Norwegian Air Shuttle (OB:NAS): Assessing Valuation After Stable November Traffic And Load Factor Gains

Norwegian Air Shuttle (OB:NAS) just published its November and rolling twelve month operating stats, and they paint a picture of steady flying, slightly fewer seats offered but a higher load factor and broadly stable passenger volumes.

See our latest analysis for Norwegian Air Shuttle.

That operational steady hand seems to be feeding into sentiment, with the share price up 16.53% over the past month and a powerful year to date share price return of 57.81%, while the 1 year total shareholder return of 70.39% suggests momentum is firmly building rather than fading.

If Norwegian’s turnaround has caught your eye, this could be a good moment to see what else is taking off in aviation and defense via aerospace and defense stocks.

With steady operations, modest revenue growth and the share price now hovering close to analyst targets, the key question is whether Norwegian Air Shuttle still trades below its true potential or if the market is already pricing in future growth.

Most Popular Narrative Narrative: 1.1% Undervalued

With Norwegian Air Shuttle last closing at NOK 17.98 against a narrative fair value near NOK 18.17, the valuation case leans on specific growth and margin assumptions rather than sentiment alone.

The analysts have a consensus price target of NOK17.3 for Norwegian Air Shuttle based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the more bullish ones expecting earnings as high as NOK3.4 billion.

Want to see how modest revenue growth, a higher profit margin and a richer future earnings multiple combine into this valuation puzzle, and which single assumption does the heavy lifting behind that fair value call?

Result: Fair Value of $18.17 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on smooth execution, with punctuality issues and ongoing legal and FX uncertainties still capable of disrupting margins and earnings progress.

Find out about the key risks to this Norwegian Air Shuttle narrative.

Another Lens On Value

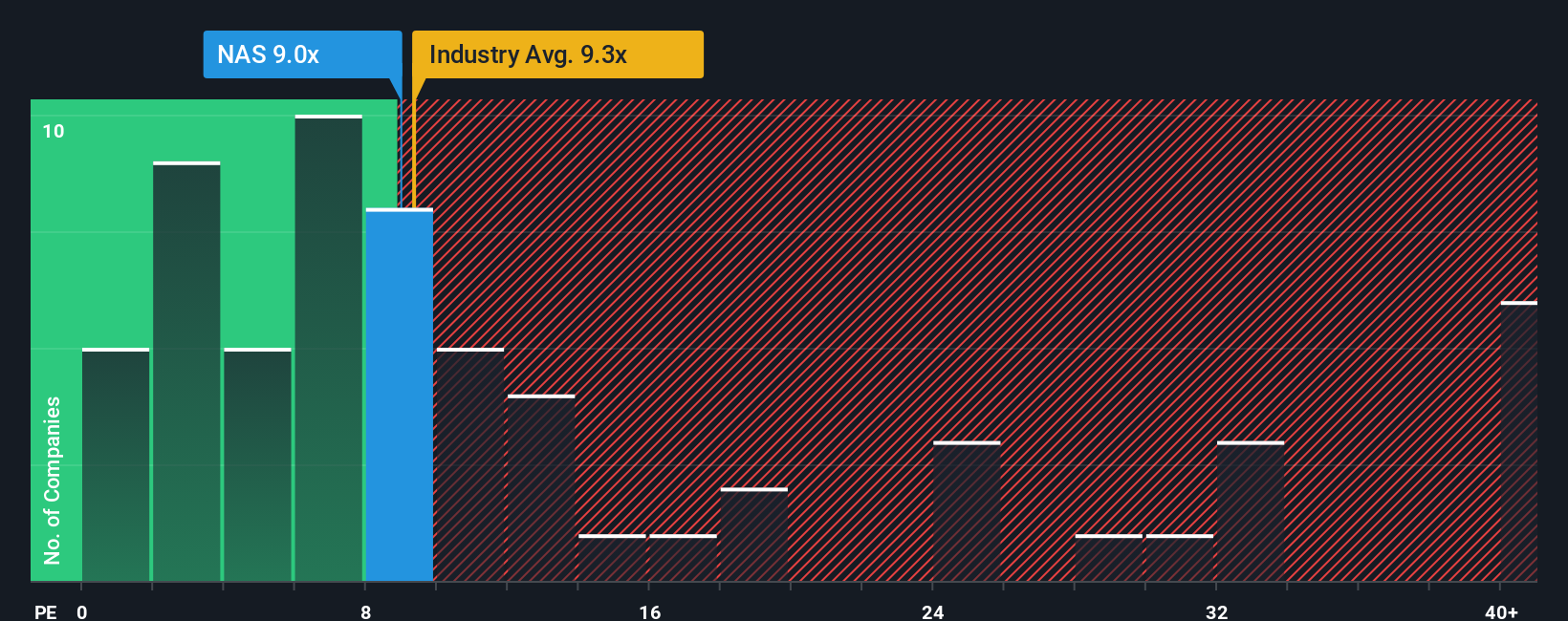

On earnings, Norwegian trades at 7.9 times versus a 7.1 fair ratio, peers at 4.4 and the global airlines average at 9.3. That mix of slightly rich versus fair value but cheap versus global rivals hints at both upside and downside. Which way could sentiment swing next?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Norwegian Air Shuttle Narrative

If you see the story differently or simply want to stress test these assumptions yourself, you can build a complete view in minutes: Do it your way.

A great starting point for your Norwegian Air Shuttle research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop with one compelling story. Use the Simply Wall Street Screener to uncover fresh, data backed opportunities before everyone else rushes in.

- Capture overlooked value by targeting these 913 undervalued stocks based on cash flows that strong cash flow analysis suggests are trading at a meaningful discount.

- Position for the next wave of innovation by zeroing in on these 25 AI penny stocks with powerful growth narratives.

- Strengthen your income stream by filtering for these 13 dividend stocks with yields > 3% that balance attractive yields with solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal