3 ASX Stocks Estimated To Be Up To 48.7% Below Intrinsic Value

As the Australian market navigates a festive atmosphere reminiscent of past highs, optimism remains palpable despite ongoing tech jitters and fluctuating commodity prices. In this context, identifying stocks that are undervalued relative to their intrinsic value can offer significant opportunities for investors looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Lynas Rare Earths (ASX:LYC) | A$12.49 | A$23.52 | 46.9% |

| LGI (ASX:LGI) | A$3.95 | A$7.72 | 48.9% |

| Kinatico (ASX:KYP) | A$0.27 | A$0.48 | 43.7% |

| IDP Education (ASX:IEL) | A$5.44 | A$10.60 | 48.7% |

| Guzman y Gomez (ASX:GYG) | A$21.75 | A$38.71 | 43.8% |

| Electro Optic Systems Holdings (ASX:EOS) | A$7.53 | A$13.76 | 45.3% |

| Cromwell Property Group (ASX:CMW) | A$0.465 | A$0.86 | 46% |

| Betmakers Technology Group (ASX:BET) | A$0.185 | A$0.34 | 45.5% |

| Bellevue Gold (ASX:BGL) | A$1.555 | A$2.80 | 44.5% |

| Airtasker (ASX:ART) | A$0.33 | A$0.63 | 47.9% |

Let's uncover some gems from our specialized screener.

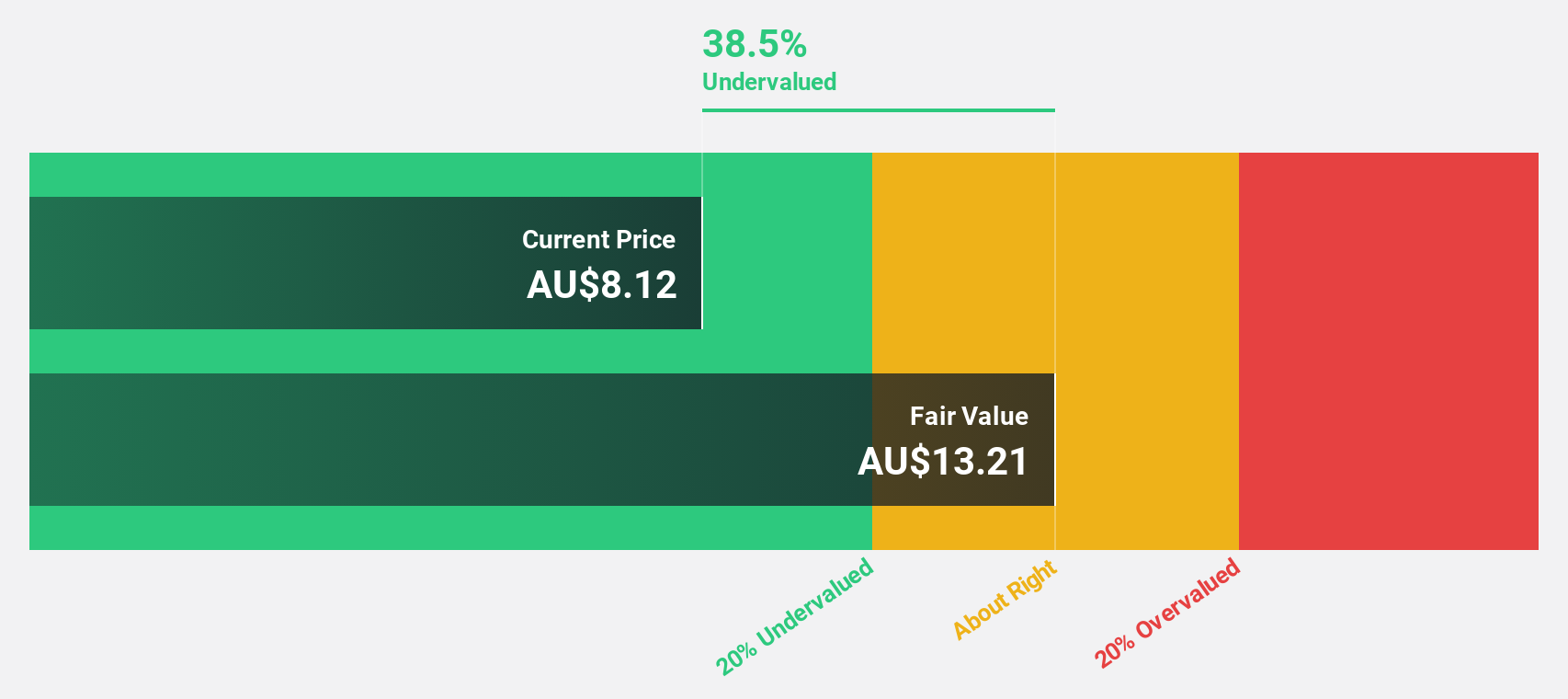

Electro Optic Systems Holdings (ASX:EOS)

Overview: Electro Optic Systems Holdings Limited develops, manufactures, and sells telescopes and dome enclosures, laser satellite tracking systems, and remote weapon systems with a market cap of A$1.45 billion.

Operations: The company's revenue is derived from two primary segments: Space, contributing A$11.99 million, and Defence, accounting for A$103.13 million.

Estimated Discount To Fair Value: 45.3%

Electro Optic Systems Holdings is trading at A$7.53, significantly undervalued compared to its estimated fair value of A$13.76, reflecting a 45.3% discount. The company is expected to achieve revenue growth of 37.7% annually, outpacing the Australian market average of 5.9%, and is projected to become profitable within three years with earnings surging over 114% per year despite recent share price volatility and low forecasted return on equity (4.2%).

- According our earnings growth report, there's an indication that Electro Optic Systems Holdings might be ready to expand.

- Unlock comprehensive insights into our analysis of Electro Optic Systems Holdings stock in this financial health report.

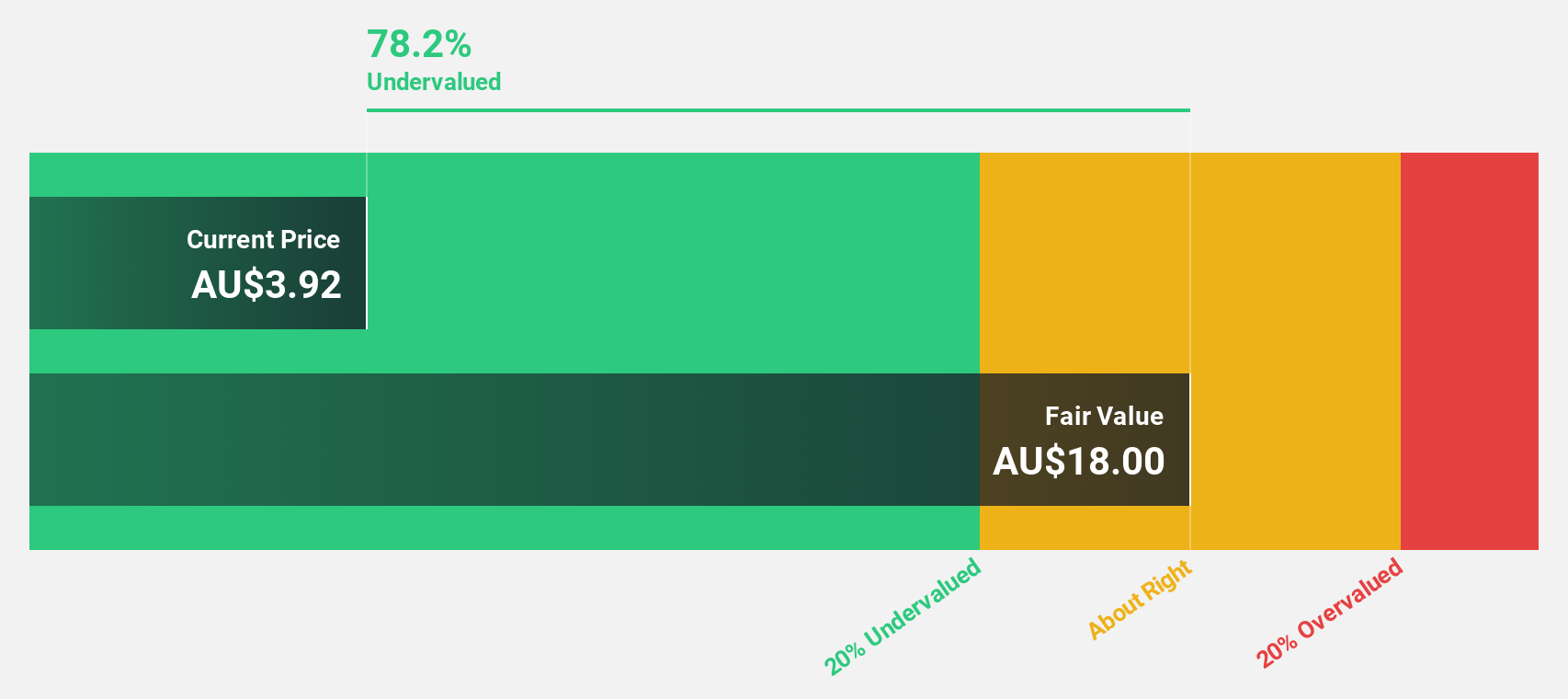

IDP Education (ASX:IEL)

Overview: IDP Education Limited facilitates student placements into educational institutions across Australia, the United Kingdom, the United States, Canada, New Zealand, and Ireland with a market cap of A$1.51 billion.

Operations: The company's revenue is derived from its Educational Services - Education & Training Services segment, which generated A$882.20 million.

Estimated Discount To Fair Value: 48.7%

IDP Education is trading at A$5.44, significantly below its estimated fair value of A$10.6, indicating it is undervalued based on cash flows by over 20%. Despite a drop from the FTSE All-World Index, the company has been added to the S&P/ASX Small Ordinaries Index. Earnings are projected to grow 23.7% annually, outpacing both revenue growth and market averages, although profit margins have declined from last year’s 12.8% to 5%.

- The analysis detailed in our IDP Education growth report hints at robust future financial performance.

- Get an in-depth perspective on IDP Education's balance sheet by reading our health report here.

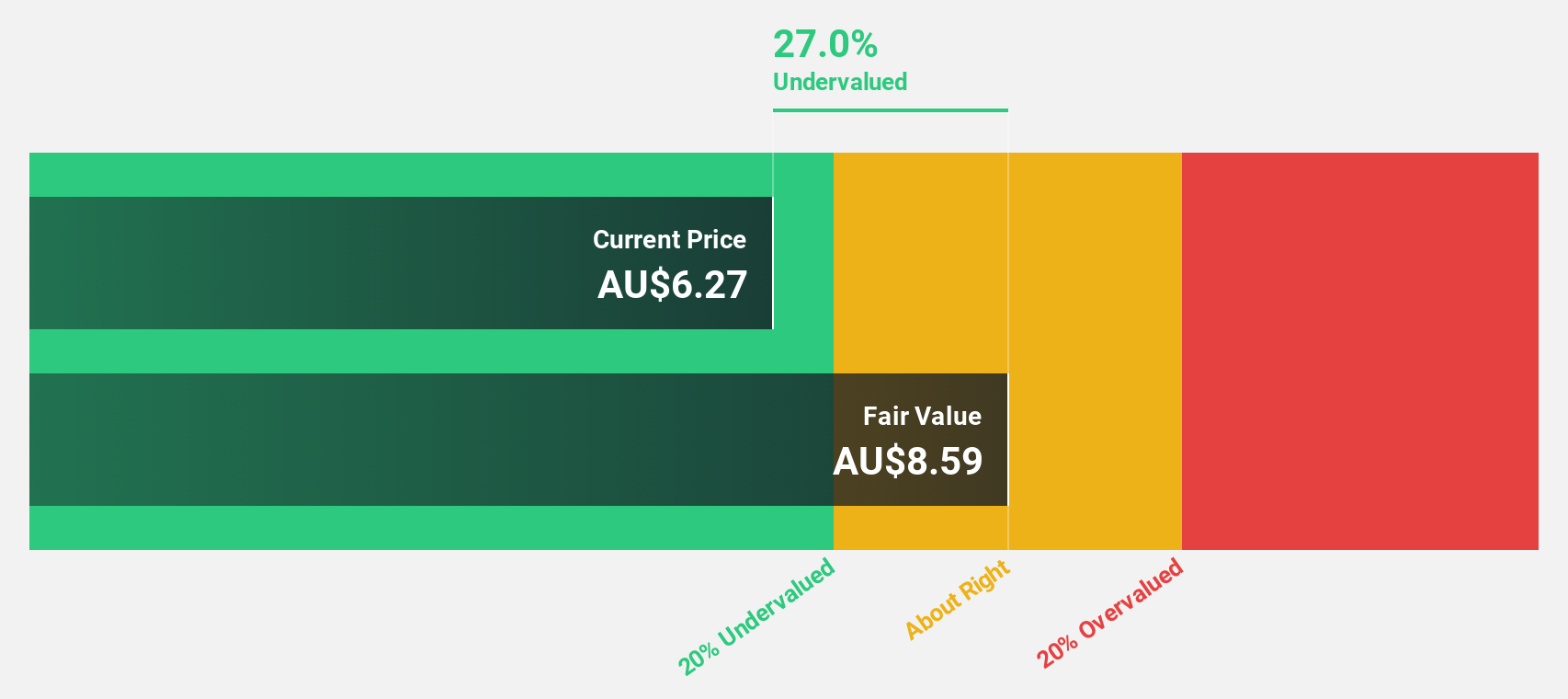

PWR Holdings (ASX:PWH)

Overview: PWR Holdings Limited designs, prototypes, produces, tests, validates, and sells cooling products and solutions across various international markets with a market cap of A$742.24 million.

Operations: The company's revenue segments include A$42.33 million from PWR C&R and A$101.83 million from PWR Performance Products.

Estimated Discount To Fair Value: 12.3%

PWR Holdings, trading at A$7.38, is undervalued relative to its estimated fair value of A$8.41. Earnings are expected to grow significantly at 26.9% annually over the next three years, surpassing market averages despite a decline in profit margins from 17.8% to 7.5%. Recent board changes include Kees Weel's transition to Chairman and Alexandra Coleman's appointment as Company Secretary, potentially impacting strategic direction and governance stability moving forward.

- Upon reviewing our latest growth report, PWR Holdings' projected financial performance appears quite optimistic.

- Dive into the specifics of PWR Holdings here with our thorough financial health report.

Taking Advantage

- Take a closer look at our Undervalued ASX Stocks Based On Cash Flows list of 38 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal