XPeng (NYSE:XPEV): Valuation Check as Malaysia Manufacturing Alliance Extends Global Expansion Narrative

XPeng (NYSE:XPEV) is back in the spotlight after signing a strategic manufacturing deal in Malaysia, adding a new production hub just as the stock digests a sharp short term pullback.

See our latest analysis for XPeng.

The Malaysia deal lands just as XPeng’s 30 day share price return of negative 26.15 percent and 90 day share price return of negative 14.49 percent contrast with a much stronger 59.91 percent year to date share price return and 43.85 percent one year total shareholder return. This suggests longer term momentum remains intact even as the market reassesses near term execution risks.

If XPeng’s expansion has you thinking more broadly about the auto space, it could be a useful moment to scan auto manufacturers for other potential opportunities.

With the shares now trading at a steep discount to analyst targets despite strong growth, the key question is whether XPeng’s pullback reflects temporary nerves or if the market has already priced in its next leg of expansion.

Most Popular Narrative Narrative: 34.6% Undervalued

XPeng’s most followed narrative pegs fair value well above the recent 18.47 dollar close, framing the Malaysia expansion as just one piece of a larger upside story.

The analysts have a consensus price target of $26.291 for XPeng based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $33.26, and the most bearish reporting a price target of just $18.27.

Want to see what justifies paying a premium for an unprofitable EV maker? The narrative leans on aggressive revenue growth, rising margins and a rich future earnings multiple. Curious how those ingredients combine into that fair value, and how much perfection is already baked in?

Result: Fair Value of $28.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent net losses and intense price competition in China could delay profitability and weaken the case for XPeng’s ambitious global expansion narrative.

Find out about the key risks to this XPeng narrative.

Another Angle On Valuation

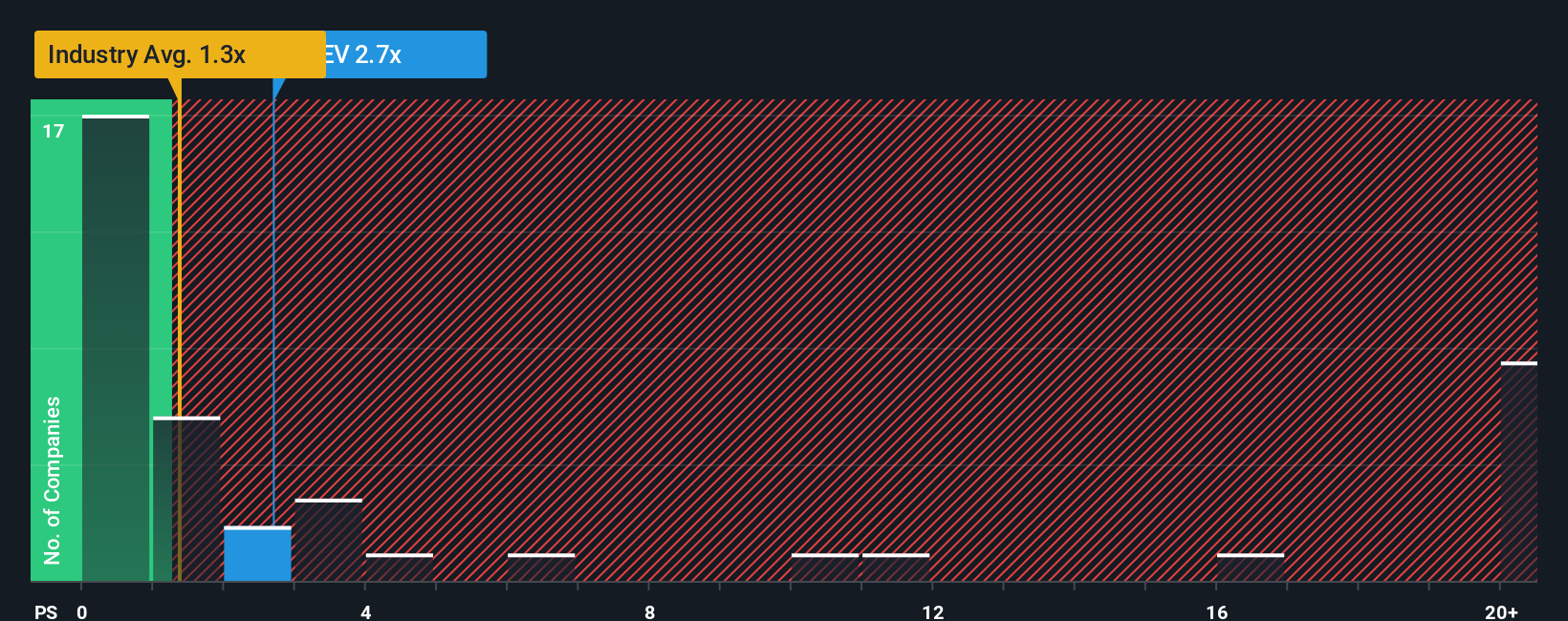

On simple sales ratios, XPeng looks punchy. It trades around 1.8 times sales, versus 0.8 times for the wider US auto industry and a 1.5 times fair ratio. That gap suggests investors are already paying up for growth, so the key question is how much upside is really left if expectations slip.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own XPeng Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding XPeng.

Looking for more investment ideas?

Before you move on, consider using the Simply Wall St Screener to uncover focused opportunities you might otherwise overlook.

- Explore potential upside with these 911 undervalued stocks based on cash flows that the market may not have fully appreciated.

- Focus on cutting edge innovation by targeting these 25 AI penny stocks at the front line of artificial intelligence progress.

- Support your income strategy by evaluating these 13 dividend stocks with yields > 3% that may enhance long term total returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal