There's No Escaping Century Therapeutics, Inc.'s (NASDAQ:IPSC) Muted Revenues Despite A 32% Share Price Rise

Century Therapeutics, Inc. (NASDAQ:IPSC) shareholders have had their patience rewarded with a 32% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 47% over that time.

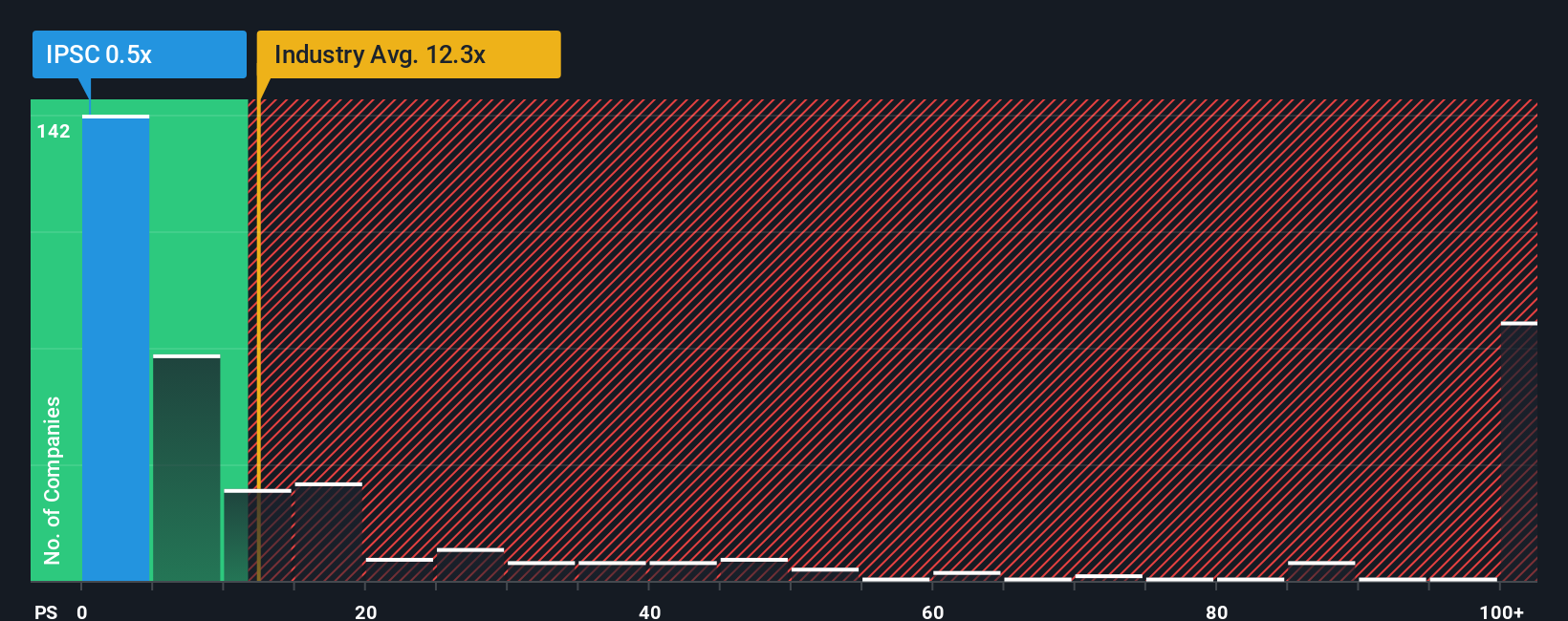

In spite of the firm bounce in price, Century Therapeutics' price-to-sales (or "P/S") ratio of 0.5x might still make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 12.3x and even P/S above 90x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Century Therapeutics

How Century Therapeutics Has Been Performing

Century Therapeutics certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Century Therapeutics.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Century Therapeutics' to be considered reasonable.

Retrospectively, the last year delivered an explosive gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue growth is heading into negative territory, declining 100% per year over the next three years. Meanwhile, the broader industry is forecast to expand by 132% each year, which paints a poor picture.

With this information, we are not surprised that Century Therapeutics is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Century Therapeutics' P/S?

Shares in Century Therapeutics have risen appreciably however, its P/S is still subdued. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's clear to see that Century Therapeutics maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

Before you take the next step, you should know about the 4 warning signs for Century Therapeutics (2 are a bit unpleasant!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal