Douglas Emmett (DEI): Revisiting Valuation After a Sharp Multi-Period Share Price Decline

Douglas Emmett (DEI) has quietly fallen out of favor this year, with the stock down sharply even as revenue still edges higher. That disconnect sets up an interesting debate around what the market is really pricing in.

See our latest analysis for Douglas Emmett.

Zooming out, the 90 day share price return of negative 28.67 percent and year to date share price return of negative 37.76 percent show sentiment has soured. A five year total shareholder return near negative 50 percent suggests investors still see structural risks outweighing gradual revenue growth at the current 11.67 dollar share price.

If this kind of reset in expectations has you rethinking where to look next, it could be a good moment to explore fast growing stocks with high insider ownership for fresh ideas beyond traditional REITs.

With the share price now trading at a steep discount to analyst estimates despite modest revenue growth, investors face a crucial question: is Douglas Emmett being unfairly punished, or is the market realistically pricing in weaker long term prospects?

Most Popular Narrative: 17.4% Undervalued

With Douglas Emmett closing at 11.67 dollars against a narrative fair value of 14.14 dollars, the spread reflects a cautiously optimistic long term outlook.

The analysts have a consensus price target of $17.773 for Douglas Emmett based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $21.0, and the most bearish reporting a price target of just $13.0.

Curious how modest revenue growth, shifting profit margins and a demanding future earnings multiple can still add up to upside from here? The full narrative unpacks the math step by step and shows exactly how these moving parts combine into that fair value call.

Result: Fair Value of $14.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case still hinges on improving office demand and manageable interest costs, both of which could easily disappoint if macro conditions worsen.

Find out about the key risks to this Douglas Emmett narrative.

Another Angle on Valuation

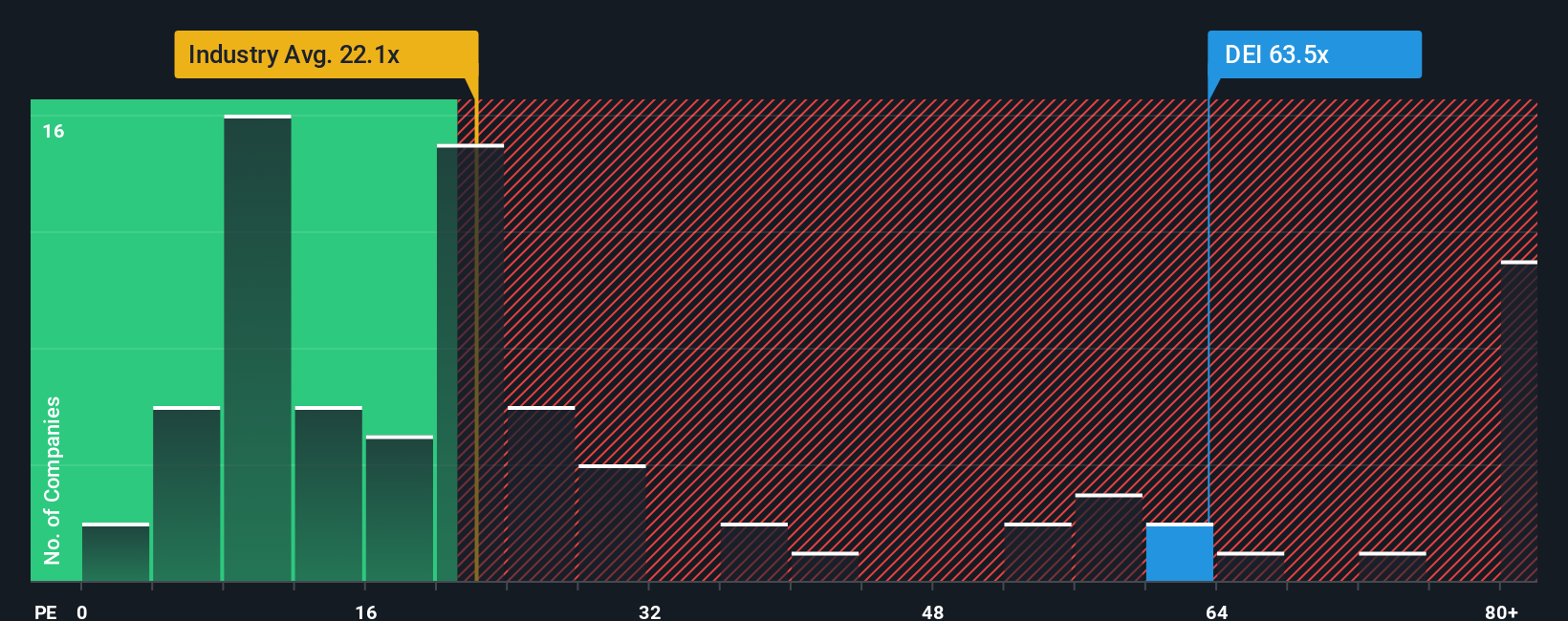

While the narrative points to upside, the current price to earnings ratio of 93.7 times looks stretched against both the global Office REITs average of 22.3 times and a fair ratio of 16.4 times, suggesting meaningful downside risk if sentiment normalizes. Is this a genuine bargain or a value trap in disguise?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Douglas Emmett Narrative

If you are skeptical of these assumptions or simply prefer your own due diligence, you can craft a personalized view in minutes: Do it your way.

A great starting point for your Douglas Emmett research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you log off, you can explore fresh opportunities on the Simply Wall Street Screener so you are not limited to watching others act first.

- Explore early-stage companies by reviewing these 3625 penny stocks with strong financials that already show stronger financial foundations than typical speculative names.

- Focus on innovation by assessing these 26 AI penny stocks that use artificial intelligence to transform traditional business models.

- Look for potential value by targeting these 13 dividend stocks with yields > 3% that combine income today with the possibility of capital gains in the future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal