Asian Growth Leaders With High Insider Stakes In December 2025

As global markets navigate a complex landscape of economic signals, Asia remains a focal point with its unique challenges and opportunities. With the Federal Reserve's recent rate cuts influencing global sentiment and technology valuations under scrutiny, investors are keenly observing growth companies in Asia where high insider ownership can signal confidence in long-term prospects. In such an environment, stocks that combine robust growth potential with significant insider stakes may offer insights into strategic positioning amidst market uncertainties.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| WinWay Technology (TWSE:6515) | 21.7% | 30.3% |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

Let's explore several standout options from the results in the screener.

Ming Yang Smart Energy Group (SHSE:601615)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ming Yang Smart Energy Group Limited is involved in the R&D, design, manufacture, sale, maintenance, and operation of energy equipment and wind turbines in China with a market cap of CN¥30.17 billion.

Operations: Ming Yang Smart Energy Group Limited generates revenue through its activities in the research and development, design, manufacture, sale, maintenance, and operation of energy equipment and wind turbines in China.

Insider Ownership: 14.9%

Earnings Growth Forecast: 67.5% p.a.

Ming Yang Smart Energy Group is actively expanding its international presence, highlighted by a recent MOU for a 2GW wind project in the Philippines and plans to build a £1.5 billion wind turbine manufacturing base in Scotland. Despite forecasted revenue growth of 14.7% annually, earnings are expected to grow significantly faster at 67.47% per year, outpacing the market average. However, debt coverage remains an area of concern as operating cash flow does not adequately cover it.

- Dive into the specifics of Ming Yang Smart Energy Group here with our thorough growth forecast report.

- Our expertly prepared valuation report Ming Yang Smart Energy Group implies its share price may be too high.

Bethel Automotive Safety Systems (SHSE:603596)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bethel Automotive Safety Systems Co., Ltd develops, manufactures, and sells automotive safety systems and advanced driver assistance systems in China, with a market cap of CN¥28.39 billion.

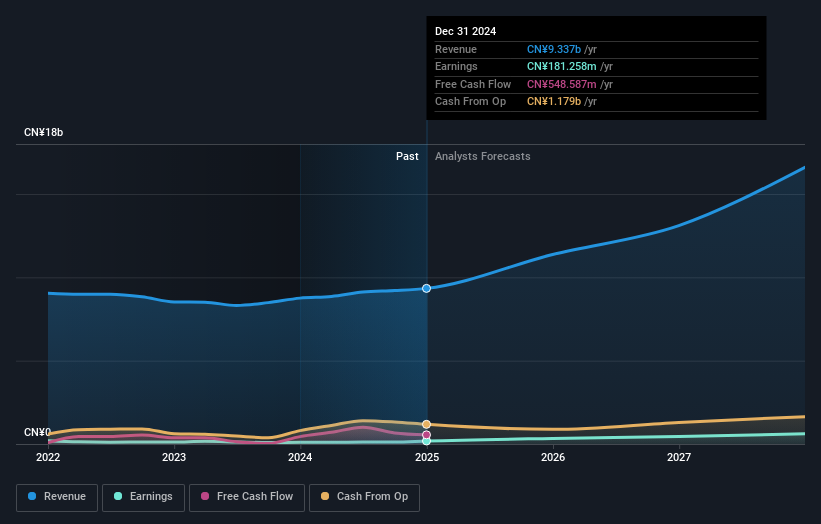

Operations: The company's revenue primarily comes from the manufacturing and selling of automobile and related accessories, amounting to CN¥11.72 billion.

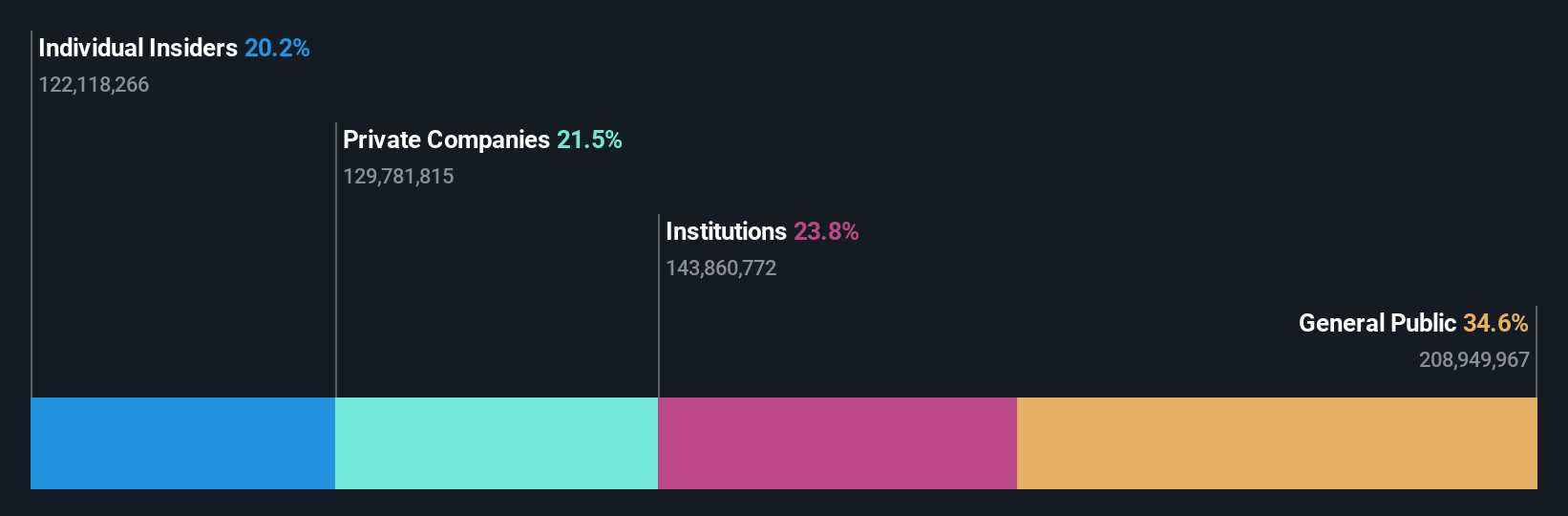

Insider Ownership: 20.2%

Earnings Growth Forecast: 25.1% p.a.

Bethel Automotive Safety Systems has demonstrated strong growth, with recent earnings showing a 23% increase year-over-year. Despite forecasts indicating slower profit growth than the market at 25.1% annually, revenue is expected to grow by 22.4%, outpacing the Chinese market average of 14.5%. Analysts agree on a potential stock price rise of nearly 45%. The company trades at a substantial discount to its estimated fair value and maintains high-quality earnings with no significant insider trading activity recently reported.

- Delve into the full analysis future growth report here for a deeper understanding of Bethel Automotive Safety Systems.

- Insights from our recent valuation report point to the potential undervaluation of Bethel Automotive Safety Systems shares in the market.

Kidswant Children ProductsLtd (SZSE:301078)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kidswant Children Products Co., Ltd. operates in China, focusing on the retail of maternal, infant, and child products with a market cap of CN¥13.47 billion.

Operations: The company generates its revenue primarily from the retailing of mother and baby products, amounting to CN¥9.89 billion.

Insider Ownership: 27%

Earnings Growth Forecast: 36.8% p.a.

Kidswant Children Products Ltd. shows robust growth, with earnings rising 116.9% over the past year and projected to grow at 36.8% annually, outpacing the Chinese market average of 27.1%. Revenue is forecasted to increase by 20.1% per year, surpassing market expectations. Despite trading at a discount to its fair value and no recent insider trading activity, its return on equity is expected to remain low at 12.1%, and it has an unstable dividend track record.

- Navigate through the intricacies of Kidswant Children ProductsLtd with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Kidswant Children ProductsLtd's share price might be on the expensive side.

Turning Ideas Into Actions

- Delve into our full catalog of 638 Fast Growing Asian Companies With High Insider Ownership here.

- Searching for a Fresh Perspective? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal