Fortrea (FTRE) Partnership With SCTbio: Is the Rebound Justified by Its Current Valuation?

SCTbio’s new collaboration with Fortrea Holdings (FTRE) is turning heads, as investors weigh how this advanced therapies partnership could reshape development timelines, costs, and Fortrea’s role across the crowded cell and gene therapy pipeline.

See our latest analysis for Fortrea Holdings.

That backdrop helps explain why the stock’s 1 month share price return of 54.27 percent and 3 month share price return of 55.77 percent look like momentum is rebuilding, even though the year to date share price return and 1 year total shareholder return are still in negative territory.

If Fortrea’s rebound has you thinking about where else sentiment could be turning in healthcare, this might be a good time to explore healthcare stocks for more potential ideas.

Yet with shares still down over the past year and trading at a steep intrinsic discount despite solid earnings momentum, investors now face a key question: is this a fresh buying opportunity, or are markets already pricing in future growth?

Most Popular Narrative: 33% Overvalued

With Fortrea Holdings last closing at $16.06 versus a narrative fair value of $12.07, the story hinges on how quickly margins and growth can reset.

The analysts have a consensus price target of $7.436 for Fortrea Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $12.8, and the most bearish reporting a price target of just $5.0.

Want to see how flat revenues, rising margins and an unusually low future earnings multiple combine to justify that fair value gap? The narrative lays out the full playbook, from earnings inflection timing to the profit profile Fortrea is expected to grow into, and how that translates into today’s price tag.

Result: Fair Value of $12.07 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent biotech win rate pressure and high customer concentration could quickly undermine margin recovery assumptions if spending slows or key clients pivot away.

Find out about the key risks to this Fortrea Holdings narrative.

Another Angle on Valuation

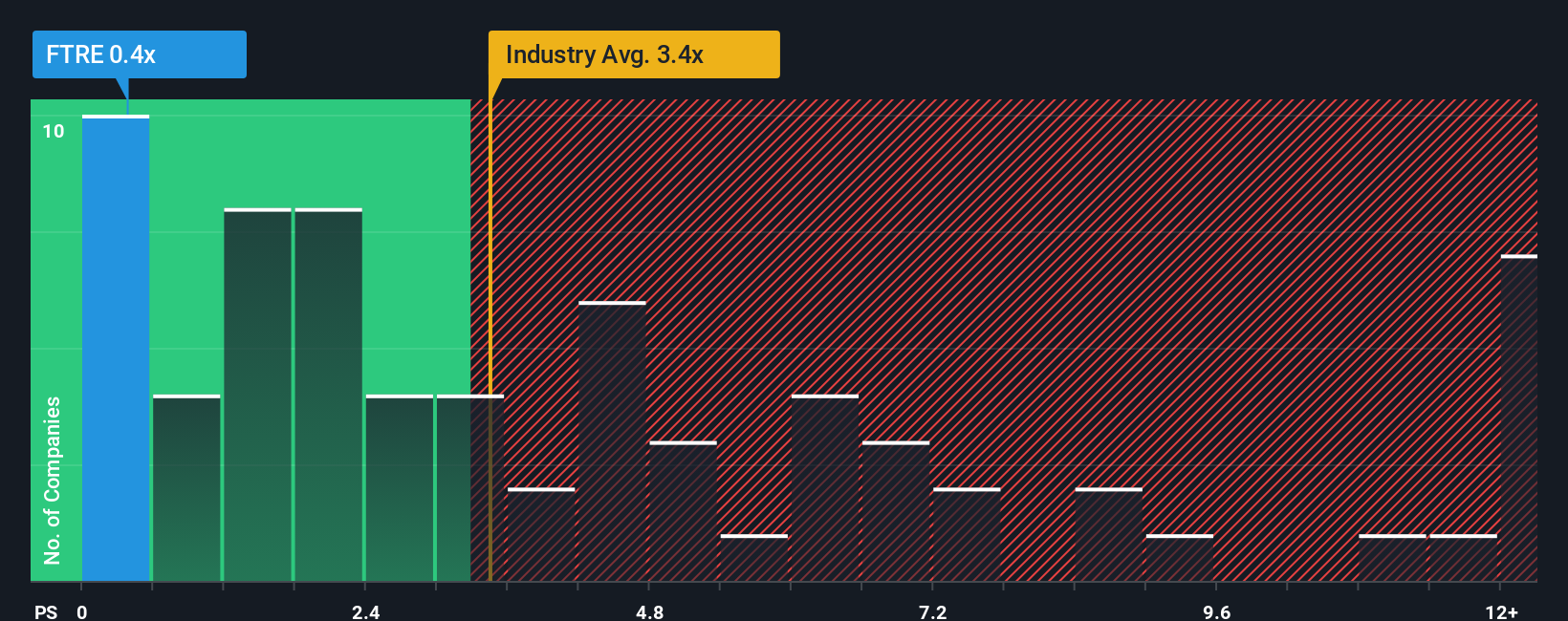

While the narrative fair value suggests Fortrea is 33 percent overvalued, the market is telling a different story. On a sales basis, FTRE trades at just 0.5 times revenue versus a fair ratio of 1.9 times and a 3.3 times industry average. This implies the market may be overpricing execution risk rather than growth limits.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fortrea Holdings Narrative

If you would rather dig into the numbers yourself and challenge this view, you can build a personalized narrative in just a few minutes: Do it your way.

A great starting point for your Fortrea Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before momentum shifts again, put your watchlist to work with curated stock ideas from Simply Wall Street’s powerful screener so you are not chasing the market later.

- Capitalize on mispriced opportunities by reviewing these 906 undervalued stocks based on cash flows that combine compelling fundamentals with attractive cash flow potential.

- Ride the next wave of innovation by targeting these 26 AI penny stocks positioned at the forefront of intelligent automation and data driven growth.

- Strengthen your income strategy by focusing on these 13 dividend stocks with yields > 3% that can support long term compounding through reliable cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal