Rocket Companies (RKT): Reassessing Valuation After Google Tests New Home Listings Feature

Rocket Companies (RKT) slipped about 4% after Google started testing a home listings feature, stirring fresh competition worries in online real estate and prompting investors to reassess Rocket’s long term positioning.

See our latest analysis for Rocket Companies.

Zooming out, that Google headline landed after a strong run, with Rocket’s share price still up sharply on a year to date basis and a three year total shareholder return above 150 percent, suggesting momentum has cooled lately but the longer term story remains very much intact.

If this kind of competitive jostling has you rethinking your watchlist, it could be a good moment to explore fast growing stocks with high insider ownership as potential next wave candidates.

With earnings rebounding, revenue growing more than 30 percent and the stock still trading below the average analyst target, investors now face a key question: Is this a fresh entry point, or is future growth already priced in?

Most Popular Narrative Narrative: 8.5% Undervalued

With Rocket Companies last closing at $18.22 against a narrative fair value near $19.92, the valuation view leans positive while still acknowledging execution hurdles.

The market may be ascribing premium value to Rocket's data ecosystem and cross sell capabilities from the expanded "FinTech ecosystem", but this could prove overly optimistic if younger demographic cohorts delay home buying due to persistent affordability problems. This could dampen anticipated growth in customer lifetime value and overall revenues. Current valuation seems to assume that technology led efficiencies alone will drive lasting operating leverage. This may be challenged if intensifying competition continues to elevate client acquisition costs and forces ongoing promotional efforts (like rate buydowns), which would weigh on net margins and future earnings.

Curious how aggressive revenue growth, sharply higher margins and a richer future earnings multiple all fit together. The narrative lays out a bold profitability roadmap.

Result: Fair Value of $19.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could unravel if housing affordability deteriorates further or if the integration of recent acquisitions fails to deliver anticipated cost and cross sell synergies.

Find out about the key risks to this Rocket Companies narrative.

Another Angle on Valuation

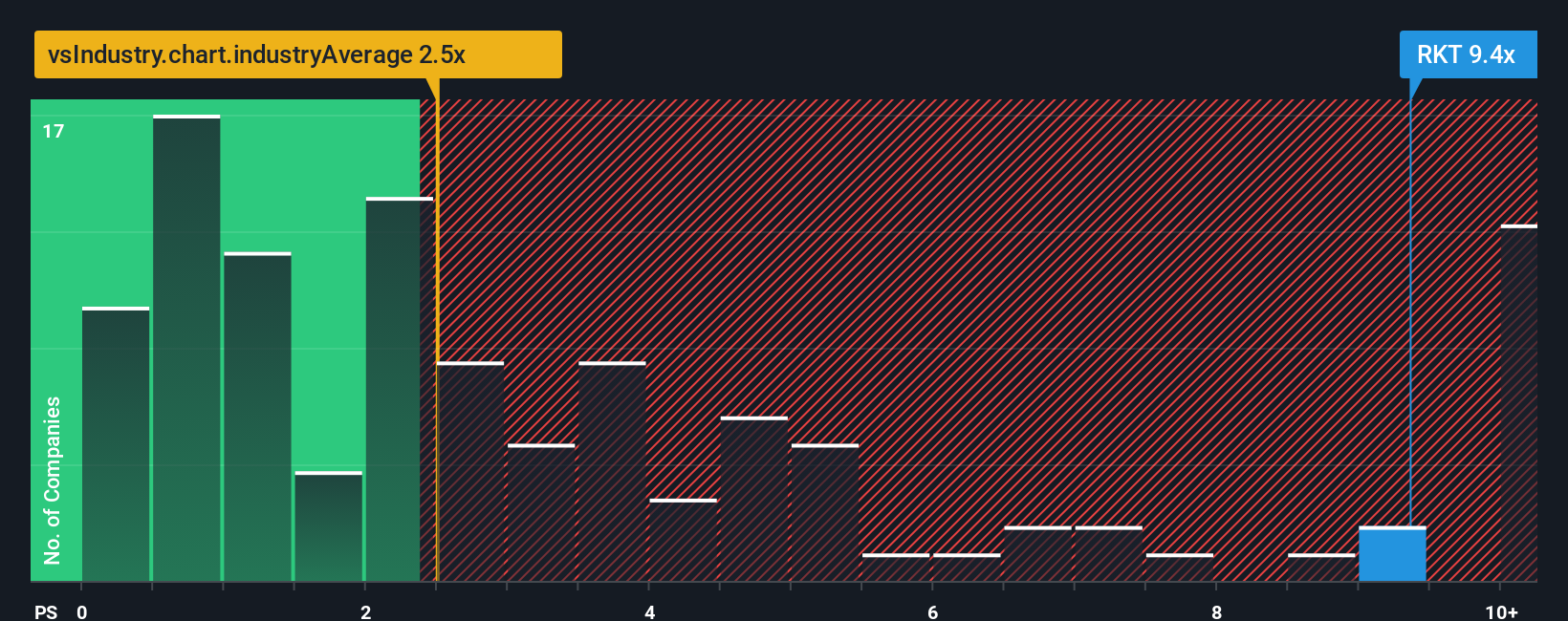

While the narrative fair value suggests Rocket is about 8.5 percent undervalued, its price to sales ratio tells a tougher story. At 8.4 times sales versus around 2.5 times for the U.S. diversified financials industry and 2.4 times peers, the stock screens expensive despite a fair ratio closer to 9.2 times that the market could drift toward. This raises the question of whether investors are paying early for growth that still needs to be delivered.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rocket Companies Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a custom view in minutes: Do it your way.

A great starting point for your Rocket Companies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop at a single opportunity. Use the Simply Wall St Screener to uncover focused, data backed stock ideas before the crowd fully catches on.

- Capitalize on overlooked value by targeting companies trading below their cash flow potential through these 915 undervalued stocks based on cash flows that highlight mispriced opportunities.

- Ride powerful income streams by zeroing in on dependable payers via these 13 dividend stocks with yields > 3% that combine attractive yields with solid fundamentals.

- Position ahead of the next digital finance surge by scanning these 80 cryptocurrency and blockchain stocks leading innovation in blockchain infrastructure and crypto adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal