Has the Recent Block Share Rebound Created a Fresh Opportunity for Investors in 2025?

- If you are wondering whether Block is a beaten down opportunity or a value trap at today’s price, you are not alone. In this article, we are going to unpack what the market might be missing.

- After a rough stretch, with the stock still down about 26.5% year to date and 27.0% over the last year, the recent 8.3% gain over the past month and a modest 0.8% move in the last week suggest sentiment may be starting to shift.

- Investors have been digesting a stream of headlines around Block’s push deeper into digital payments, its growing Cash App ecosystem, and the ongoing regulatory scrutiny that comes with being a key fintech infrastructure player. Together, these themes have kept expectations high while also raising questions about how much risk is already baked into the share price.

- Right now Block scores a 3/6 valuation check. This means it looks undervalued on half of the metrics we track and fairly or fully valued on the rest. That combination makes it a strong candidate for testing different valuation lenses. Later on, we will dig into an even more holistic way to think about what the stock is really worth.

Find out why Block's -27.0% return over the last year is lagging behind its peers.

Approach 1: Block Excess Returns Analysis

The Excess Returns model looks at how much profit Block can generate above the minimum return investors demand on its equity, then capitalizes those surplus profits into a per share value.

In this framework, Block starts with a Book Value of $36.94 per share and a Stable Book Value forecast of $41.89 per share, based on weighted estimates from 8 analysts. Those same analyst expectations imply Stable EPS of $3.91 per share and an Average Return on Equity of 9.33%, while investors require an estimated Cost of Equity of $3.24 per share. The difference between what Block is expected to earn and what it must earn to compensate shareholders is the Excess Return, around $0.67 per share.

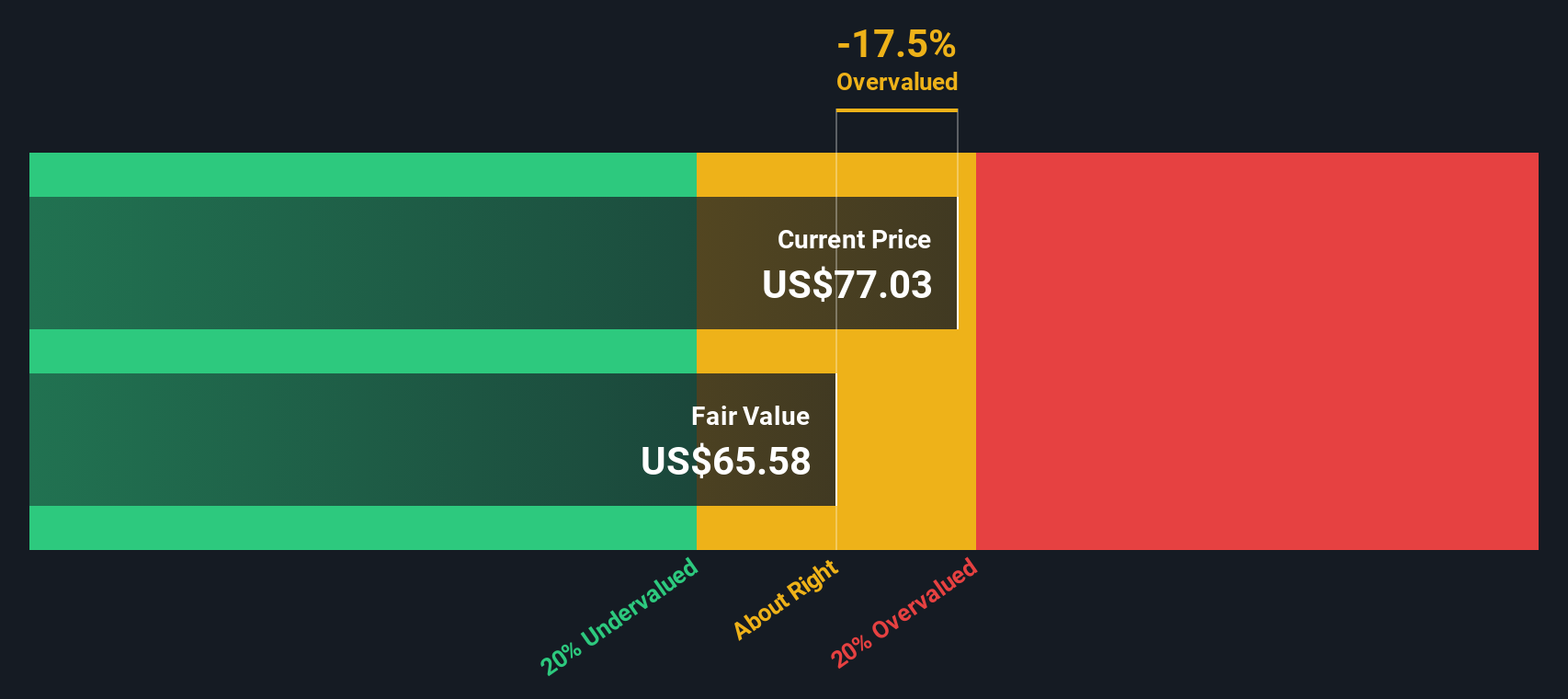

By projecting these excess returns over time and discounting them, the model arrives at an intrinsic value of about $56.80 per share. With the Excess Returns valuation indicating the stock is roughly 12.3% above this estimate, Block screens as modestly overvalued rather than a clear bargain at current levels.

Result: OVERVALUED

Our Excess Returns analysis suggests Block may be overvalued by 12.3%. Discover 913 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Block Price vs Earnings

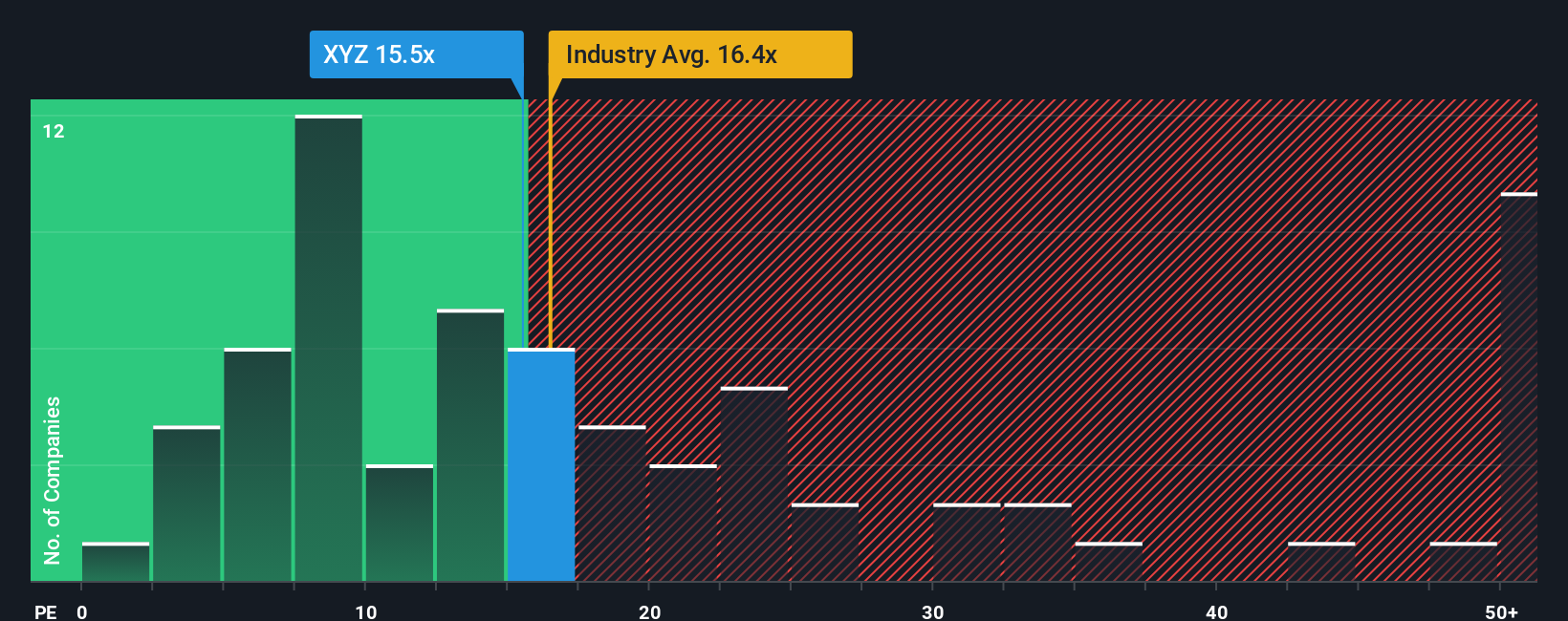

For a company like Block that is generating positive earnings, the price to earnings ratio is a practical way to gauge how much investors are paying for each dollar of profit. It captures, in a single number, the market's view on both current profitability and the sustainability of that performance.

What counts as a fair PE ratio depends heavily on growth prospects and risk. Faster earnings growth and more predictable cash flows can justify a higher multiple, while slower or riskier profiles deserve a discount. Block currently trades on a PE of about 12.4x, slightly below the Diversified Financial industry average of 13.6x and far below the broader peer group, which sits around 59.0x.

Simply Wall St’s Fair Ratio offers a more tailored lens. It estimates a fair PE of 19.0x for Block, based on its earnings growth outlook, margins, risk profile, industry, and market cap, rather than relying on blunt peer or industry comparisons. Because this Fair Ratio incorporates company specific fundamentals, it can better distinguish between deserved premiums and unjustified discounts. With Block’s actual PE of 12.4x sitting well below the 19.0x Fair Ratio, the shares appear meaningfully undervalued on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1462 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Block Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Block’s story to a concrete forecast and fair value. A Narrative on Simply Wall St is your own storyline for the company, where you spell out what you think happens to Block’s revenue, earnings and margins, then see what that implies for fair value and how it compares to today’s price on the Community page used by millions of investors. Because Narratives are tied directly to financial forecasts, they help you decide whether Block looks like a buy, hold or sell by comparing your Fair Value to the current share price, and they automatically update when new data, news or earnings arrive so your view stays current without extra work. For example, one investor might build a bullish Block Narrative that leans toward the higher analyst targets around $104, assuming strong adoption of new Cash App and Square products. In contrast, a more cautious investor could anchor closer to the $35 bear case, expecting slower growth and more margin pressure. Both investors can immediately see how those different stories translate into numbers and decisions.

Do you think there's more to the story for Block? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal