Neste (HLSE:NESTE): Revisiting Valuation After Berenberg’s Upgrade and Renewables Recovery Narrative

Berenberg's upgrade on Neste Oyj (HLSE:NESTE) puts the spotlight back on the Finnish renewables player, as faster than expected recovery, regulatory support and tighter cost discipline start to reshape the narrative around the stock.

See our latest analysis for Neste Oyj.

The upbeat call from Berenberg lands after a strong run, with Neste’s share price up sharply this year, including a roughly 7.6% 3 month share price return and a 54.5% 1 year total shareholder return that hints momentum is rebuilding after a tough few years.

If this kind of rebound has you rethinking the energy transition opportunity set, it could be worth scanning fast growing stocks with high insider ownership for other under the radar growth stories with skin in the game.

But with the shares already up strongly and trading only modestly below Berenberg’s new price target, is Neste still flying under the radar for value hunters, or is the market now fully pricing in the recovery story?

Price-to-Sales of 0.7x: Is it justified?

Neste Oyj currently trades on a price to sales ratio of 0.7x, which leaves the stock looking expensive versus Finnish peers despite its recent rebound to €18.6.

The price to sales multiple compares the company’s market value to the revenue it generates, a useful lens for a business that is presently loss making and where earnings are not yet a reliable guide.

Against its domestic peer group, Neste screens as expensive on this measure, with a 0.7x price to sales ratio versus a 0.4x average, suggesting investors are already paying a premium for its renewables growth story and the anticipated swing back to profitability.

However, set against the broader European Oil and Gas industry, that same 0.7x multiple flips the narrative, as it sits at a clear discount to the 1.3x regional average and implies the market is still valuing Neste’s top line more conservatively than many larger integrated players.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 0.7x (ABOUT RIGHT)

However, significant risks remain, including execution missteps in scaling renewables and prolonged losses if margins fail to recover despite stronger revenue growth.

Find out about the key risks to this Neste Oyj narrative.

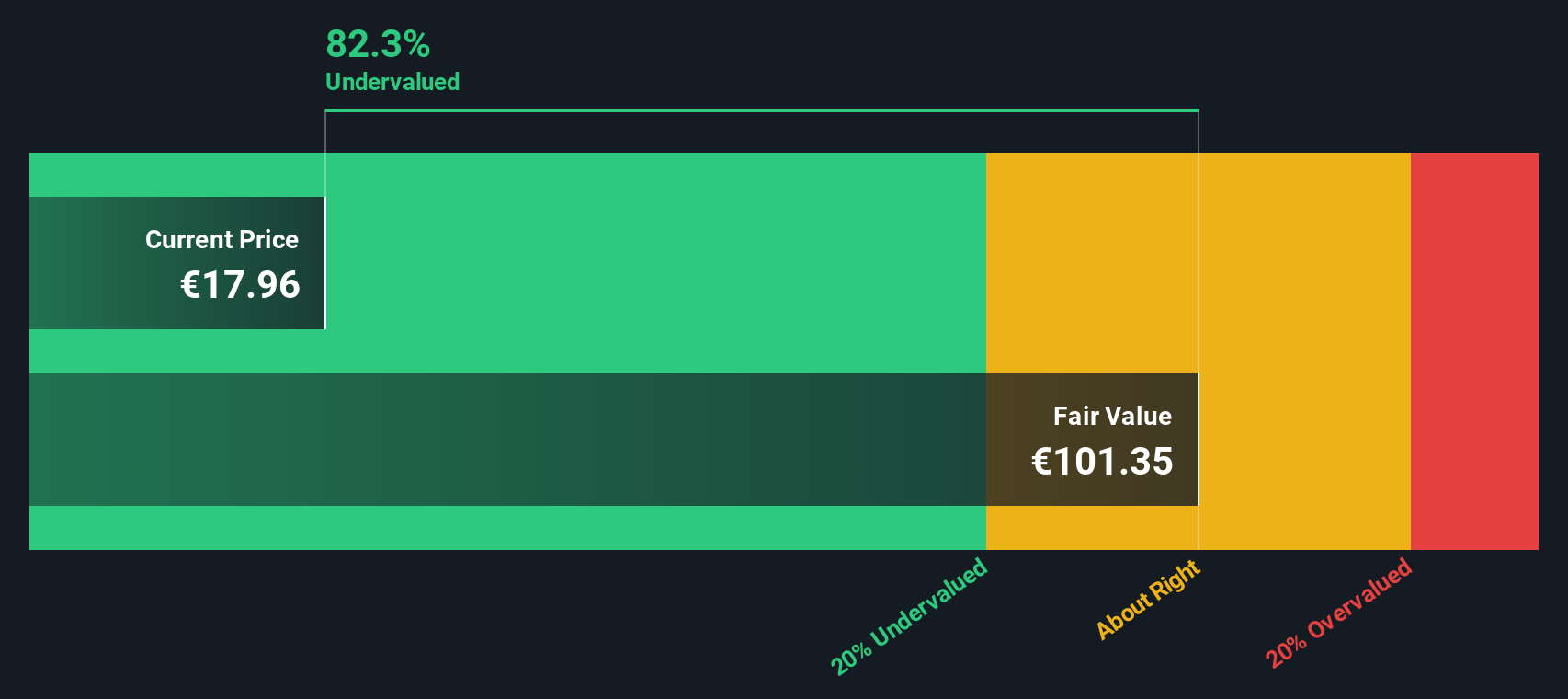

Another View: DCF Points to Deep Undervaluation

While the 0.7x price to sales ratio suggests Neste is roughly fairly valued relative to its sales, our DCF model paints a very different picture, implying fair value closer to €110.9 per share, around 83.2% above today’s €18.6 level.

If that gap is even half right, are investors underestimating how profitable Neste’s renewables push could become, or are DCF assumptions simply too generous for such a volatile, capital intensive business?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Neste Oyj for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Neste Oyj Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your Neste Oyj research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

If you stop with just one stock, you could miss the next big winner. Use the Simply Wall Street Screener to uncover more targeted opportunities today.

- Capture mispriced potential by targeting companies trading below intrinsic value through these 906 undervalued stocks based on cash flows that align with your conviction and risk profile.

- Tap into cutting edge innovation by focusing on these 26 AI penny stocks that could benefit most as AI adoption accelerates across industries.

- Lock in reliable portfolio income by screening for these 13 dividend stocks with yields > 3% that may sustain payouts even when markets turn volatile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal