Brink's (BCO) Valuation After Approving a Major $750 Million Share Buyback Program

Brink's (BCO) just rolled out a new 750 million dollar share repurchase plan, a sizable slice of its market value. The move signals management’s confidence in cash generation, capital discipline, and the company’s long term growth strategy.

See our latest analysis for Brink's.

The announcement fits neatly into a strong run, with Brink's posting a roughly 30 percent year to date share price return and a powerful three year total shareholder return above 130 percent, suggesting positive momentum is still building.

If this capital return story has you rethinking your watchlist, it could be a good moment to explore fast growing stocks with high insider ownership as potential next candidates.

But with the stock already up strongly and trading below, yet not far from, analyst targets, is Brink's still meaningfully undervalued or are markets already pricing in the next leg of its growth story?

Most Popular Narrative: 10.4% Undervalued

With Brink's last closing at $119.64 against a narrative fair value of about $133.50, the storyline leans toward upside from disciplined growth and capital returns.

Rapid expansion and strong momentum in AMS (ATM Managed Services) and DRS (Digital Retail Solutions) are unlocking a significantly larger and higher-margin addressable market, with double-digit organic growth expected to accelerate in the back half of the year and into the mid term, supporting higher future revenue and net margins.

Curious how steady top line growth, surging margins, and shrinking share count can still point to a value gap at today’s price? The full narrative unpacks the earnings runway, the forward valuation multiple, and the cash return math that hold this 10 percent plus upside case together.

Result: Fair Value of $133.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, faster than expected shifts toward cashless payments or missteps in digital investments could crimp AMS and DRS growth and compress margins.

Find out about the key risks to this Brink's narrative.

Another Lens On Value

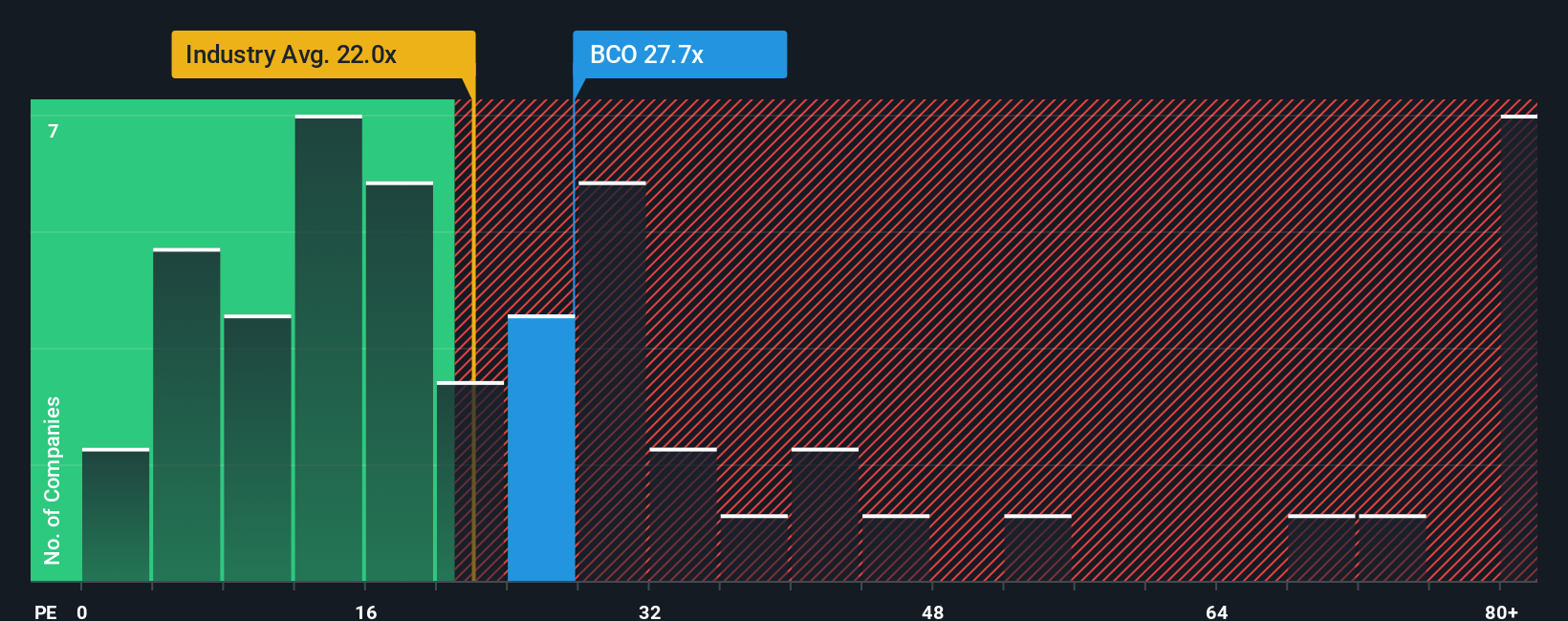

While the narrative fair value suggests Brink's is about 10 percent undervalued, the earnings multiple paints a hotter picture. At roughly 29.4 times earnings versus 24.6 times for the broader US Commercial Services industry and 17.4 times for peers, the stock already commands a premium.

Even set against a higher fair ratio of 47.8 times, that gap hints at limited room for multiple expansion and more downside risk if sentiment cools, especially after such a strong run. Is this a value opportunity in progress, or one investors are arriving late to?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Brink's Narrative

If you are not aligned with this view or would rather dig into the numbers yourself, you can build a custom narrative in just minutes: Do it your way.

A great starting point for your Brink's research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before you move on, lock in your next opportunities using the Simply Wall St Screener so you are never left watching the best ideas pass by.

- Capture potential mispricings by targeting companies trading below their cash flow value with these 912 undervalued stocks based on cash flows that might not stay cheap for long.

- Ride powerful long term innovation trends by focusing on these 25 AI penny stocks where real revenues, not just hype, could fuel the next leg of market gains.

- Strengthen your income stream by filtering for reliable payers through these 13 dividend stocks with yields > 3% and position yourself for potential compounding of total returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal