Nordea (HLSE:NDA FI) Valuation Check After Recent Share Price Strength

Nordea Bank Abp (HLSE:NDA FI) keeps edging higher, with the stock up about 4 % this month and roughly 13 % over the past 3 months, inviting a closer look at what is driving this steady climb.

See our latest analysis for Nordea Bank Abp.

The recent climb sits on top of a much stronger backdrop, with a roughly 45 % year to date share price return and a near 60 % one year total shareholder return. This suggests momentum is firmly building as investors reassess Nordea’s earnings power and risk profile.

If Nordea’s run has you rethinking your bank exposure, it may also be worth exploring opportunities in other financials through our screener of fast growing stocks with high insider ownership.

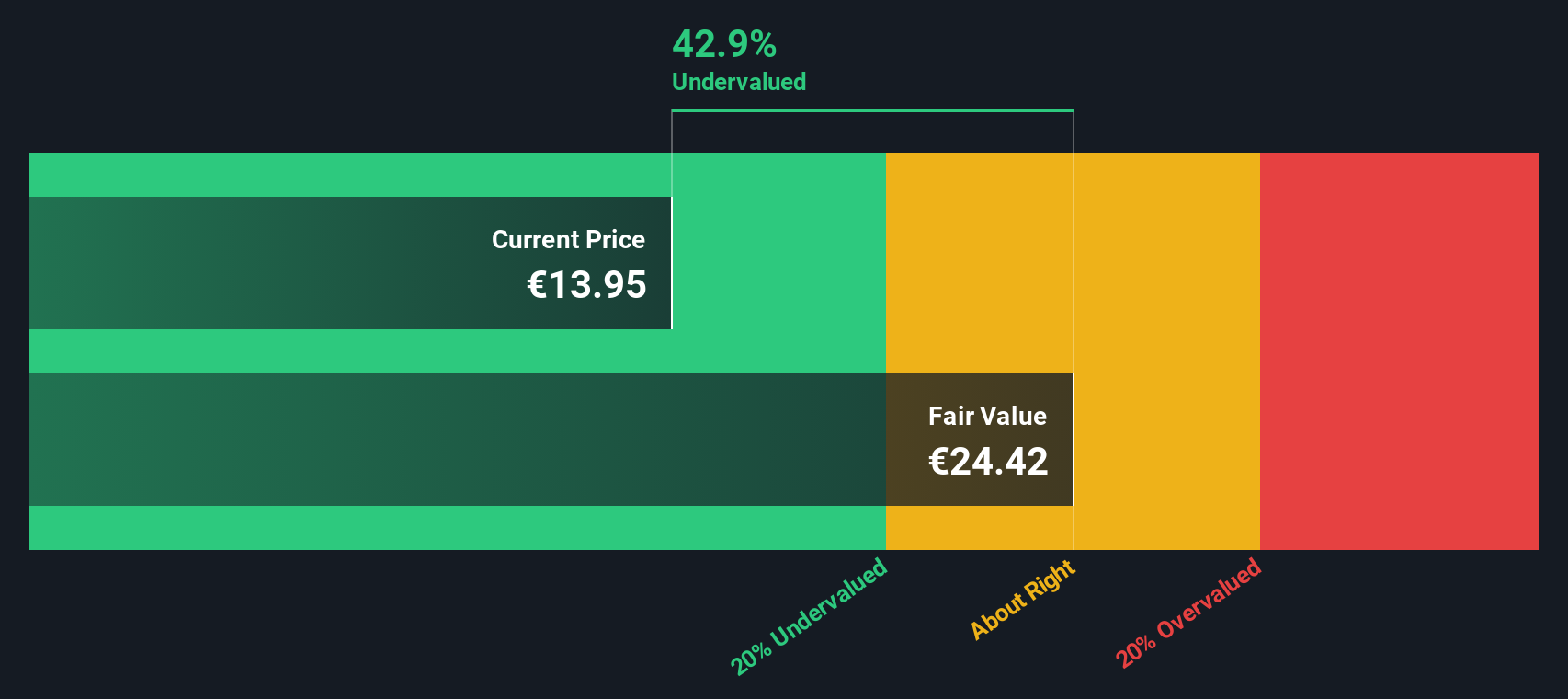

With the shares trading close to analyst targets but still showing a hefty implied intrinsic discount, the key question now is whether Nordea remains undervalued or if the market is already baking in the next leg of growth.

Most Popular Narrative: 0% Overvalued

With Nordea Bank Abp last closing at €15.49 against a most popular narrative fair value of about €15.44, the valuation gap has almost closed, sharpening the focus on what is driving that finely balanced outlook.

Nordea's disciplined focus on efficiency and capital optimization, with cost-to-income ratio maintained around 46% and continued active capital return via buybacks, creates strong potential for sustained EPS and ROE outperformance, especially as secular shifts toward digital and sustainable banking accelerate revenue opportunities.

Want to see how modest growth assumptions, deliberate margin tweaks, and a future earnings multiple come together to justify this tight fair value band? The narrative breaks down which revenue engines, profitability levers, and share count moves need to line up almost perfectly to keep Nordea in this valuation sweet spot.

Result: Fair Value of €15.44 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a prolonged squeeze on net interest income and tougher capital rules in key Nordic markets could quickly challenge the current fair value narrative.

Find out about the key risks to this Nordea Bank Abp narrative.

Another View: Market Ratios Flash a Caution Signal

Our SWS DCF model suggests Nordea is around 39% undervalued, with fair value near €25.53, a far more optimistic view than the tight narrative fair value band around €15.44. If the DCF is closer to the truth, is the market underestimating Nordea’s long term cash generation?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nordea Bank Abp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nordea Bank Abp Narrative

If you see the story differently or simply want to test your own assumptions against the numbers, you can build a personalised view in just a few minutes, Do it your way.

A great starting point for your Nordea Bank Abp research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at Nordea when you can quickly scan focused shortlists of opportunities on Simply Wall St, sharpen your watchlist, and avoid missing tomorrow’s standouts.

- Capture potential income streams by reviewing these 13 dividend stocks with yields > 3% that can help strengthen your long term cash flow.

- Position ahead of innovation waves by assessing these 25 AI penny stocks targeting real world AI adoption instead of just hype.

- Strengthen your value hunting by scanning these 913 undervalued stocks based on cash flows that still trade below what their cash flows may justify.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal