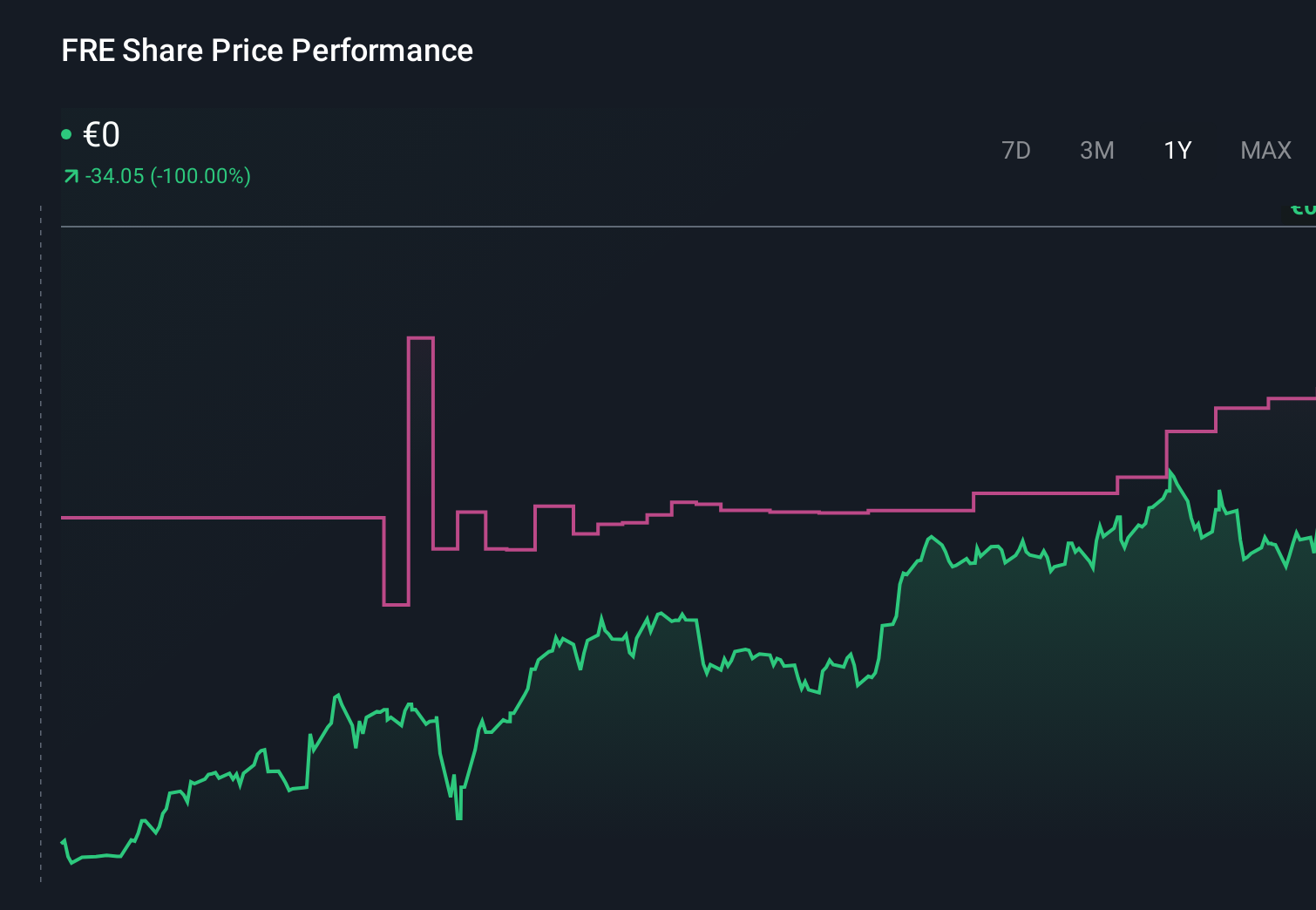

How Investors Are Reacting To Fresenius SE (XTRA:FRE) Doubling Biopharma Ambition By 2030

- Earlier this month, Fresenius SE & Co. KGaA held its Analyst/Investor Day, outlining a plan to double its biopharma revenue and portfolio by 2030 while targeting a 20% EBIT margin through innovation, cost leadership, and global commercial expansion.

- Management emphasized that a robust biopharma pipeline, strong underlying financial performance, and significant R&D and manufacturing investments are intended to support this long-term value creation roadmap.

- We’ll now explore how Fresenius’s ambition to double its biopharma revenue by 2030 may reshape the company’s broader investment narrative.

We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Fresenius SE KGaA Investment Narrative Recap

To own Fresenius SE & Co. KGaA, you need to believe it can translate steady demand for hospital and chronic care services into structurally higher profitability while managing cost and reimbursement pressure. The new ambition to double biopharma revenue by 2030 supports this longer term story but does not materially change the near term focus on delivering EBIT growth within guidance and guarding against margin compression from inflation and healthcare budget constraints.

Among recent announcements, the raised full year 2025 EBIT growth guidance to 4–8% stands out alongside the Analyst/Investor Day targets, as it ties the long horizon biopharma plan to tangible near term execution. For shareholders, the combination of improving earnings, ongoing portfolio reshaping and a clearer biopharma roadmap will likely be watched closely against risks such as pricing pressure, biosimilar competition and exposure to healthcare cost containment.

Yet behind Fresenius’s upgraded profit outlook, one risk that investors should be aware of is...

Read the full narrative on Fresenius SE KGaA (it's free!)

Fresenius SE KGaA's narrative projects €25.5 billion revenue and €2.2 billion earnings by 2028. This requires 4.6% yearly revenue growth and roughly a €1.1 billion earnings increase from €1.1 billion today.

Uncover how Fresenius SE KGaA's forecasts yield a €54.26 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community currently estimate Fresenius’s fair value between €54.26 and €129.28, highlighting very different expectations. When you set those views against the company’s ambition to double biopharma revenue and expand margins, it underlines how important it is to weigh several perspectives on Fresenius’s long term earnings power.

Explore 5 other fair value estimates on Fresenius SE KGaA - why the stock might be worth over 2x more than the current price!

Build Your Own Fresenius SE KGaA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fresenius SE KGaA research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Fresenius SE KGaA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fresenius SE KGaA's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal