Lean hogs

I am Stephen Davis, senior market strategist at Walsh Trading, Inc., Chicago, Illinois. You can reach me at 312-878-2391.

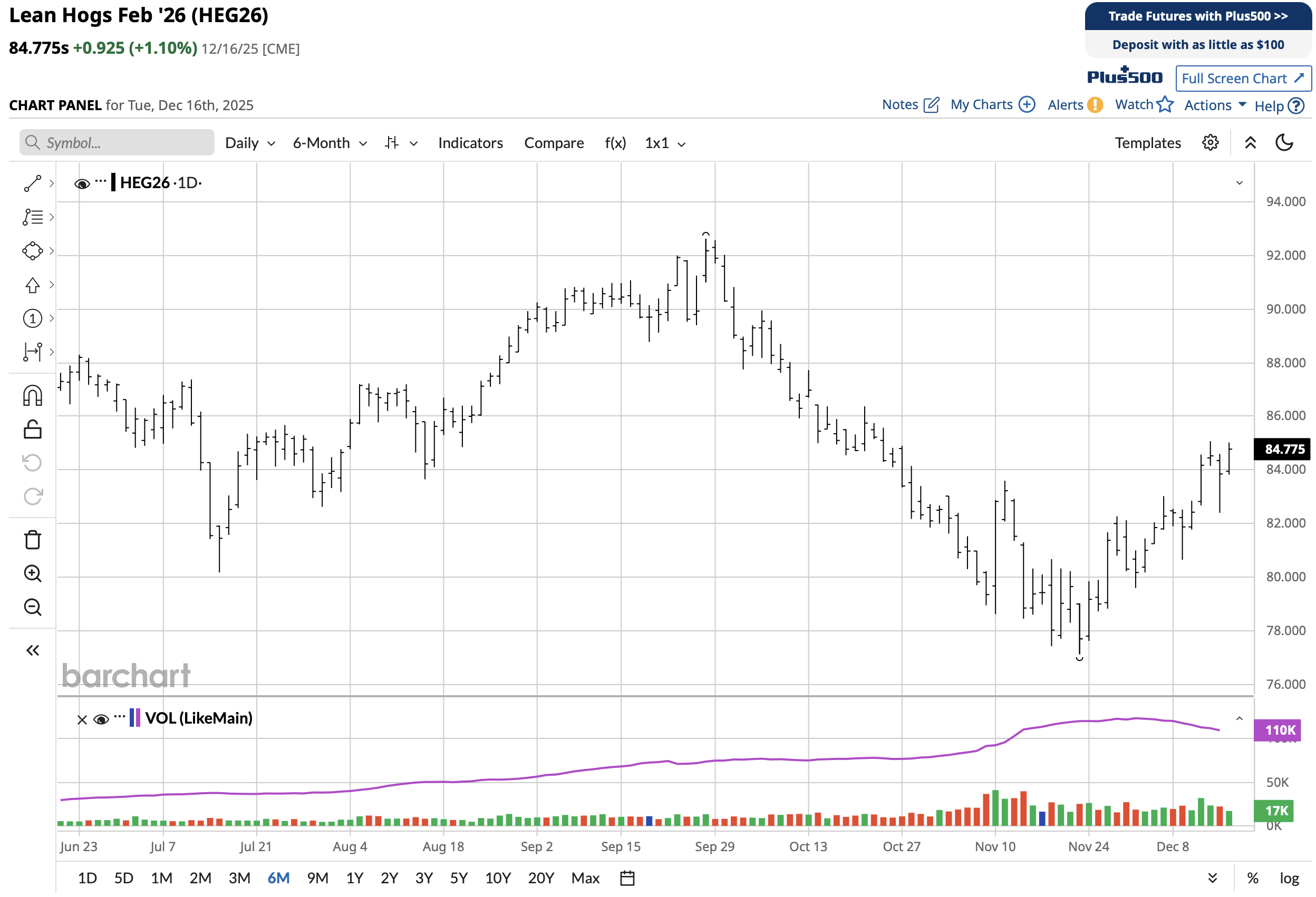

I like the weekly chart pattern for lean hogs presented below. We are working on five weeks of higher highs and higher lows. In my opinion, that is a positive trend for higher prices.

Looking at global pork production, Spain recently detected several cases of African Swine Flu (ASF) in wild boars but ASF has not been detected in the commercial hog herds at this time. This is the first report in 30 years, according to the University of Minnesota Swine Health Information Center (SHIC). Nevertheless, SHIC reports that several countries, including Japan and Mexico, implemented complete suspensions of pork imports from Spain. Spain, which is undertaking measures to protect domestic herds, is the third-largest pork producer globally, after China and the United States. The SHIC Swine Disease Global Surveillance Report (link) lists a handful of other countries that have confirmed disease in wild boars and a small number of domestic pigs.

In an article by National Hog Farmer, U.S. Meat Export Federation Vice President for Economic Analysis Erin Borror says, “As we look at the big impacts, those countries that have suspended Spain's pork – so their second-largest destination, after China, is Japan, and Japan is a full suspension. – there should be some opportunities for U.S. pork into Japan, thinking mostly frozen loins. For Malaysia, I am optimistic. Again, the potential for kind of a mix of cuts, and just given the limited facilities eligible globally to supply that market, there should be some incremental business for the U.S.”

Today's trade strategy is to buy February 2026 lean hogs at today's low, 83.820, Good Till Cancelled (GTC). Risk the trade 81.72 stop GTC ($880 risk per contract). The profit objective is to sell February 2026 lean hogs at 89.900 GTC. That is a good risk-versus-reward trade.

I predict we are going to see $90 February 2026 lean hog prices. Markets fill gaps, in my opinion. Notice the gap on the daily chart on October 14 at 86.425. Look to fill this first gap and then go up to 89.900.

An option strategy is to sell February 2026 lean hogs 80.000 puts at .90 ($360 each option). With that premium, buy February 2026 lean hogs 90 call at .80 ($320 per contract). The puts you sell pay for the calls you buy. These options expire February 13, 2026.

Contact me any time to discuss futures and options strategies. Have an excellent day.

Stephen Davis

Senior Market Strategist

Walsh Trading

Direct 312 878 2391

Toll Free 800 556 9411

sdavis@walshtrading.com

www.walshtrading.com

Use this link to join my email list: SIGN UP NOW

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal