Curtiss-Wright (CW) Valuation Check as Citigroup Initiates Neutral Coverage and Street Stays Constructive

Citigroup just initiated coverage on Curtiss-Wright (CW) with a Neutral stance, adding fresh institutional eyes to a stock that already carries an Outperform consensus from other brokerages and is drawing more investors into the story.

See our latest analysis for Curtiss-Wright.

That fresh coverage lands as Curtiss-Wright trades around $547.36, with strong year to date share price momentum feeding into an impressive multi year total shareholder return profile. This suggests investors are steadily repricing its growth and defense exposure.

If Citigroup’s move has you thinking more broadly about defense names, it could be a good time to explore other opportunities across aerospace and defense stocks and see what else matches your thesis.

After such a powerful multiyear run and with shares already sitting within reach of Wall Street targets, is Curtiss-Wright still quietly undervalued, or is the market already paying up for its next leg of growth?

Most Popular Narrative: 10% Undervalued

With Curtiss-Wright closing at $547.36 against a most-followed fair value of about $608.17, the narrative leans toward meaningful upside still being on the table.

Record backlog growth (+12% YTD to $3.8B), strong book-to-bill ratios (1.2x in A&D), and a healthy order pipeline in both defense and nuclear align with management's confidence in posting 9 to 10% sales growth, 16 to 19% EPS growth, and over 100 bps of margin expansion in 2025, signaling undervaluation if current pricing underappreciates this forward visibility and operational leverage.

Want to see how long cycle defense programs, nuclear optionality, and richer margins combine into this valuation math? The growth, profitability and future multiple assumptions may surprise you.

Result: Fair Value of $608.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained nuclear policy delays or a sharp pivot toward software centric defense budgets could choke Curtiss-Wright’s hardware growth and compress margins.

Find out about the key risks to this Curtiss-Wright narrative.

Another Take on Valuation

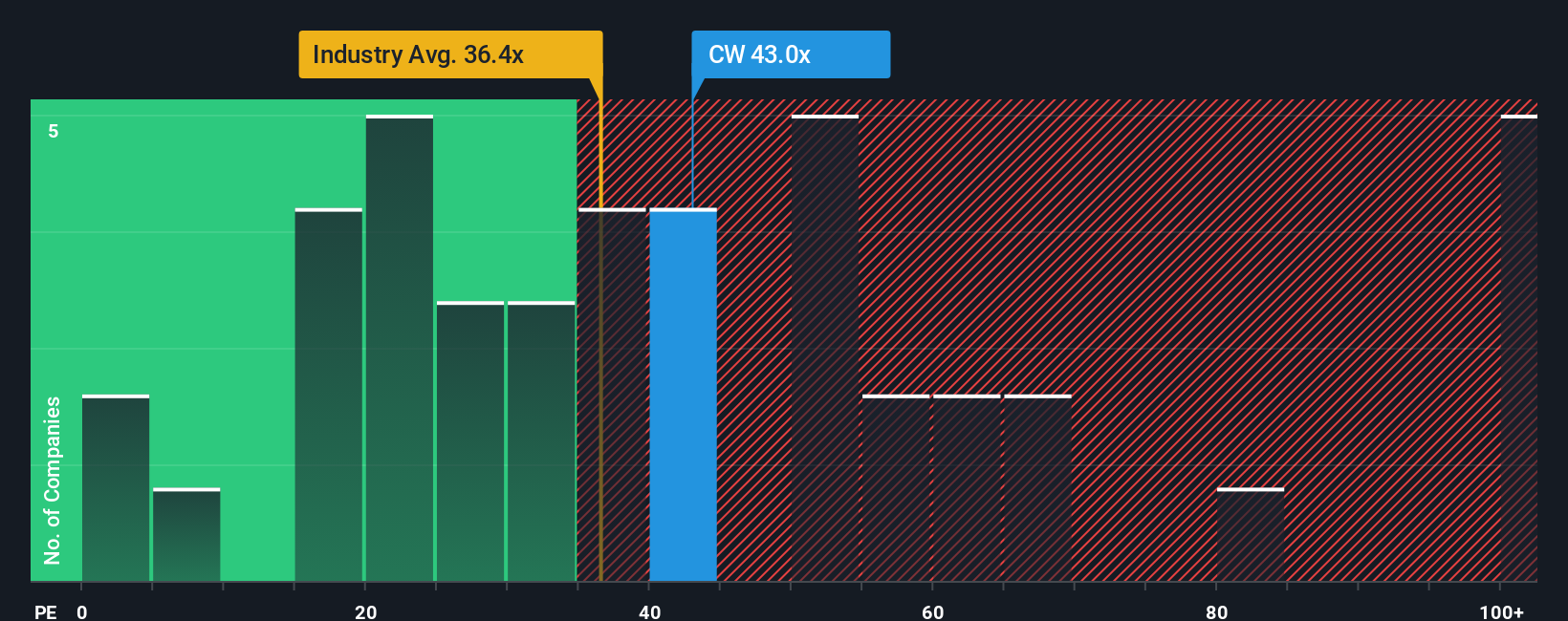

Not everyone agrees Curtiss-Wright is cheap. On earnings, the stock trades at about 43.4 times profits, clearly richer than both the US Aerospace and Defense average of 38.7 times and its peer average of 41.1 times, and far above a fair ratio near 27.1 times. That gap suggests less margin for error if growth stumbles. Are investors paying tomorrow’s price today?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Curtiss-Wright Narrative

If you see the story differently or simply want to stress test the numbers yourself, you can spin up a custom narrative in just minutes, Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Curtiss-Wright.

Looking for more investment ideas?

Do not stop your research with one company. Use Simply Wall Street’s powerful screener to uncover focused, high conviction ideas that could sharpen your portfolio edge.

- Capitalize on potential mispricing by targeting quality opportunities trading below intrinsic value through these 906 undervalued stocks based on cash flows before the market fully wakes up.

- Ride structural growth trends in artificial intelligence by zeroing in on innovators shaping tomorrow’s platforms with these 26 AI penny stocks while they are still gaining traction.

- Strengthen your income stream by focusing on reliable payers using these 13 dividend stocks with yields > 3% so you do not miss out on compelling yield plus growth combinations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal