OCBC (SGX:O39) Valuation Check as New Sustainability, SME Financing and China QR Initiatives Take Shape

Oversea-Chinese Banking (SGX:O39) just rolled out a trio of strategic moves, backing a low carbon steel project, deepening SME financing with Marriott, and expanding QR payments into China, giving investors fresh angles on future growth.

See our latest analysis for Oversea-Chinese Banking.

These moves come as sentiment has already been turning in OCBC’s favour, with a roughly 16 percent 3 month share price return and a 21 percent 1 year total shareholder return suggesting momentum is building rather than fading.

If OCBC’s recent run has you thinking about what else could surprise on the upside, this is a good moment to explore fast growing stocks with high insider ownership.

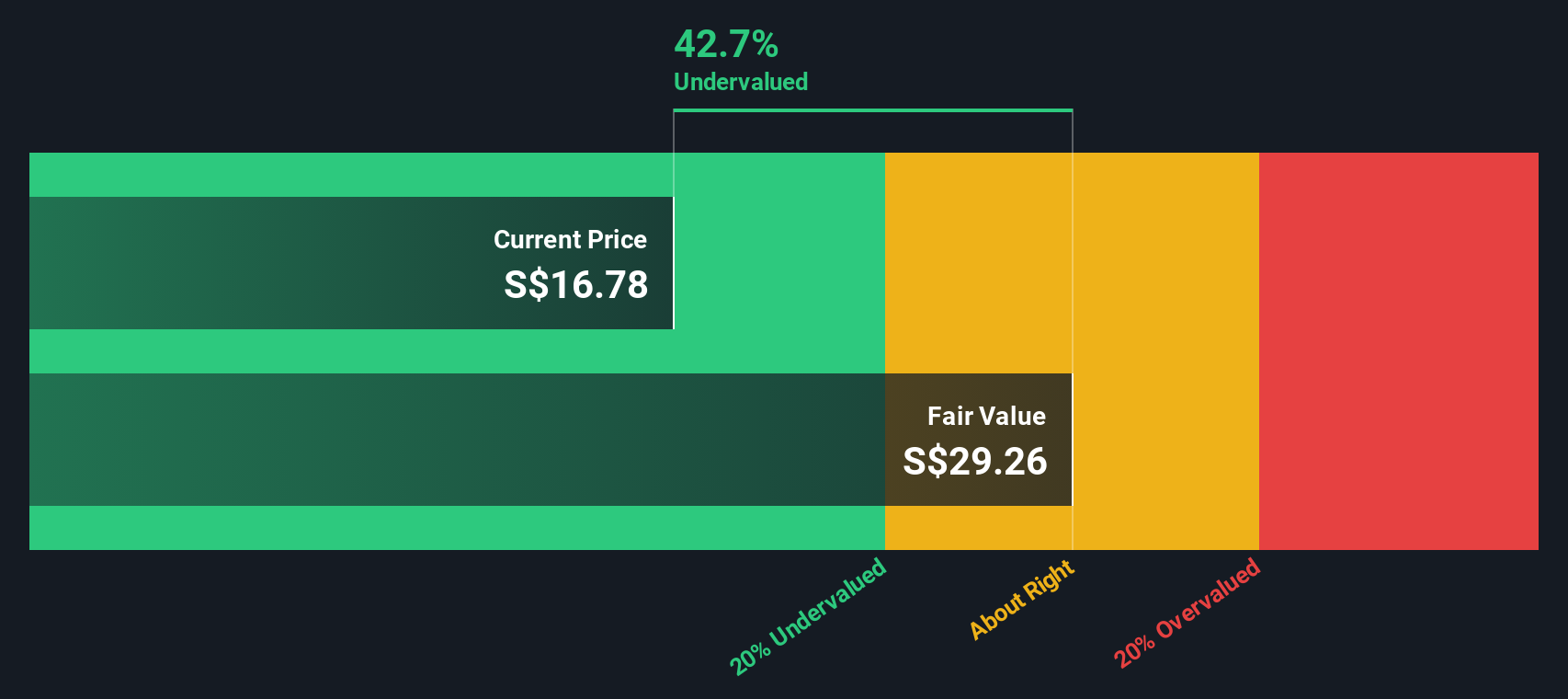

Yet with the share price already near analyst targets, but our intrinsic estimates implying a wide margin of safety, the real question is whether OCBC is still undervalued or if the market is already pricing in this next leg of growth.

Most Popular Narrative Narrative: 1% Overvalued

With Oversea-Chinese Banking last closing at SGD19.44 against a narrative fair value of about SGD19.29, the valuation gap is razor thin but assumptions run deep.

Conservative capital management and proactive credit risk policies, coupled with a strong capital buffer (CET1 17%), position OCBC to defensively capture market share and maintain asset quality during downturns. This should result in more resilient earnings and potentially allow for higher shareholder returns (via dividends or buybacks) as the macro environment stabilizes.

Want to know what kind of steady growth and profit margins justify paying a premium bank multiple here? The narrative quietly bakes in disciplined expansion, rising earnings power, and a richer valuation profile than the wider sector. Curious which specific long term revenue and earnings paths have to play out for that price to hold up?

Result: Fair Value of $19.29 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this steady growth story could quickly be challenged if interest rates fall faster than expected or trade tensions in Greater China intensify.

Find out about the key risks to this Oversea-Chinese Banking narrative.

Another Lens on Value

Our SWS DCF model paints a very different picture, suggesting OCBC is trading about 37 percent below its estimated fair value of roughly SGD30.83 per share. If the cash flow story is right and the market eventually closes that gap, how patient are you willing to be?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Oversea-Chinese Banking for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Oversea-Chinese Banking Narrative

If you are not entirely on board with this view, or simply prefer to dig into the numbers yourself, you can build a tailored thesis in just a few minutes, starting with Do it your way.

A great starting point for your Oversea-Chinese Banking research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not park your capital in just one story when you can quickly uncover new opportunities with our screeners designed to surface strong, actionable ideas.

- Accelerate your hunt for quality by reviewing these 913 undervalued stocks based on cash flows that may be trading at meaningful discounts to their long term cash flow potential.

- Ride structural tech shifts by checking out these 25 AI penny stocks positioned to benefit from rapid advances in artificial intelligence and automation.

- Strengthen your income stream by scanning these 13 dividend stocks with yields > 3% that combine attractive yields with the potential for capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal