Cumberland Pharmaceuticals Leads 3 Promising Penny Stocks

Major stock indexes in the United States have recently retreated following delayed jobs data, with unemployment rates higher than anticipated. In this context, investing in penny stocks—an investment area that remains relevant despite being somewhat outdated—can still present unique opportunities. These stocks often represent smaller or newer companies and can offer a blend of affordability and growth potential when backed by strong financials. Let's examine several promising penny stocks that stand out for their financial strength.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.05 | $437.18M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.05 | $179.57M | ✅ 4 ⚠️ 1 View Analysis > |

| LexinFintech Holdings (LX) | $3.16 | $531.71M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.17 | $1.31B | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $1.76 | $178.24M | ✅ 5 ⚠️ 0 View Analysis > |

| Global Self Storage (SELF) | $4.97 | $56.35M | ✅ 3 ⚠️ 3 View Analysis > |

| CI&T (CINT) | $4.73 | $589.37M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 1 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.8701 | $6.32M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.05 | $91.76M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 342 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Cumberland Pharmaceuticals (CPIX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cumberland Pharmaceuticals Inc. is a specialty pharmaceutical company that acquires, develops, and commercializes prescription products for hospital acute care, gastroenterology, and oncology in the United States and internationally, with a market cap of $44.42 million.

Operations: The company's revenue is derived entirely from its specialty pharmaceutical products, totaling $41.28 million.

Market Cap: $44.42M

Cumberland Pharmaceuticals Inc., with a market cap of US$44.42 million, has been trading at 58.4% below its estimated fair value, indicating potential value for investors in the penny stock space. Despite being unprofitable, Cumberland has reduced its losses over the past five years and maintains a positive cash flow runway exceeding three years. Recent developments include strategic partnerships to commercialize Talicia and expand Vibativ's market reach in Saudi Arabia, alongside securing CMS reimbursement for Caldolor® Injection—a non-opioid pain management option amid an ongoing opioid crisis—highlighting efforts to diversify revenue streams and enhance financial stability.

- Dive into the specifics of Cumberland Pharmaceuticals here with our thorough balance sheet health report.

- Evaluate Cumberland Pharmaceuticals' historical performance by accessing our past performance report.

American Well (AMWL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: American Well Corporation is an enterprise platform and software company that provides digitally enabled hybrid care services in the United States and internationally, with a market cap of approximately $75.47 million.

Operations: The company generates revenue from its Internet Information Providers segment, which amounted to $265.02 million.

Market Cap: $75.47M

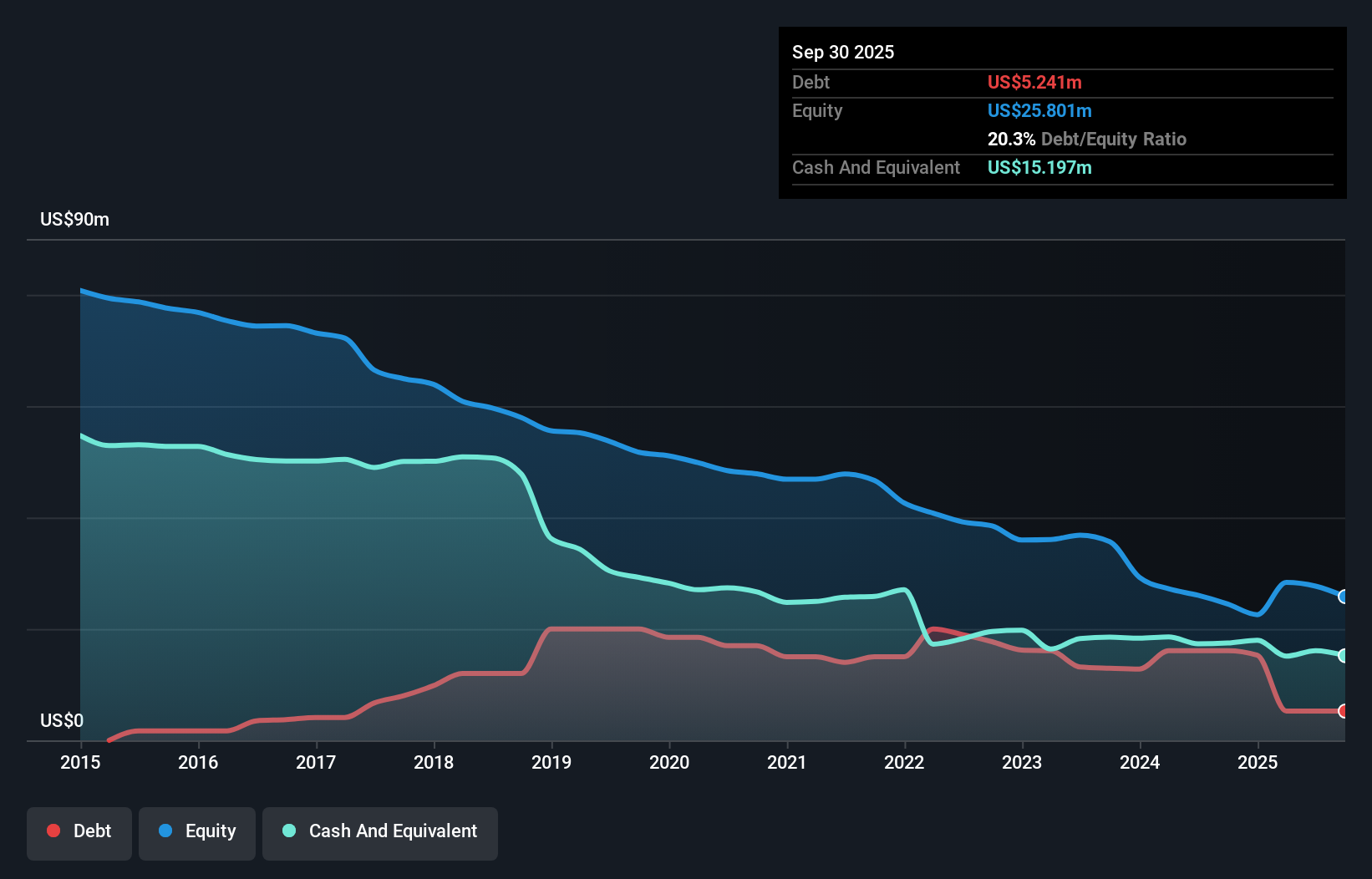

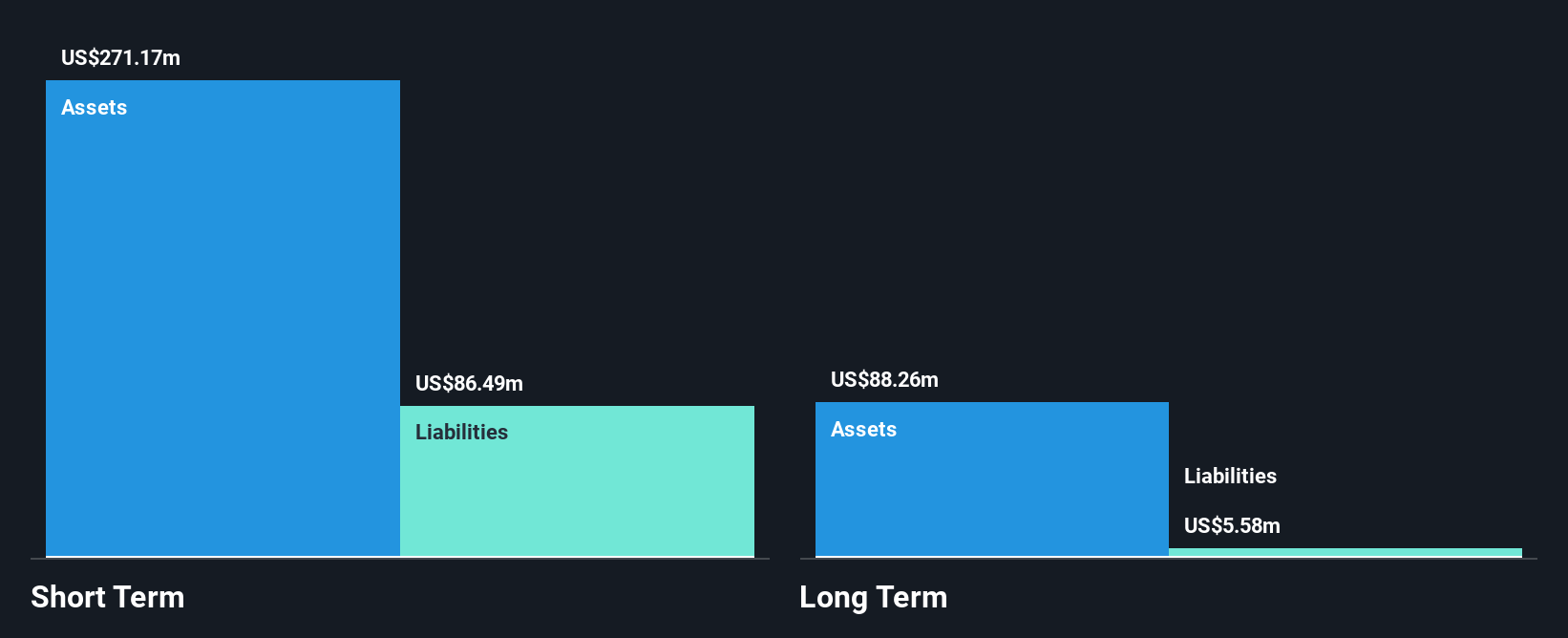

American Well Corporation, with a market cap of US$75.47 million, operates in the digital healthcare sector and faces challenges typical of penny stocks, such as unprofitability and negative return on equity at -42.78%. Despite this, it maintains a strong financial position with short-term assets of US$271.2 million well exceeding both its short- and long-term liabilities. The company has no debt and possesses a cash runway sufficient for over three years if current cash flow trends persist. Recent guidance revisions suggest revenue stabilization between US$245 million to US$248 million for 2025 amidst ongoing operational adjustments.

- Click here and access our complete financial health analysis report to understand the dynamics of American Well.

- Gain insights into American Well's future direction by reviewing our growth report.

Liquidmetal Technologies (LQMT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Liquidmetal Technologies, Inc. is a materials technology company that designs, develops, and sells custom products and parts made from bulk amorphous alloys to various industries globally, with a market cap of $96.31 million.

Operations: The company's revenue is primarily derived from developing and manufacturing products and applications using amorphous alloys, totaling $0.74 million.

Market Cap: $96.31M

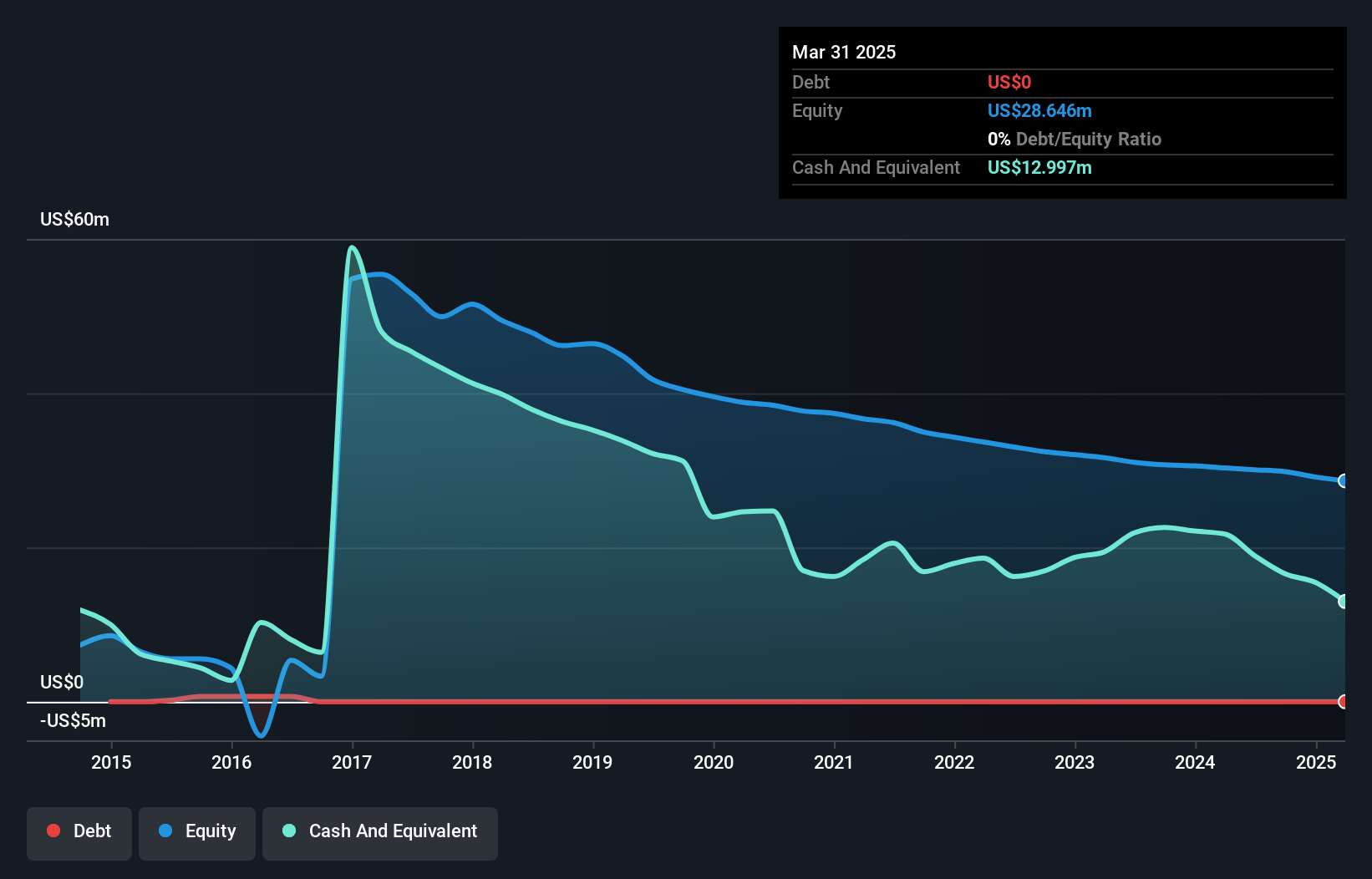

Liquidmetal Technologies, Inc., with a market cap of US$96.31 million, remains pre-revenue with earnings of just US$0.74 million. Despite being unprofitable, it has reduced losses by 13.6% annually over the past five years and maintains a solid financial footing with no debt and short-term assets of US$14.9 million surpassing liabilities significantly. The company reported declining revenues for Q3 2025 at US$0.037 million compared to the previous year while net losses widened to US$0.552 million from US$0.441 million, reflecting ongoing challenges in achieving profitability amidst its strategic focus on amorphous alloys development.

- Click here to discover the nuances of Liquidmetal Technologies with our detailed analytical financial health report.

- Gain insights into Liquidmetal Technologies' historical outcomes by reviewing our past performance report.

Summing It All Up

- Unlock more gems! Our US Penny Stocks screener has unearthed 339 more companies for you to explore.Click here to unveil our expertly curated list of 342 US Penny Stocks.

- Looking For Alternative Opportunities? We've found 13 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal