Ryman Hospitality Properties (RHP): Revisiting Valuation After a Confident Dividend Increase

Ryman Hospitality Properties (RHP) increased its fourth quarter cash dividend to $1.20 per share, a move that signals management’s confidence in cash flows and draws new attention to the stock’s income profile.

See our latest analysis for Ryman Hospitality Properties.

The higher payout lands at a time when sentiment has been mixed, with the share price at $98.81 and a slightly negative year to date share price return. However, a strong five year total shareholder return hints that long term holders have still been well rewarded, while near term momentum has yet to fully re accelerate.

If this dividend move has you thinking more broadly about income and growth, it could be worth exploring fast growing stocks with high insider ownership as a source of fresh ideas beyond the REIT space.

With revenue and earnings still growing and the shares trading at a discount to analyst targets and some estimates of intrinsic value, is Ryman quietly undervalued here, or is the market already pricing in that future growth?

Most Popular Narrative Narrative: 11.9% Undervalued

With Ryman Hospitality Properties closing at $98.81 against a narrative fair value near $112, the valuation case leans on robust long range cash generation.

Recent acquisitions and ongoing capital investments (e.g., JW Marriott Desert Ridge, meeting space upgrades at Gaylord properties) put Ryman in a strong position to capitalize on renewed appetite for large scale experiential travel and gatherings, supporting revenue growth and long term cash flow. Visible increases in advance group booking activity and a robust pipeline for 2026 and 2027 indicate sustained demand for destination meetings and conventions as organizations prioritize periodic large scale events, providing predictability for future revenues and earnings.

Curious how steady but not explosive revenue growth, shifting margins, and a richer future earnings multiple all combine to justify that higher value? The answers are in the full narrative.

Result: Fair Value of $112.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent labor cost inflation and structurally higher interest rates could squeeze margins and free cash flow, which may challenge the upbeat long term growth narrative.

Find out about the key risks to this Ryman Hospitality Properties narrative.

Another Way to Look at Value

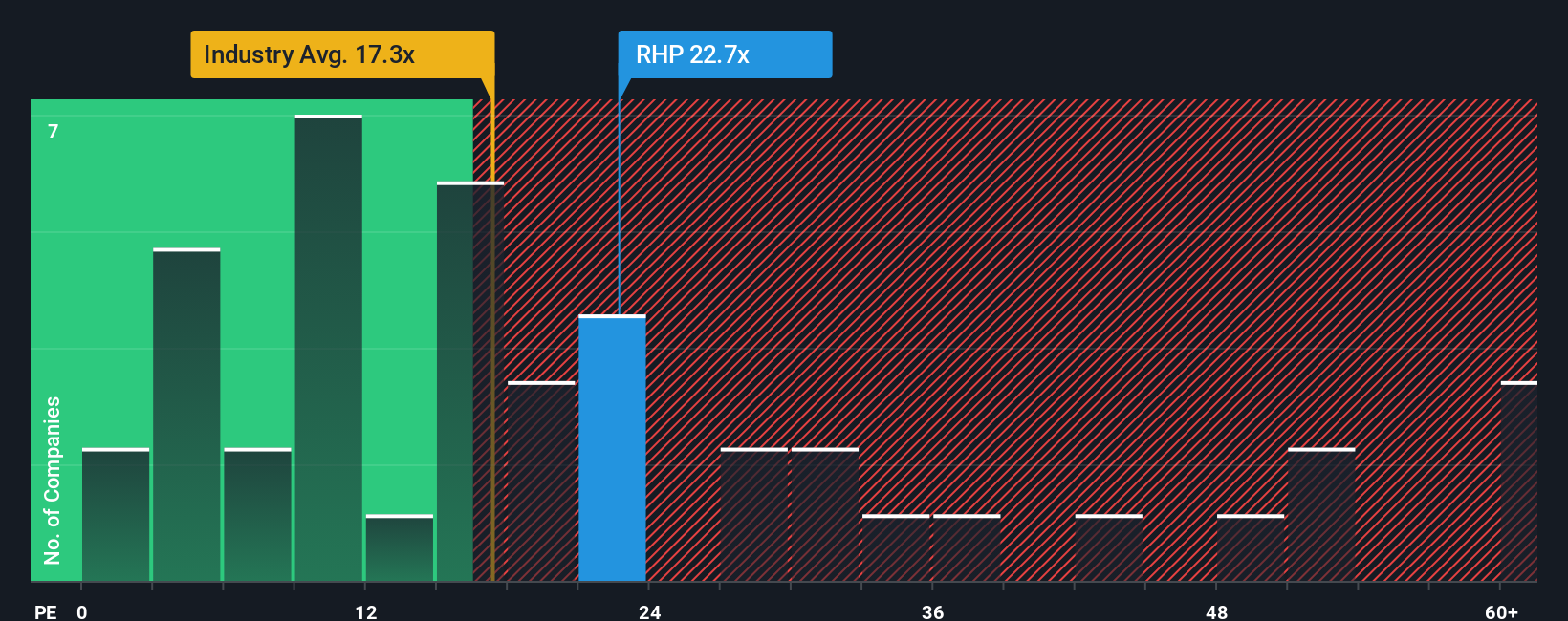

On earnings multiples, Ryman looks pricey, trading at about 25.8 times earnings versus 23.6 times for peers and 15.5 times for the wider Hotel and Resort REITs industry, even though our fair ratio is closer to 34.5 times. So is the real risk overpaying today or missing a rerating later?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ryman Hospitality Properties Narrative

If the story outlined here does not fully align with your own view, dig into the numbers yourself and craft a personalized thesis in minutes: Do it your way.

A great starting point for your Ryman Hospitality Properties research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next potential opportunity by using the Simply Wall St Screener to quickly surface focused, data driven stock ideas that others might miss.

- Capture potential mispricings by targeting companies that may be trading below their intrinsic value using these 912 undervalued stocks based on cash flows as your starting point.

- Ride powerful technological shifts by zeroing in on innovators reshaping automation, data, and software through these 25 AI penny stocks before sentiment fully catches up.

- Strengthen your income stream by filtering for reliable payers with attractive yields via these 13 dividend stocks with yields > 3% while the market is still overlooking them.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal