Tokyo Gas (TSE:9531) Valuation Check as It Commits Major Capital to US Gas Infrastructure Expansion

Tokyo GasLtd (TSE:9531) just signaled a bigger push into the US, earmarking hundreds of billions of yen for downstream assets such as liquefaction plants and export terminals to tighten its global gas supply chain.

See our latest analysis for Tokyo GasLtd.

That planned US expansion comes on the back of a powerful rally, with Tokyo GasLtd’s share price up around 42 percent year to date and a hefty 1 year total shareholder return near 44 percent, signaling still strong momentum despite today’s dip.

If this global gas pivot has you thinking about where else capital is quietly compounding, it could be worth exploring fast growing stocks with high insider ownership as a next stop.

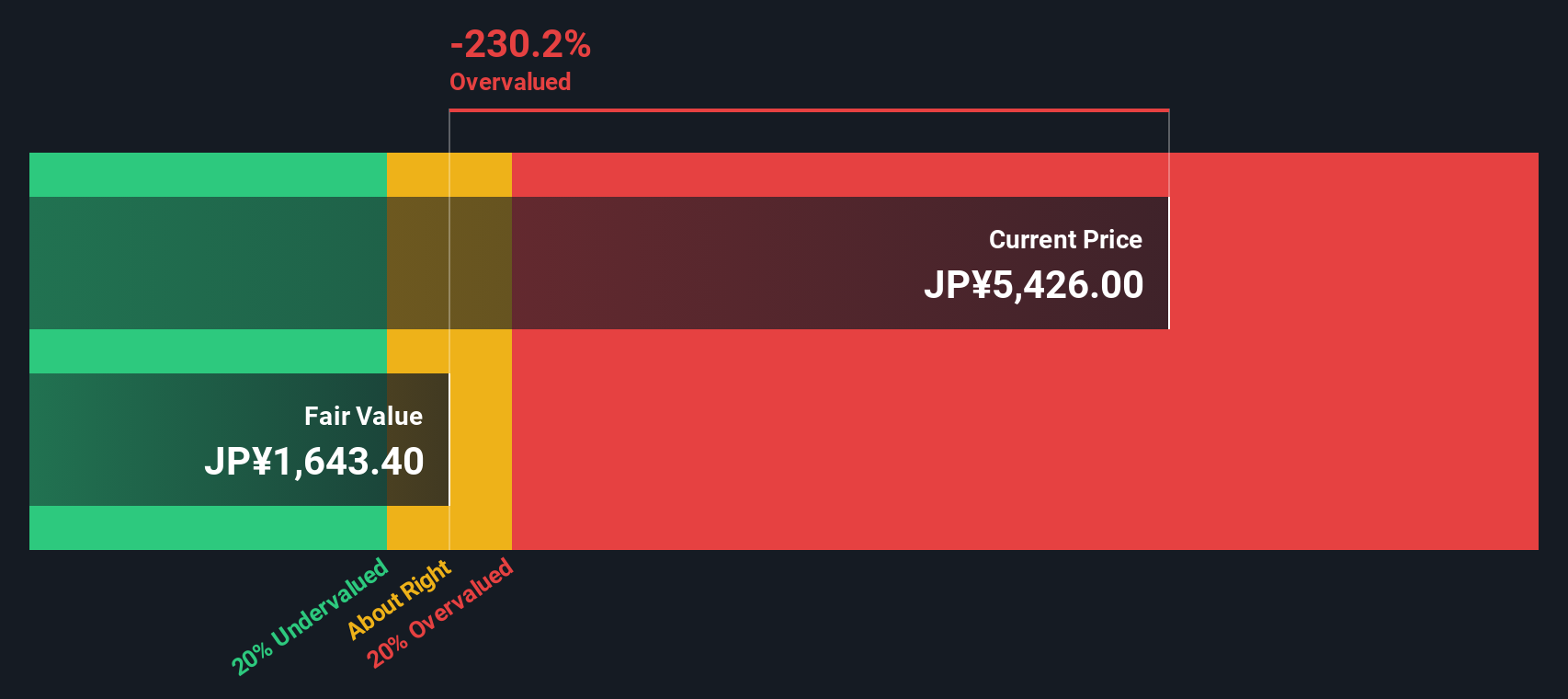

With the share price now above analyst targets but a discounted intrinsic value pointing the other way, is Tokyo GasLtd still a mispriced compounder, or is the market already baking in years of future growth?

Price-to-Earnings of 11.4x: Is it justified?

On a price-to-earnings ratio of 11.4x at the last close of ¥6,205, Tokyo GasLtd screens cheaper than many peers but not against its own fair benchmark.

The price to earnings multiple compares what investors pay today for each unit of current earnings. This is a key lens for mature, cash generative utilities like Tokyo GasLtd. At 11.4x, the market is assigning a lower earnings multiple than the Asian Gas Utilities industry average, which hints at some relative value. However, this still sits above the level our fair ratio work suggests.

Relative to its peer set, Tokyo GasLtd looks attractively priced, with its 11.4x price to earnings ratio sitting below both the Asian Gas Utilities industry average of 13.3x and the broader peer average of 15.9x, a meaningful valuation gap. However, compared with the estimated fair price to earnings ratio of 8.6x that our regression based fair ratio points to, the current multiple remains elevated, implying room for the market to compress the valuation towards that lower level if earnings expectations cool further.

Explore the SWS fair ratio for Tokyo GasLtd

Result: Price-to-Earnings of 11.4x (OVERVALUED)

However, sliding earnings and a share price already above analyst targets could quickly challenge the bullish rerating story that investors are leaning on.

Find out about the key risks to this Tokyo GasLtd narrative.

Another View: DCF Says the Market Is Too Pessimistic

While the 11.4x price to earnings ratio looks rich against an 8.6x fair ratio, our DCF model tells a different story. It suggests Tokyo GasLtd is trading about 17 percent below its estimated fair value of roughly ¥7,483, hinting at a margin of safety rather than excess.

If earnings do drift lower but cash flows stay resilient, the current price could be closer to a long term entry point than a late cycle exit.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tokyo GasLtd for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tokyo GasLtd Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in minutes using Do it your way.

A great starting point for your Tokyo GasLtd research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next move?

Do not stop at one opportunity when you can quickly scan fresh ideas across themes, sectors and strategies using the Simply Wall St Screener today.

- Capture mispriced potential early by reviewing these 906 undervalued stocks based on cash flows, which combine solid fundamentals with attractive valuations before the crowd catches on.

- Ride structural growth trends by sizing up these 30 healthcare AI stocks, transforming diagnostics, treatment pathways and hospital efficiency with intelligent technology.

- Position ahead of the next digital wave by assessing these 80 cryptocurrency and blockchain stocks, building infrastructure, payments and services around blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal