Booking Holdings (BKNG): Reassessing Valuation After Strong Q3 Beat and Renewed Investor Confidence

Booking Holdings (BKNG) just followed up its strong third quarter beat with a wave of market optimism, as investors zero in on rising room nights, healthier margins, and growing direct bookings despite a choppy macro backdrop.

See our latest analysis for Booking Holdings.

The upbeat Q3 numbers and new partnerships around experiences have clearly reset sentiment, with the share price now at $5,457.70 and a solid year to date share price return of about 11 percent supporting already impressive multi year total shareholder returns. These factors point to momentum still broadly intact rather than fading.

If this kind of travel strength has you rethinking your exposure to consumer names, it could be a good time to explore fast growing stocks with high insider ownership for other fast growing ideas with committed insiders.

With earnings surging, a richer margin profile, and shares still trading at a double digit discount to analyst targets and intrinsic value estimates, is this a rare chance to buy Booking at a reasonable price, or is the market already baking in its next leg of growth?

Most Popular Narrative: 12.1% Undervalued

With the most followed fair value sitting around $6,208 per share versus a $5,457.70 last close, the narrative points to upside that hinges on ambitious growth and margin assumptions while still acknowledging higher required returns from here.

Booking Holdings is incorporating AI technology across its platforms to improve operations, streamline traveler experiences, and enhance supplier partnerships, which is expected to drive future revenue growth and margin improvement. The company's focus on increasing alternative accommodations and expanding its Genius loyalty program aims to strengthen customer retention and capture a broader market, potentially boosting revenue and net margins.

Want to see how steady double digit growth, richer margins, and a premium future earnings multiple combine into that value gap? The core assumptions, and their stretch points, are all laid bare in the narrative projections. Curious which levers matter most if travel demand cools or competition intensifies? Read on to unpack the full valuation blueprint behind this call.

Result: Fair Value of $6,208.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macro uncertainty and rising customer acquisition costs could dent travel demand, squeeze margins and challenge the upbeat growth and valuation assumptions.

Find out about the key risks to this Booking Holdings narrative.

Another Take On Valuation

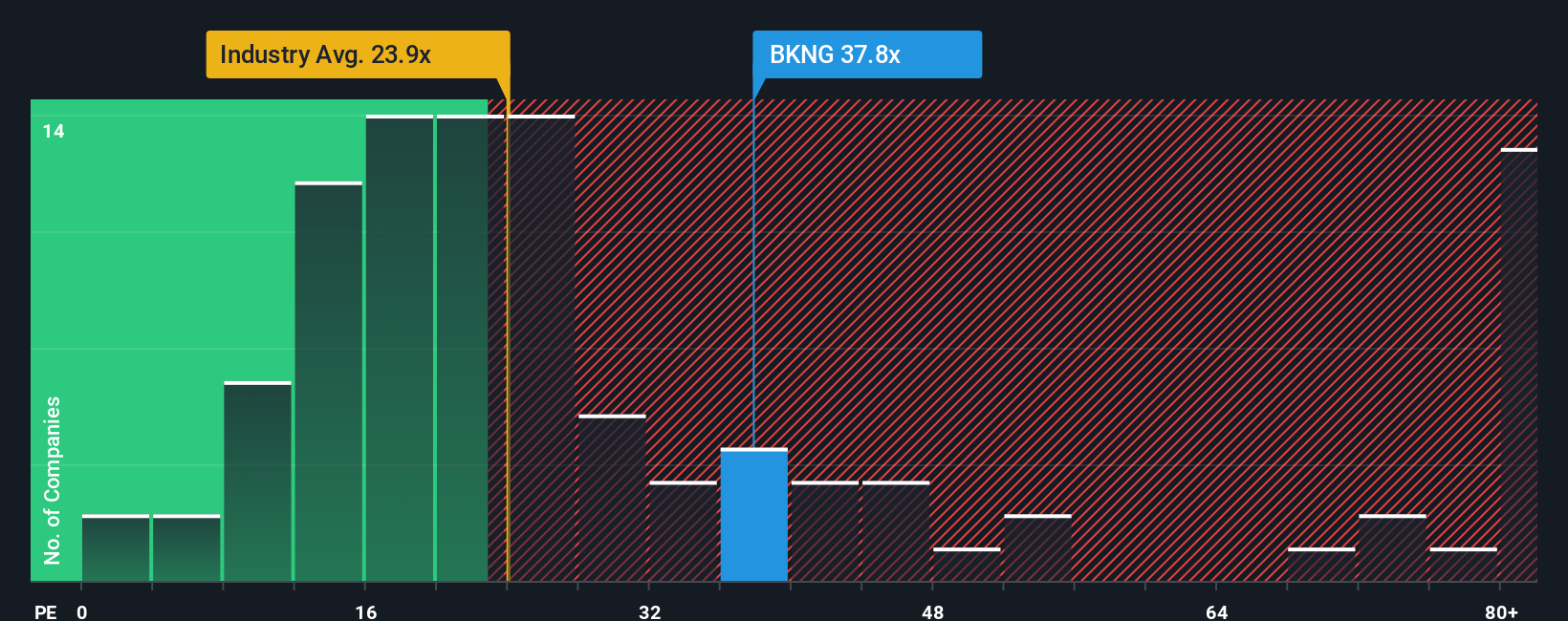

On earnings based metrics, the story looks less forgiving. Booking trades on a 34.9x price to earnings ratio versus 23.1x for the US Hospitality industry and 30.3x for peers, even though our fair ratio sits higher at 39.5x. This leaves investors weighing quality against multiple risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Booking Holdings Narrative

If you see the setup differently or would rather dig into the numbers yourself, you can build a personalized Booking view in minutes. Do it your way.

A great starting point for your Booking Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before you move on, lock in an edge by using the Simply Wall St Screener to uncover fresh opportunities that match your strategy, not the crowd's.

- Position your portfolio for tomorrow's winners by reviewing these 26 AI penny stocks with potential in automation, data intelligence, and next generation software.

- Strengthen your income stream by assessing these 13 dividend stocks with yields > 3% that combine income-focused payouts with resilient business models.

- Explore possible mispriced opportunities by scanning these 906 undervalued stocks based on cash flows where cash flow fundamentals point to upside the market has yet to fully recognize.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal