Talen Energy (TLN): Reassessing Valuation After Leadership Reshuffle and Long-Term Incentive Overhaul

Talen Energy (TLN) just reshuffled its C suite, promoting Terry Nutt to President and appointing Cole Muller as CFO, while tightening executive contracts and equity plans to reinforce long term strategy and retention.

See our latest analysis for Talen Energy.

The reshuffle lands after a powerful run, with a roughly 77 percent year to date share price return and an 83 percent one year total shareholder return, even as the 90 day share price return has cooled. This suggests momentum is consolidating rather than breaking.

If leadership moves at Talen have you rethinking where growth and execution really matter, this could be a good moment to explore fast growing stocks with high insider ownership for fresh ideas.

With the stock up sharply this year but still trading below analyst targets and some estimates of intrinsic value, the key question now is whether Talen remains mispriced or if the market is already discounting its next leg of growth.

Most Popular Narrative: 16.2% Undervalued

Against a last close near $377, the most followed narrative sees fair value closer to $450, implying meaningful upside if its growth math holds.

The analysts have a consensus price target of $401.735 for Talen Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $450.0, and the most bearish reporting a price target of just $307.0.

Want to see what kind of revenue surge, margin expansion, and earnings step change could justify this premium power play valuation? The narrative breaks down bold growth assumptions, aggressive profitability gains, and a surprisingly rich future multiple that together underpin this fair value call. Curious how those moving parts stack up across the next few years?

Result: Fair Value of $449.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could wobble if PJM prices undershoot expectations or if debt tied to gas fired growth leaves less room for buybacks and reinvestment.

Find out about the key risks to this Talen Energy narrative.

Another Lens on Valuation

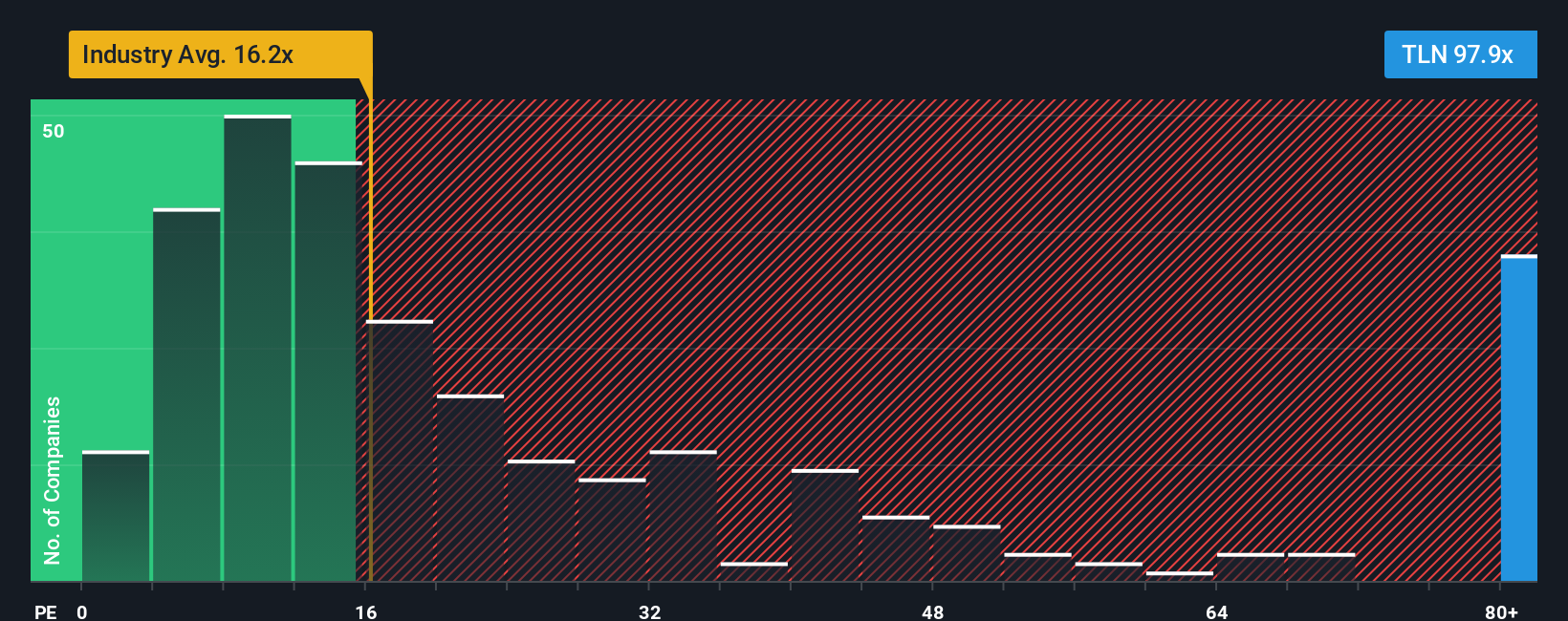

Analysts see upside, but earnings based valuation paints a tougher picture. At around 72 times earnings versus peers on 27 times and a fair ratio near 48, Talen screens rich, not cheap. If sentiment cools or growth stumbles, how quickly could that gap close?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Talen Energy Narrative

If you see the numbers differently or want to test your own thesis using our tools, you can build a custom narrative in minutes: Do it your way.

A great starting point for your Talen Energy research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before the next move in Talen plays out, lock in your edge by scanning a broader watchlist of high potential stocks tailored to your strategy and risk profile.

- Capitalize on early stage opportunities by targeting these 3627 penny stocks with strong financials that pair tiny market caps with solid fundamentals and potential for growth.

- Position ahead of emerging productivity trends by focusing on these 25 AI penny stocks where artificial intelligence supports real revenue, loyal customers, and scalable business models.

- Strengthen your income stream by selecting these 13 dividend stocks with yields > 3% that combine meaningful yields with balance sheets designed to support payouts through different market environments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal