Should Ryman’s $1b Recap and Australian Funding Shift Require Action From Ryman Healthcare (NZSE:RYM) Investors?

- Ryman Healthcare has recently completed a financial overhaul under new CEO Naomi James, including a very large capital raising of about $1.00 billion and a reset of its capital structure, while Australian aged-care reforms have improved funding arrangements for operators.

- A key shift is that Australian rules now allow providers like Ryman to retain a portion of new refundable accommodation deposits, creating a structurally more supportive revenue model for its care operations.

- We’ll now examine how this overhaul of Ryman’s balance sheet, alongside the Australian funding changes, reshapes its existing investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Ryman Healthcare Investment Narrative Recap

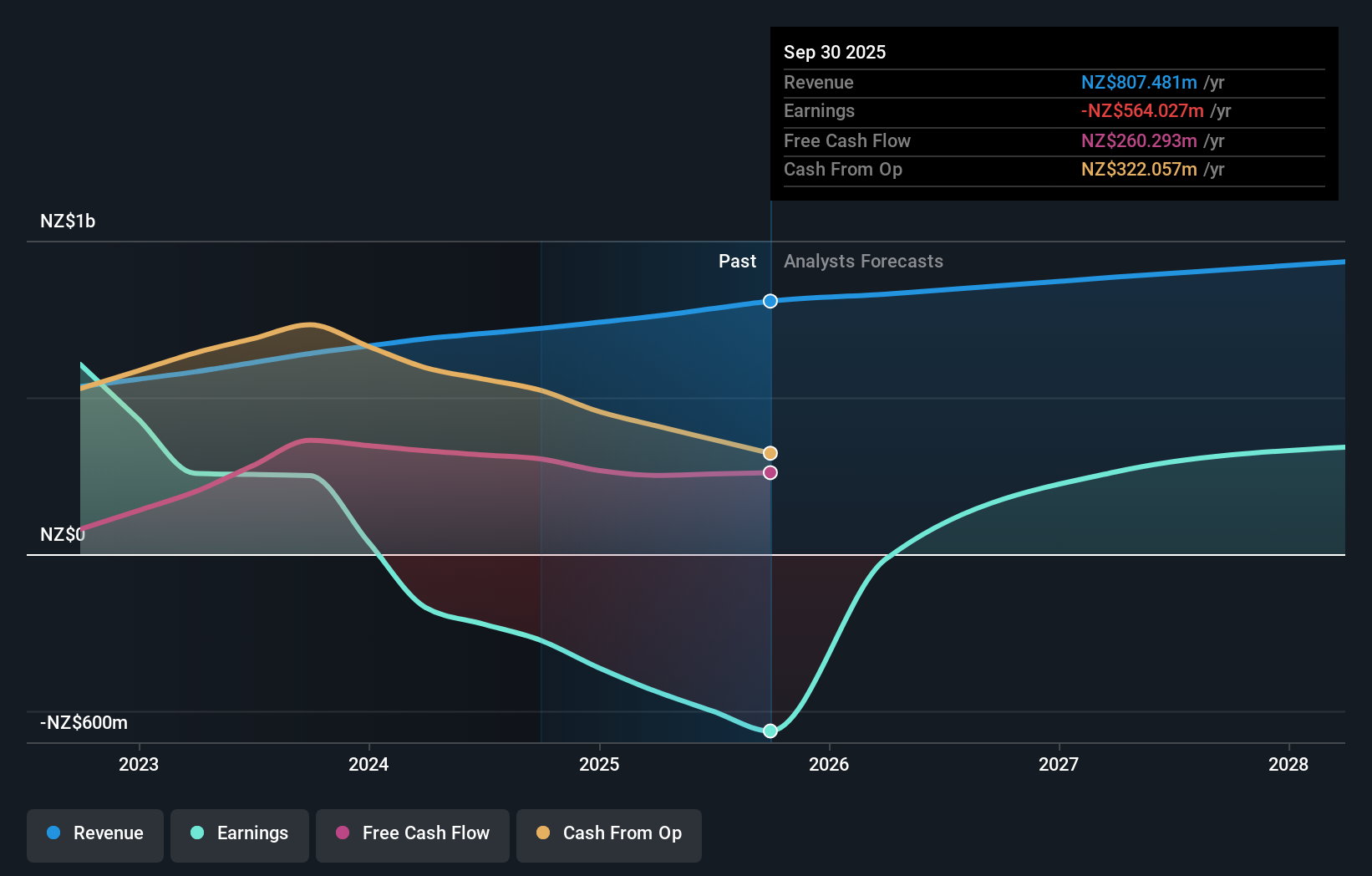

To invest in Ryman Healthcare, you need to believe its reshaped balance sheet and integrated village model can eventually convert current losses into sustainable cash generation. The recent NZ$1.00 billion equity raise and more supportive Australian funding rules materially shift the near term catalyst toward execution on sales and development, while the biggest immediate risk remains restoring profitability and trust after sizeable recent losses and dilution.

The half year 2026 result, showing NZ$413.8 million in revenue but a NZ$45.2 million net loss, sits directly alongside this recapitalisation story. It underlines that while the capital structure has been reset, the real proof for investors will be whether higher care funding in Australia and new unit pricing actually feed through to better margins and more consistent operating cash flow.

Yet, for all these changes, investors still need to be aware of the risk that high debt levels and recent dilution could...

Read the full narrative on Ryman Healthcare (it's free!)

Ryman Healthcare’s narrative projects NZ$940.4 million revenue and NZ$390.0 million earnings by 2028. This requires 7.4% yearly revenue growth and about an NZ$826.8 million earnings increase from NZ$-436.8 million today.

Uncover how Ryman Healthcare's forecasts yield a NZ$3.22 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Sixteen fair value estimates from the Simply Wall St Community span from NZ$0.36 to NZ$5.64 per share, showing how far apart individual views can be. When you set that spread against the company’s recent net losses and heavy recapitalisation, it underlines why many investors choose to compare several risk and return scenarios before reaching a conclusion.

Explore 16 other fair value estimates on Ryman Healthcare - why the stock might be worth less than half the current price!

Build Your Own Ryman Healthcare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ryman Healthcare research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Ryman Healthcare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ryman Healthcare's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal