Assessing Realty Income’s (O) Valuation After Its Recent Steady Share Price Climb

Realty Income (O) has quietly pushed higher over the past month, and that steady climb is catching income investors attention. With reliable dividends and improving earnings, the stock’s current valuation deserves a closer look.

See our latest analysis for Realty Income.

That recent uptick in the share price, now at about $58.08, comes after a solid year to date, with a 10.42% year to date share price return and a 12.59% one year total shareholder return, suggesting steady, not explosive, momentum.

If Realty Income’s gradual climb has you thinking about what else might offer dependable growth, this could be a good moment to explore fast growing stocks with high insider ownership.

Yet with shares trading at a modest discount to analyst targets but a hefty discount to some intrinsic value estimates, investors face a key question: Is Realty Income undervalued today or already pricing in its future growth?

Most Popular Narrative Narrative: 5.2% Undervalued

According to andre_santos, Realty Income’s fair value of about $61.26 sits modestly above the recent $58.08 close, framing a measured upside story.

Given the expectation that Realty Income’s dividend growth will decelerate in the coming years, greater weight will be assigned to the Dividend Discount Model. This model reflects more appropriately the anticipated slowdown in dividend growth.

To see what powers that dividend focused framework, and how future payouts and required returns interact to create this fair value, dive into the full narrative.

Result: Fair Value of $61.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising interest rates or weaker tenant demand could pressure valuations and cash flows, challenging the assumption of steady, inflation-like dividend growth.

Find out about the key risks to this Realty Income narrative.

Another Angle on Valuation: Earnings Multiple Sends a Different Signal

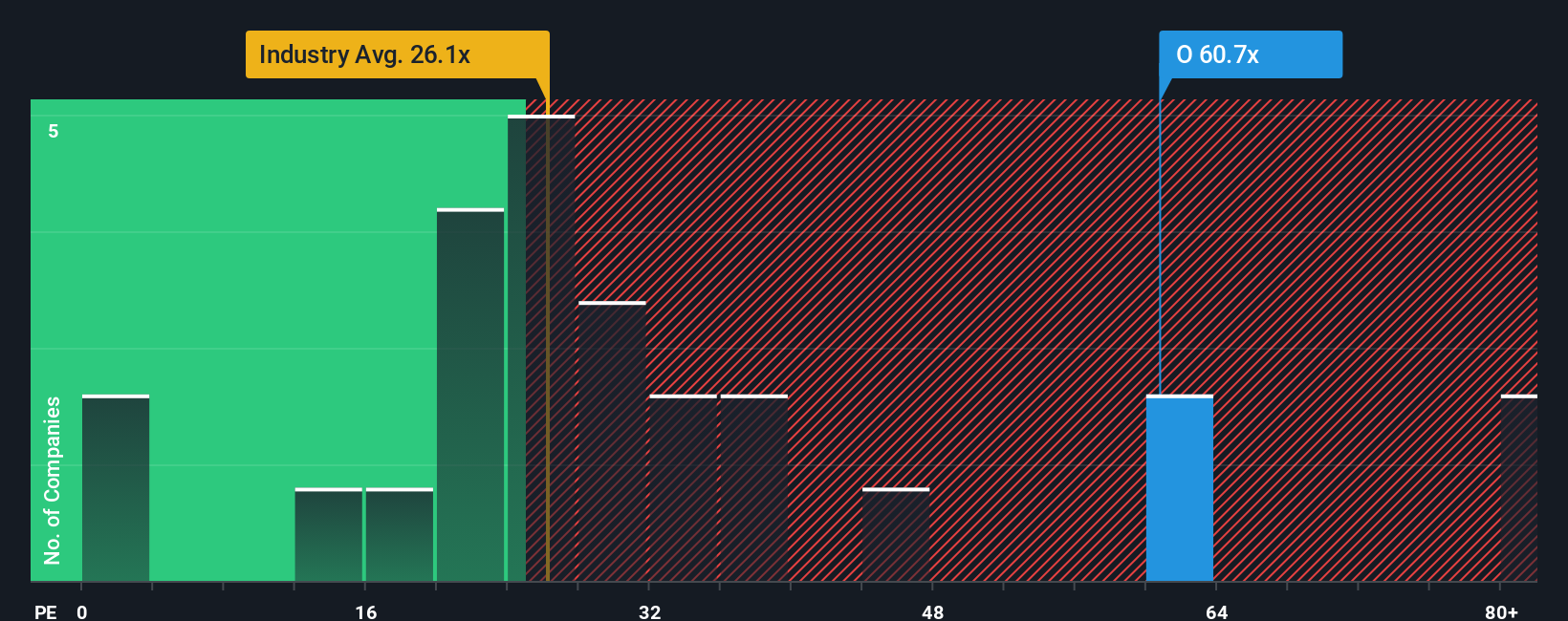

While the dividend focused narrative sees modest upside, our earnings multiple view is harsher. Realty Income trades at about 55.5 times earnings, roughly double the Retail REITs industry at 27.5 and well above its 34.6 fair ratio, hinting at richer pricing than the dividend models suggest. Could investors be overpaying for safety here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Realty Income Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalised view in just a few minutes using Do it your way.

A great starting point for your Realty Income research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, lock in an edge by using the Simply Wall St Screener to uncover fresh, data driven opportunities beyond Realty Income.

- Capture potential market mispricing early by scanning these 913 undervalued stocks based on cash flows that the crowd might be overlooking.

- Ride powerful structural trends by targeting these 25 AI penny stocks positioned at the heart of machine learning and automation.

- Strengthen your income stream by zeroing in on these 13 dividend stocks with yields > 3% that can complement or outperform your current holdings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal