Doximity (DOCS): Assessing Valuation After Analyst Upgrades and Growing AI-Driven Growth Prospects

Morgan Stanley and Raymond James just turned more positive on Doximity (DOCS), arguing that the recent pullback, stronger free cash flow, and deeper AI driven clinician tools could make today’s valuation more interesting for patient investors.

See our latest analysis for Doximity.

Even after these upgrades, Doximity’s latest share price of $43.8 reflects a 90 day share price return of minus 39.7 percent. However, its three year total shareholder return of 25.3 percent shows that longer term momentum has not completely faded.

If this kind of digital health story has your attention, it could be worth exploring other healthcare names through healthcare stocks as you look for the next opportunity.

With Wall Street now flagging Doximity as both cheaper than its history and primed for AI driven growth, the key question becomes whether this pullback is a genuine buying opportunity or if the market already anticipates the rebound.

Most Popular Narrative Narrative: 38.4% Undervalued

Compared with Doximity’s last close at $43.8, the most followed narrative points to a meaningfully higher fair value, framing a long term compounding story rather than a quick rebound trade.

The expanded adoption of AI powered workflow tools (Scribe, Doximity GPT, and Pathway AI) is expected to further entrench Doximity as a core clinician productivity suite, driving frequency of platform use, deeper customer retention, and ultimately higher average revenue per user over time supporting long term revenue and margin expansion.

Want to see how steady double digit growth, firm margins, and a rich future earnings multiple are stitched together into one valuation story? The full narrative unpacks the assumptions that turn today’s pullback into a potentially compounding setup, and the exact profitability profile it believes Doximity can sustain.

Result: Fair Value of $71.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this setup still hinges on successful AI monetization and resilient pharma ad budgets; any stumble here could quickly puncture the undervaluation thesis.

Find out about the key risks to this Doximity narrative.

Another Angle on Valuation

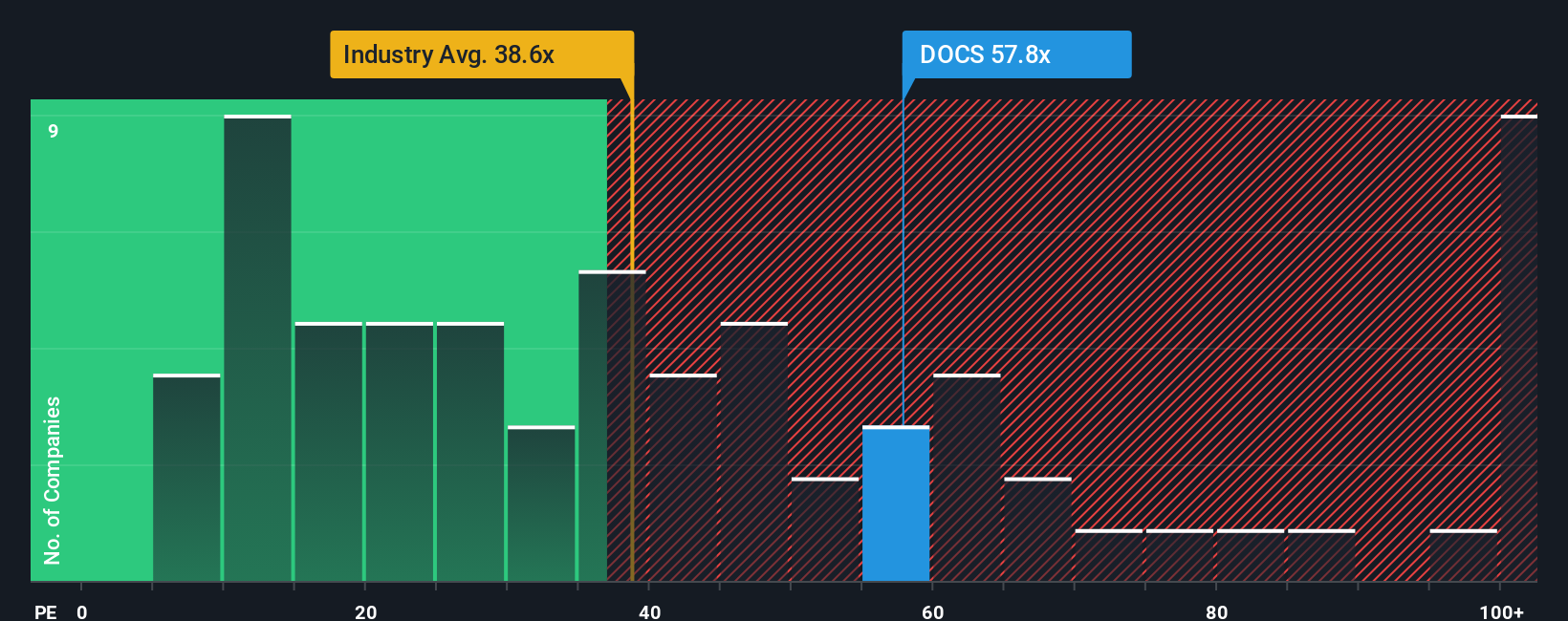

While the narrative and analyst targets frame Doximity as materially undervalued, its current price to earnings ratio of 32.6 times still sits well above a fair ratio of 25.1 times, even if it is lower than peers at 63.7 times and close to the global healthcare services average of 32.9 times. That gap hints at some remaining valuation risk if growth expectations slip. This raises the question: are investors really being paid enough for the uncertainty around AI monetization and pharma budgets?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Doximity Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Doximity.

Ready for more high conviction ideas?

Before markets move on without you, put fresh names on your radar using the Simply Wall Street Screener to target specific themes, fundamentals, and future growth.

- Capitalize on mispriced potential by targeting companies that look cheap on cash flow with these 909 undervalued stocks based on cash flows and tighten your focus on genuine value candidates.

- Ride structural tech tailwinds by scanning for innovative businesses shaping tomorrow with these 25 AI penny stocks and position yourself early in major shifts.

- Strengthen your income stream by zeroing in on reliable payers through these 13 dividend stocks with yields > 3% and avoid missing out on compelling yield opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal