very much intact.

If Luckin’s rebound has you thinking about what else could surprise on the upside, this is a good moment to explore fast growing stocks with high insider ownership.

Yet despite double digit revenue and profit growth and a sizeable gap to analyst price targets, investors have recently turned cautious. So is Luckin still trading below its true potential, or is the market already baking in its next chapter?

Most Popular Narrative Narrative: 29.9% Undervalued

With the narrative fair value sitting well above Luckin Coffee’s last close of $34.8, the valuation case leans on robust long term expansion dynamics.

The rapid pace of store expansion, especially growth in both high tier and lower tier Chinese cities, combined with persistent urbanization and rising middle class incomes in China, is likely to continue driving strong top line revenue growth as Luckin increases its retail footprint and captures a still untapped market.

Curious how this growth engine translates into the projected earnings path and future profit multiple that underpin that fair value target? The narrative’s model leans heavily on sustained double digit revenue compounding, resilient margins and a forward valuation usually reserved for market leaders. Want to see which assumptions really carry the weight in that calculation? Read on to uncover the numbers behind the story.

Result: Fair Value of $49.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, surging delivery costs and potential store overexpansion could quickly erode margins, challenging assumptions behind both Luckin’s growth trajectory and potential valuation upside.

Find out about the key risks to this Luckin Coffee narrative.

Another View: Market Multiple Sends a Different Signal

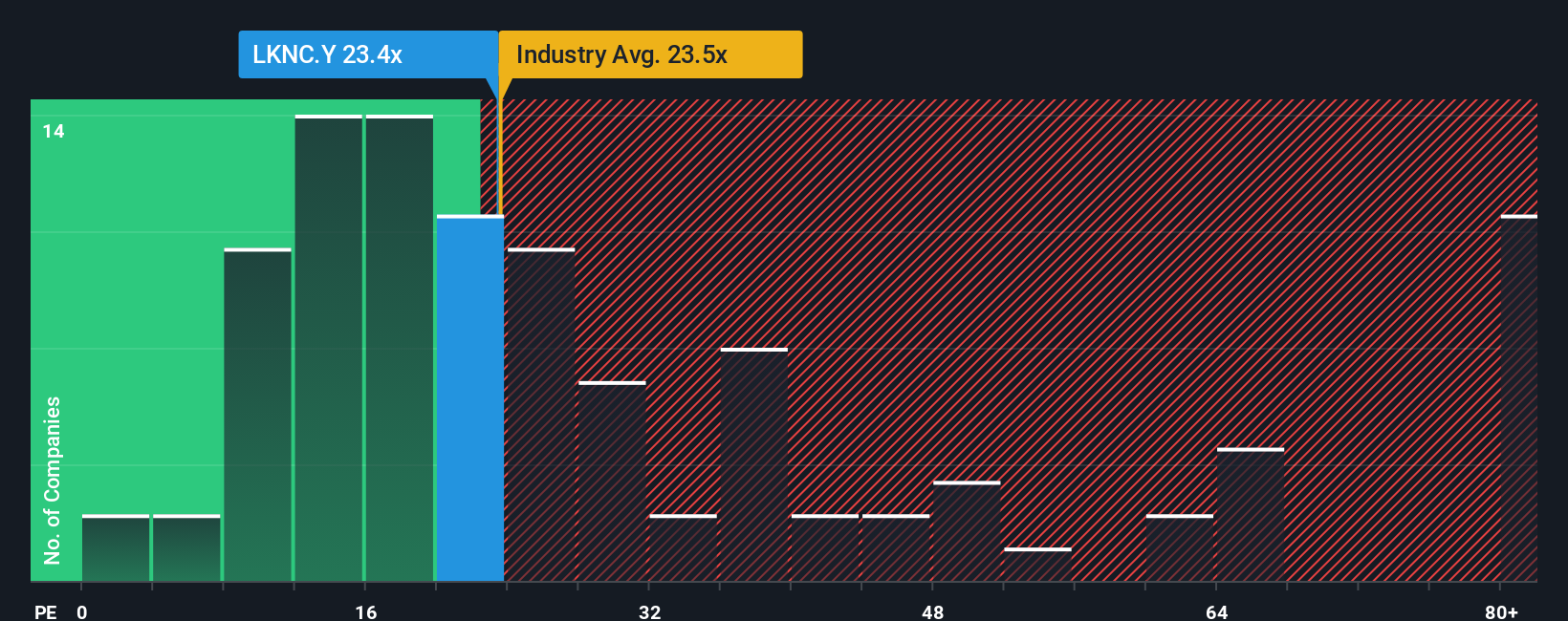

Our ratio based view is far less enthusiastic. Luckin trades on a 20.1x price to earnings ratio, below the US Hospitality average of 24.1x and well under a 26.3x fair ratio that the market could eventually move toward. However, our DCF fair value sits lower at $29.42, implying the shares may already be pricing in plenty of growth.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Luckin Coffee for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Luckin Coffee Narrative

If you see the story differently or want to stress test the assumptions yourself, you can build a personalised narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Luckin Coffee.

Looking for your next investment move?

Do not stop with one opportunity. Use the Simply Wall Street Screener to pinpoint fresh ideas that match your strategy before the market wakes up.

- Capture momentum in future tech by targeting these 26 AI penny stocks that are turning artificial intelligence breakthroughs into real, scalable revenue growth.

- Lock in potential income streams with these 12 dividend stocks with yields > 3% that combine attractive yields with businesses built to support consistent payouts.

- Position early in structural mispricing by focusing on these 913 undervalued stocks based on cash flows where cash flow strength is not yet fully reflected in the share price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal