Hs Hyosung Advanced Materials (KRX:298050) Will Pay A Dividend Of ₩6500.00

Hs Hyosung Advanced Materials (KRX:298050) has announced that it will pay a dividend of ₩6500.00 per share on the 2nd of April. This makes the dividend yield 3.4%, which will augment investor returns quite nicely.

Estimates Indicate Hs Hyosung Advanced Materials' Dividend Coverage Likely To Improve

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Even though Hs Hyosung Advanced Materials is not generating a profit, it is still paying a dividend. It is also not generating any free cash flow, we definitely have concerns when it comes to the sustainability of the dividend.

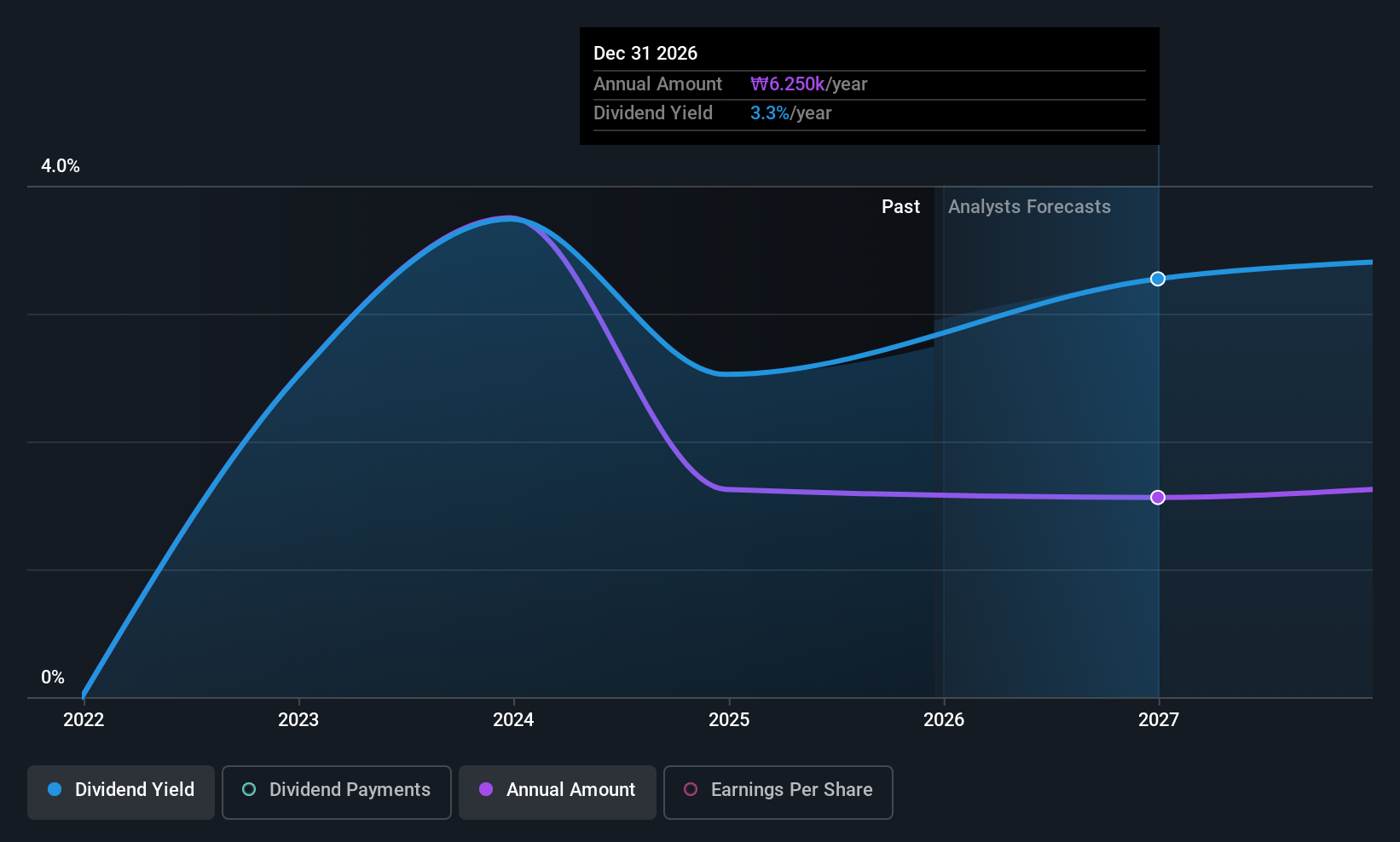

According to analysts, EPS should be several times higher next year. Assuming the dividend continues along recent trends, we think the payout ratio will be 59%, which makes us pretty comfortable with the sustainability of the dividend.

See our latest analysis for Hs Hyosung Advanced Materials

Hs Hyosung Advanced Materials' Dividend Has Lacked Consistency

The track record isn't the longest, but we are already seeing a bit of instability in the payments. The dividend has gone from an annual total of ₩10000.00 in 2021 to the most recent total annual payment of ₩6500.00. The dividend has fallen 35% over that period. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

The Dividend Has Limited Growth Potential

Dividends have been going in the wrong direction, so we definitely want to see a different trend in the earnings per share. Earnings per share has been sinking by 22% over the last five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

Hs Hyosung Advanced Materials' Dividend Doesn't Look Great

In summary, while it is good to see that the dividend hasn't been cut, we think that at current levels the payment isn't particularly sustainable. The company's earnings aren't high enough to be making such big distributions, and it isn't backed up by strong growth or consistency either. Overall, the dividend is not reliable enough to make this a good income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For instance, we've picked out 2 warning signs for Hs Hyosung Advanced Materials that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal