Aura Minerals (NasdaqGS:AUGO): Valuation Check After Higher 2025 Guidance and Bullish Era Dorada Study

Aura Minerals (NasdaqGS:AUGO) just lifted its 2025 production guidance to over 600,000 gold equivalent ounces and paired that with a bullish feasibility study for its newly acquired Era Dorada underground mine.

See our latest analysis for Aura Minerals.

The guidance hike and strong Era Dorada economics come at a time when Aura’s momentum is already strong, with the share price at $46.78 and a year to date share price return of 288.22 percent. The five year total shareholder return of 496.70 percent shows the longer term compounding story is very much intact.

If Aura’s surge has you thinking about what else could rerate on execution, this might be the moment to explore fast growing stocks with high insider ownership.

Yet with Aura now trading just above consensus targets despite negative trailing earnings and hefty growth promises, investors face a key question: is this still an overlooked compounding story, or is the market already pricing in the next leg of expansion?

Price to Sales of 5.1x: Is it justified?

Aura Minerals last closed at $46.78, and on a price to sales ratio of 5.1x it screens noticeably expensive against both its industry and fair value benchmarks.

The price to sales multiple compares the company’s market value to its annual revenue, a useful lens for a gold and copper producer that is currently loss making and therefore difficult to value on earnings. For Aura, investors are effectively paying just over five times last year’s $771.6 million of revenue for a business that is still unprofitable today but expected to move into the black over the next few years.

Relative to the broader US Metals and Mining industry average of 1.7x sales, Aura’s 5.1x multiple implies the market is already baking in a much steeper revenue and margin trajectory than the typical peer. Even when set against an estimated fair price to sales ratio of 3.9x, today’s valuation looks stretched. This suggests room for the multiple to compress if execution or gold prices disappoint, or for the share price to drift while fundamentals catch up with expectations.

Explore the SWS fair ratio for Aura Minerals

Result: Price to Sales of 5.1x (OVERVALUED)

However, Aura still faces meaningful risks, including execution missteps at Era Dorada and weaker commodity prices that could derail its ambitious growth trajectory.

Find out about the key risks to this Aura Minerals narrative.

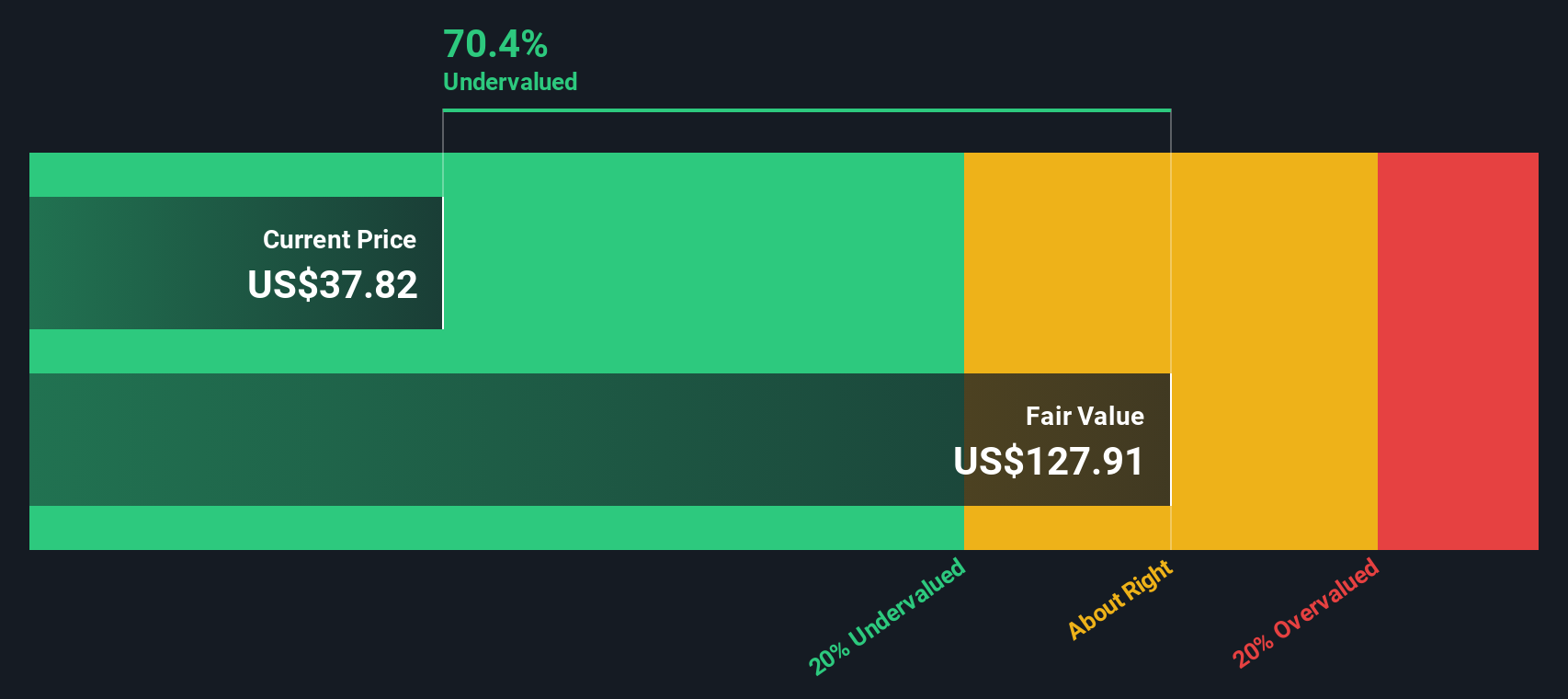

Another View: DCF Points the Other Way

While Aura looks expensive on 5.1x sales, our DCF model presents a very different picture. It suggests fair value closer to $116.70, or around 60 percent above today’s $46.78 share price. If the SWS DCF model is right, this raises the question of whether the market is underestimating the next phase of growth.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aura Minerals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aura Minerals Narrative

If you would rather rely on your own judgments and dig into the numbers yourself, you can build a personalized view in minutes: Do it your way.

A great starting point for your Aura Minerals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next move with fresh stock ideas tailored to different strategies, so your watchlist continues working harder than the market.

- Explore potential multi baggers early by scanning through these 3625 penny stocks with strong financials that already pair their low share prices with real financial strength.

- Prepare for the next wave of innovation by checking out these 26 AI penny stocks that may be well positioned as artificial intelligence influences entire industries.

- Seek to strengthen your long term returns by focusing on income opportunities across these 13 dividend stocks with yields > 3% that pay you while you wait for the market to adjust.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal