Asian Dividend Stocks To Consider For Your Portfolio

As global markets navigate a complex landscape of interest rate adjustments and economic uncertainties, Asian markets are also experiencing shifts influenced by deflationary pressures in China and anticipated policy changes in Japan. Amid these dynamics, dividend stocks offer a potential avenue for investors seeking steady income, especially as central banks across the region assess their monetary policies to stabilize growth and inflation.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.82% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.09% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.95% | ★★★★★★ |

| NCD (TSE:4783) | 4.10% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.78% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.08% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.29% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.87% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.74% | ★★★★★★ |

Click here to see the full list of 1056 stocks from our Top Asian Dividend Stocks screener.

We'll examine a selection from our screener results.

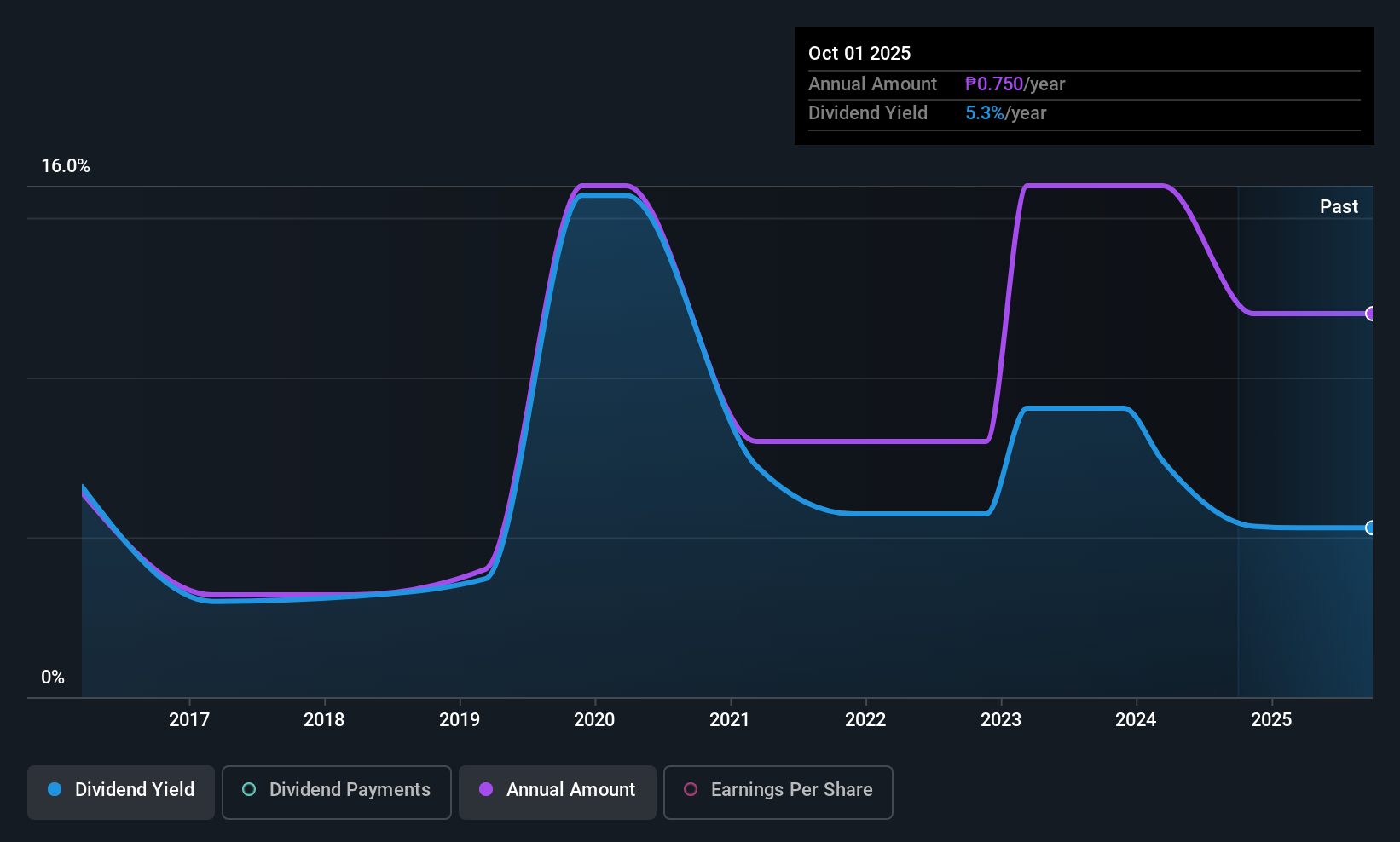

A. Soriano (PSE:ANS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: A. Soriano Corporation, with a market cap of ₱16.20 billion, operates in the Philippines through its subsidiaries in resort management, cable and wire manufacturing, and other sectors.

Operations: A. Soriano Corporation generates revenue primarily from its wire manufacturing segment at ₱12.30 billion, followed by the holding company operations at ₱3.67 billion and resort operations at ₱1.43 billion.

Dividend Yield: 5.7%

A. Soriano's dividend payments are well-covered by earnings with a payout ratio of 21%, and cash flows cover the dividends at a 78.1% cash payout ratio, indicating sustainability despite a volatile track record over the past decade. The company's price-to-earnings ratio is favorable compared to the Philippine market average, suggesting potential value for investors. Recent earnings showed growth in Q3 revenue and net income year-over-year, although nine-month figures declined compared to last year.

- Click here and access our complete dividend analysis report to understand the dynamics of A. Soriano.

- In light of our recent valuation report, it seems possible that A. Soriano is trading beyond its estimated value.

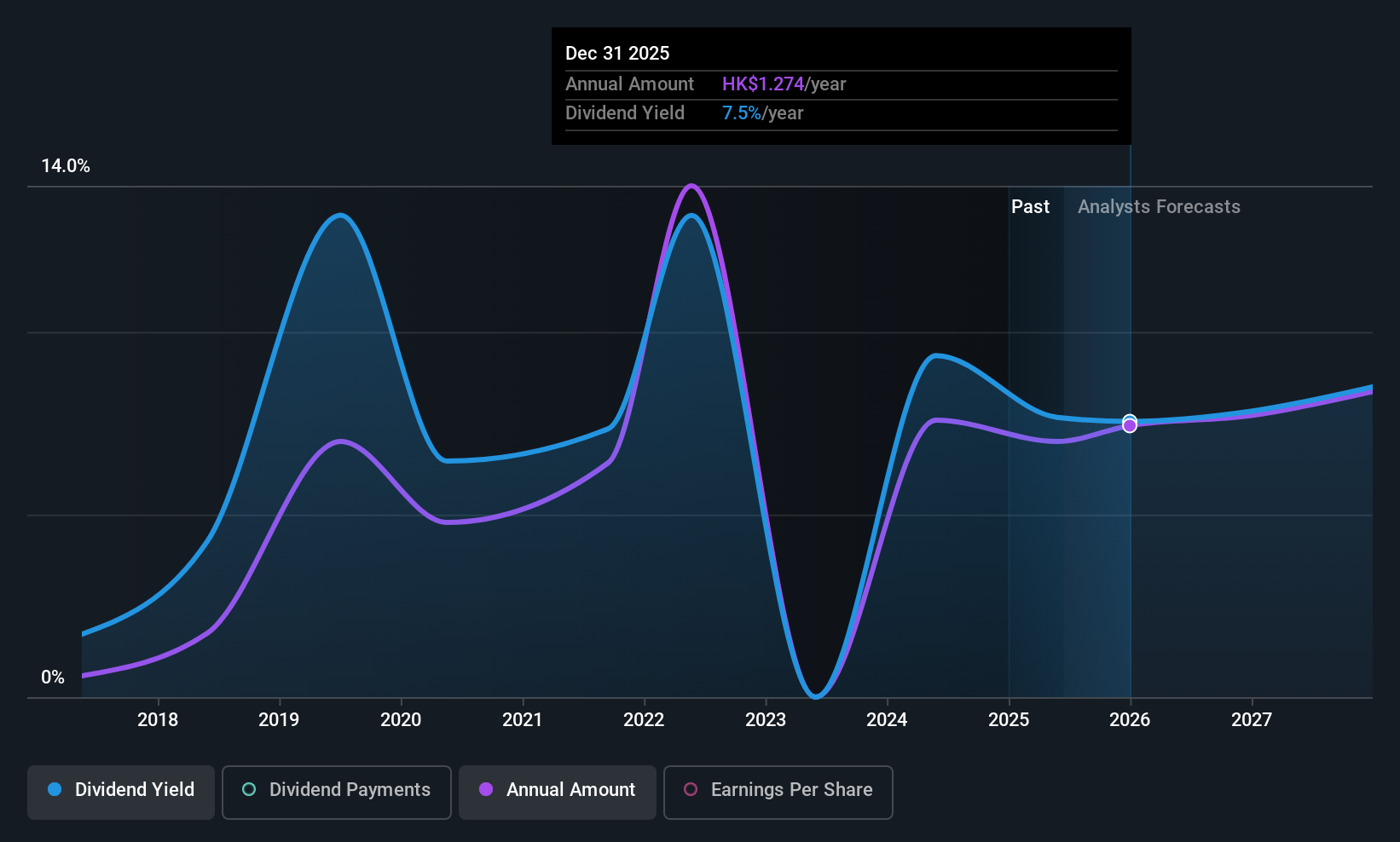

C&D International Investment Group (SEHK:1908)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: C&D International Investment Group Limited is an investment holding company involved in property development, real estate industry chain investment services, and industry investment activities in China, with a market cap of HK$37.81 billion.

Operations: C&D International Investment Group Limited generates revenue primarily from its property development and management services, amounting to CN¥144.40 billion.

Dividend Yield: 7.1%

C&D International Investment Group offers a high dividend yield of 7.11%, ranking in the top 25% among Hong Kong dividend payers, with strong coverage by earnings and cash flows, given its payout ratios of 48.5% and 12.8%, respectively. Despite trading at a significant discount to estimated fair value, its dividends have been unstable over nine years. Recent executive changes may impact future strategic direction, while sales figures showed mixed performance with increased revenue but decreased floor area sold.

- Take a closer look at C&D International Investment Group's potential here in our dividend report.

- According our valuation report, there's an indication that C&D International Investment Group's share price might be on the cheaper side.

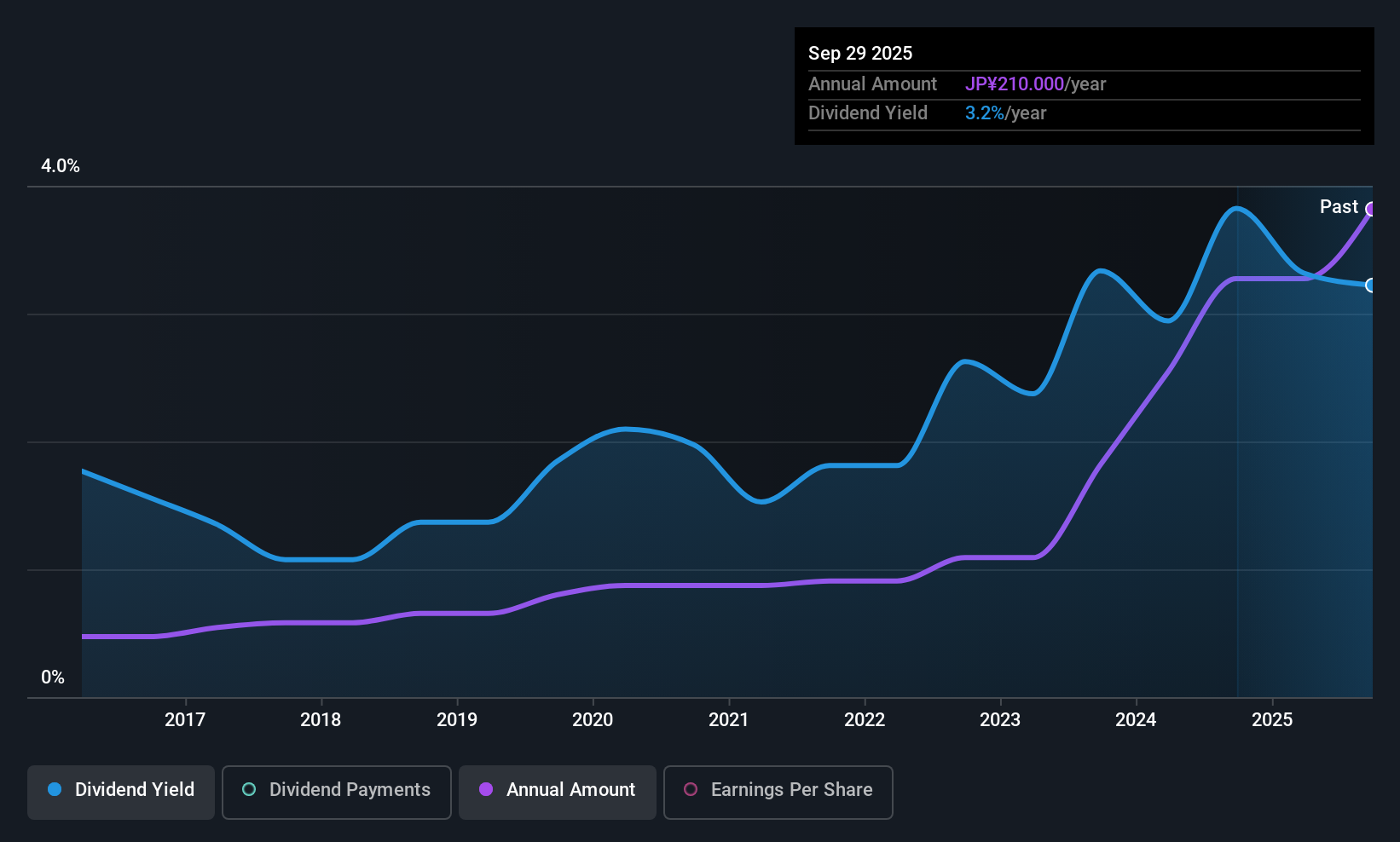

Murakami (TSE:7292)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Murakami Corporation manufactures and sells rear-view mirrors for automobile manufacturers in Japan, the Rest of Asia, North America, and internationally, with a market cap of ¥78.55 billion.

Operations: Murakami Corporation's revenue segments are comprised of ¥34.46 billion from Asia, ¥53.61 billion from Japan, and ¥27.50 billion from North America.

Dividend Yield: 3.1%

Murakami's dividends have been stable and growing over the past decade, supported by a low payout ratio of 38.9% from earnings and 40.1% from cash flows, ensuring sustainability. Although its dividend yield of 3.1% is below the top tier in Japan, it remains reliable with minimal volatility. Trading at a significant discount to its estimated fair value, Murakami presents an attractive option for investors focused on consistent dividend income in Asia.

- Get an in-depth perspective on Murakami's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Murakami's share price might be too pessimistic.

Taking Advantage

- Reveal the 1056 hidden gems among our Top Asian Dividend Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal