The Bank of Japan is expected to raise interest rates to a 30-year high, and forward-looking guidance will become the focus of the market

The Zhitong Finance App learned that the Bank of Japan is expected to raise the benchmark interest rate to the highest level in 30 years on Friday, indicating that the confidence of decision makers in achieving the goal of stable inflation is growing. The market generally expects that after the two-day policy meeting, the Bank of Japan will raise the overnight lending rate by 25 basis points to 0.75%.

This is the first time that the Bank of Japan has raised interest rates since January of this year. Since two members of the committee have publicly called for interest rate hikes at the previous two meetings, the market expects this resolution to be passed by a full vote. If successful, this will be the first time that Governor Ueda Kazuo has received unanimous support from the board of directors on the interest rate hike during his tenure.

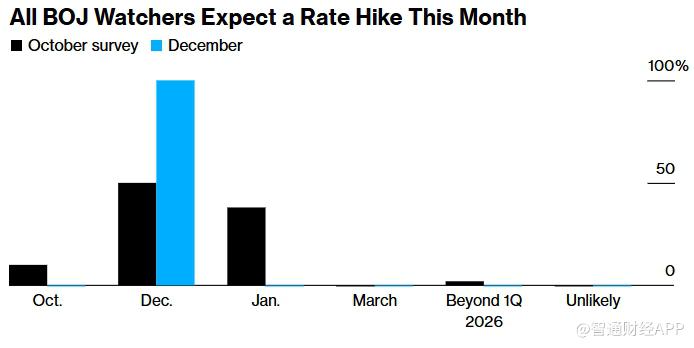

Earlier this month, Ueda and Kazuo unusually sent a clear signal of interest rate hikes, and a series of subsequent economic data further strengthened market expectations. The data shows that the momentum for wage growth in Japan is still stable, while the impact of US tariffs on the Japanese economy is less than previously feared. This is also the first time since Ueda took office that all Bank of Japan observers have unanimously predicted interest rate hikes in a media survey.

Against the backdrop of interest rate hikes being viewed almost as a “foregone conclusion,” the focus of the market turned to how the Bank of Japan would delineate the future path of interest rates. People familiar with the matter revealed earlier that the convenience rate was raised to 0.75%, and the Bank of Japan still believes that the policy interest rate has not reached the so-called “neutral interest rate,” and some officials even think that the 1% level is still low. Neutral interest rates are generally defined as the level of interest that neither stimulates nor inhibits economic growth.

Generally speaking, interest rate hikes help boost the yen exchange rate, but since this action has been fully measured by the market, if the central bank releases dovish signals in forward-looking guidance, it may weaken the yen. Once the exchange rate once again approaches the critical mark of 160 yen per dollar, the financial authorities may be forced to reconsider intervention in the market.

Conversely, if the Bank of Japan sends a more hawkish signal, it may help avoid pressure on the yen, but at the same time, it may also reignite the recent rapid rise in Japanese government bond yields. This result may unease the Takaichi Sanae government, which is preparing a budget for the next fiscal year.

If this rate hike is implemented, interest rates in Japan will rise to the highest level since 1995. Back then, Japan was in the early stages after the bubble burst, and the economy then stagnated for decades. Unlike then, the current economic environment has changed significantly, which also means that Kazuo Ueda is leading the Bank of Japan into “unknown waters” and is trying to preserve maximum flexibility in future policy paths.

According to the interest rate swap market, traders currently expect the probability of interest rate hikes at this meeting to be about 95%, almost double that of the beginning of last month. According to convention, the Bank of Japan will issue a policy statement around noon, while Kazuo Ueda's press conference is scheduled to be held at 3:30 p.m.

The study points out that in a situation where the market has fully absorbed expectations of interest rate hikes, the focus will be on Kazuo Ueda's words at the press conference. The analysis predicts that he will maintain a cautious tone and avoid sending clear signals about the exact timing of the next rate hike.

Looking ahead to the details of policy communication, the Bank of Japan may suggest that there is still room for further interest rate hikes in the future by emphasizing that the financial environment is still relaxed. Even if raised to 0.75%, interest rates in Japan are still low among major economies, and the inflation rate has been running at or above the central bank's 2% target level for more than three consecutive years.

Furthermore, the market will also pay close attention to how Kazuo Ueda expresses a “neutral interest rate.” The range previously given by the Bank of Japan was 1% to 2.5%. If there is a clear increase in this judgment, it may mean that there is more room for policy austerity than previously anticipated. Some observers expect that Ueda may first start with the concept of “natural interest rate” and then explain it in conjunction with the 2% inflation target.

Balancing hawkish and dovish signals is considered the core challenge facing Kazuo Ueda today. This academic-turned-central bank governor often emphasizes reasons for action when raising interest rates, while favoring dovish statements when standing still.

Considering that Prime Minister Sanae Takaichi has always advocated stimulating the economy, how Kazuo Ueda will communicate with the government on interest rate hikes in the future has also attracted attention from the outside world. Some analysts will be watching to see if government representatives will express concerns about this rate hike. If the voting results on Friday pass unanimously as expected, this will also be the first time since Ueda took charge of the Bank of Japan that he received full support in four interest rate hikes.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal