Assessing F&G Annuities & Life (FG) Valuation After a Recent Short-Term Share Price Rebound

F&G Annuities & Life (FG) has been quietly grinding higher, with the stock up around 5% over the past week and 7% over the past month, even as its year-to-date return stays negative.

See our latest analysis for F&G Annuities & Life.

That recent 7 day share price return of 5.33% looks more like a relief rally than a full trend change. The year to date share price return is still down 15.46%, and the 1 year total shareholder return sits at a weak negative 20.42%, despite a strong 3 year total shareholder return of almost 90%.

If this move in FG has you rethinking where you want defensive exposure, it could be a good moment to explore healthcare stocks as potential alternatives.

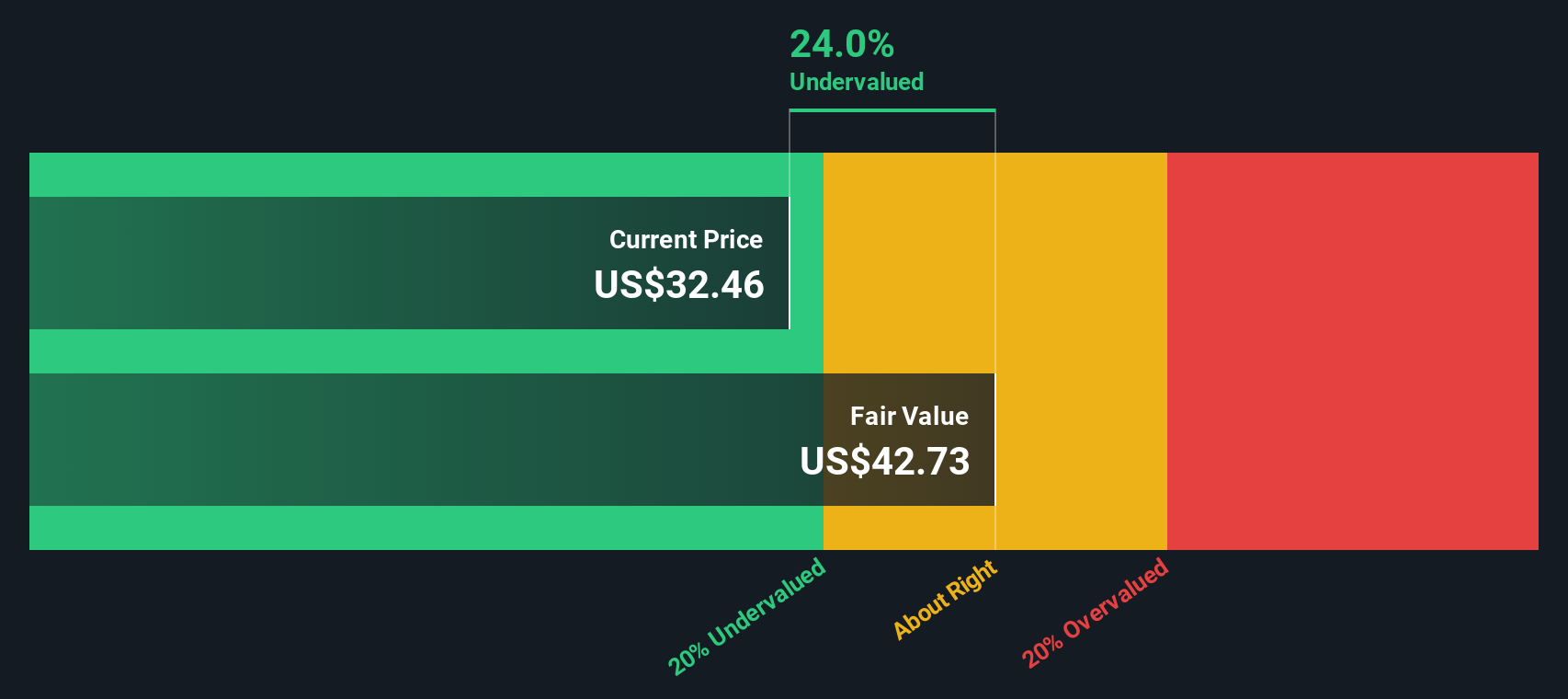

With shares still well below their three year highs yet trading just above the average analyst target, the key question now is whether FG remains undervalued or if the market is already pricing in its future growth.

Price-to-Earnings of 10.5x: Is it justified?

FG trades on a 10.5x price to earnings multiple, which looks undemanding relative to both insurance peers and the broader US equity market.

The price to earnings ratio compares what investors pay today for each dollar of current earnings, and it is a primary yardstick for mature, profitable insurers like FG. With the company now consistently in the black and generating positive net margins, this multiple is a direct read on how the market values its profit stream.

Relative to the US Insurance industry average of 13.4x, FG's 10.5x multiple implies investors are applying a noticeable discount to its earnings power. That discount persists even though the stock has transitioned to higher net profit margins and is trading almost a fifth below our DCF estimate of fair value. This suggests the market is still cautious about the durability and growth profile of those earnings.

Against a peer average multiple of 11x, FG again screens as cheaper on earnings. This reinforces the idea that the stock is modestly undervalued on traditional metrics rather than aggressively priced for perfection.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 10.5x (UNDERVALUED)

However, investors still face risks if interest rates stay higher for longer or credit markets deteriorate, which could squeeze spreads and dampen demand for annuity products.

Find out about the key risks to this F&G Annuities & Life narrative.

Another View: What Does Our DCF Say?

Our DCF model paints a more optimistic picture, suggesting fair value around $42.73, roughly 18.6% above the current $34.77 share price, which implies the stock screens as undervalued. If both earnings multiples and cash flows indicate FG is inexpensive, what might the market be missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out F&G Annuities & Life for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own F&G Annuities & Life Narrative

If you see things differently or prefer to dig into the numbers yourself, you can quickly build a personalised view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding F&G Annuities & Life.

Ready to act on your next opportunity?

Before you move on, give yourself an edge by scanning fresh ideas on the Simply Wall St screener, so promising opportunities do not pass you by.

- Strengthen your watchlist by targeting reliable income streams through these 13 dividend stocks with yields > 3%. This can help you avoid scrambling for yield after the best payouts are gone.

- Position yourself early in transformative technology by reviewing these 25 AI penny stocks, which may highlight companies involved in developing or applying artificial intelligence.

- Identify potential bargains ahead of the crowd with these 913 undervalued stocks based on cash flows, so you do not hear about underpriced candidates only after they have already moved.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal