Box (BOX) Valuation Check After Recent Share Price Pullback

Box (BOX) has slipped over the past month and quarter, even as its long term performance remains solid. That pullback has investors asking whether the current valuation fairly reflects its growth profile.

See our latest analysis for Box.

Over the past year, Box’s share price return has drifted lower, with the recent 7 day and 30 day share price returns both negative, even though the 5 year total shareholder return remains meaningfully positive. This suggests momentum has cooled while the long term thesis is intact.

If Box’s recent pullback has you reassessing growth names, it could be a good moment to explore other high growth tech and AI ideas through high growth tech and AI stocks.

With Box trading below analyst targets yet already delivering steady revenue growth, investors now face a key question: is the recent weakness a chance to buy into underappreciated upside, or a sign the market has fully priced in its future growth?

Most Popular Narrative Narrative: 18% Undervalued

Based on the most followed valuation, Box’s fair value of 36.25 dollars sits comfortably above the 29.71 dollars last close. This frames a sizable upside gap.

Ongoing investments in AI powered metadata extraction, no code workflow automation, and integration with leading AI model providers (OpenAI, Anthropic, xAI) and enterprise software ecosystems (Microsoft, Google, Salesforce) are deepening Box's value proposition, supporting premium pricing, reducing churn, and contributing to margin expansion over time.

Want to see what kind of steady revenue climb, margin trajectory, and future earnings multiple are baked into that upside case? The full narrative reveals the exact roadmap behind this seemingly modest growth outlook that still supports a premium valuation profile.

Result: Fair Value of $36.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, escalating competition from hyperscalers and increasingly commoditized cloud pricing could erode Box’s premium positioning, challenging both its growth outlook and its margin expansion story.

Find out about the key risks to this Box narrative.

Another Angle on Valuation

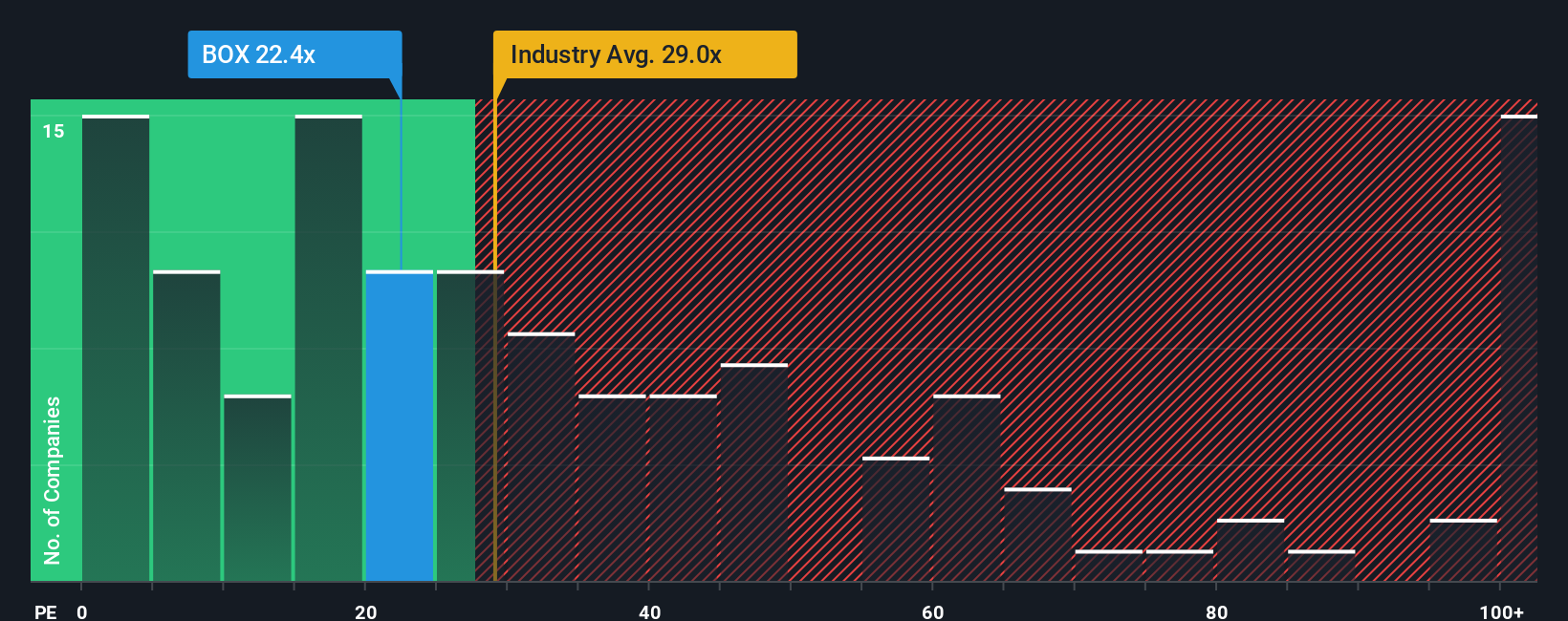

On earnings, the picture flips. Box trades at 22.8 times earnings, cheaper than both US software peers at 32.9 times and right in line with its own growth profile, yet still above a fair ratio of 18.4 times. Is that a cushion or a warning if growth stumbles?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Box Narrative

If this view does not quite fit your own, or you simply prefer hands on research, you can build a custom narrative yourself in just a few minutes, starting with Do it your way.

A great starting point for your Box research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, put Simply Wall Street’s powerful Screener to work and uncover fresh opportunities that could sharpen your portfolio and support your long term returns.

- Capture mispriced potential by reviewing these 913 undervalued stocks based on cash flows where strong cash flows and attractive entry points might help identify tomorrow’s standout performers.

- Explore the next wave of intelligent innovation by targeting these 25 AI penny stocks that are exposed to advances in automation, data analytics, and machine learning.

- Strengthen your income stream by focusing on these 13 dividend stocks with yields > 3% that can help support regular cash returns alongside potential capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal