Qunzhi Consulting: The focus of TV panel market growth is expected to shift to large sizes in 2026

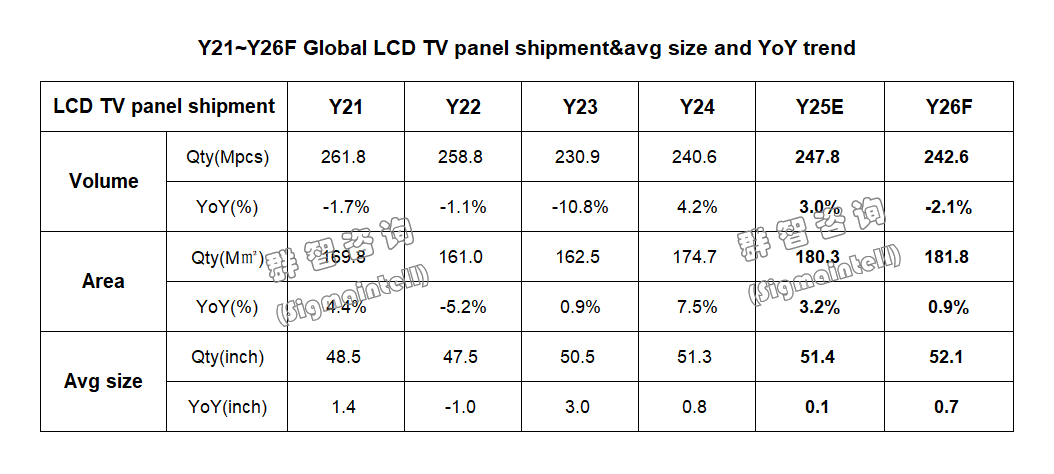

The Zhitong Finance App learned that on December 16, Qunzhi Consulting released the 2026 TV panel market outlook. In 2025, global LCD TV panel shipments were better than expected. In particular, due to factors such as World Cup preparations and expectations of panel price increases in the first quarter, LCD TV panel shipments grew strongly year-on-year in the fourth quarter, but structural imbalances led to a marked slowdown in area growth. Global LCD TV panel shipments in 2025 were 248 million pieces, up 3.0% year on year; the TV panel market growth focus is expected to shift to large sizes in 2026, so the quantity benchmark falls back to 243 million pieces, down 2.1% year on year, but the shipping area is driven by the trend of larger size increases by 0.9% year on year. In 2026, multiple factors will disrupt the TV industry chain. Qunzhi Consulting believes that by gradually, and building a growth flywheel based on large sizes, the TV panel industry will be able to establish an industrial chain collaboration system in a dynamic balance and steadily consolidate the profit moat.

Panel shipments: Pushing average size back to a growth trajectory is the core gripper for stable demand in 2026

Continued growth in the area dimension is the main direction of the TV panel market in 2026: the outlook for terminal demand is still not optimistic. The contrarian increase in demand for small-size panels is expected to be unsustainable in 2026, the phenomenon of overdraft in medium- and large-size demand will gradually ease, and average size growth is expected to revive. The main factors affecting the size of TV panels and the fundamentals of supply and demand in 2026 are as follows:

① Tournament preparation is the main driver of TV panel demand from the end of the year to the first quarter. The 2026 tournament year is coming soon, and the US-Mexico-Canada World Cup is expected to start in June. Under this premise, considering the long-term nature of overseas stocking, starting in the fourth quarter of 2025, brand manufacturers began preparations for the competition one after another, helping panel demand in the fourth quarter to be better than expected. It is expected that the first quarter will still be in the bonus period for tournament preparation, but we need to pay attention to the risk that panel stocking demand will fall back at the end of the first quarter as event preparation ends.

② The “double-edged sword” effect of the increase in the price of memory devices on the TV panel market. On the one hand, the sharp rise in storage prices has stimulated the increased willingness of some machine manufacturers to prepare goods at risk in the short term, driving the early release of demand for TV panels. On the other hand, the increase in storage costs may increase the risk of losses for downstream machine manufacturers, and their acceptance of future price increases for other materials, including panels, will decline. At the same time, for agents and channel vendors with poor bargaining power, excessive storage price increases directly leading to the cancellation of some of their small to medium size demand, so the risk of cutting orders for small to medium size panels will increase.

③ The demand stimulus for macroeconomic policies varies from region to region. Looking at the North American and Chinese markets, the two main regions of the world, North America is driven by competition preparations and internal tax reduction policies, and market vitality is expected to continue; China's national supplements will continue, but their marginal effects are likely to weaken. The North American market economy is resilient. Coupled with external tax increases and domestic tax cuts, TV demand is expected to increase steadily and slightly in 2026, which is beneficial to the procurement demand for leading brands. The continued downturn in real estate in the Chinese market is an underlying factor in the weakening of the TV market. Coupled with the weakening influence of national subsidies, the impact on brand procurement strategies has shrunk further.

④ Leading manufacturers are preparing plans to control production in Yuanchun to look forward to achieving a “good start” for the whole year. Combined with the multiple influencing factors of the demand environment, it can be seen that despite some positive conditions in 2026, the downstream environment did not have strong recovery support for the upstream. For panel manufacturers, the “good start” strategy is the ballast stone for the annual revenue rhythm, so panel manufacturers expect to achieve price increases through production control during the Spring Festival. As of mid-December, leading manufacturers have indicated that production will be controlled for 1 to 2 weeks during the Spring Festival holiday. Although the specific rules have not yet been implemented, they played a critical role in the transformation of the supply and demand environment in the first quarter.

According to data from Qunzhi Consulting, global LCD TV panel shipments in 2025 were 248 million pieces, up 3.0% year on year; the TV panel market growth focus is expected to shift to large sizes in 2026, so the quantity benchmark falls back to 243 million pieces, down 2.1% year on year, but the shipping area is driven by the trend of larger size increases by 0.9% year on year.

Panel factory strategy: promote the dual development of “continuous area growth” and “steady increase in profit”

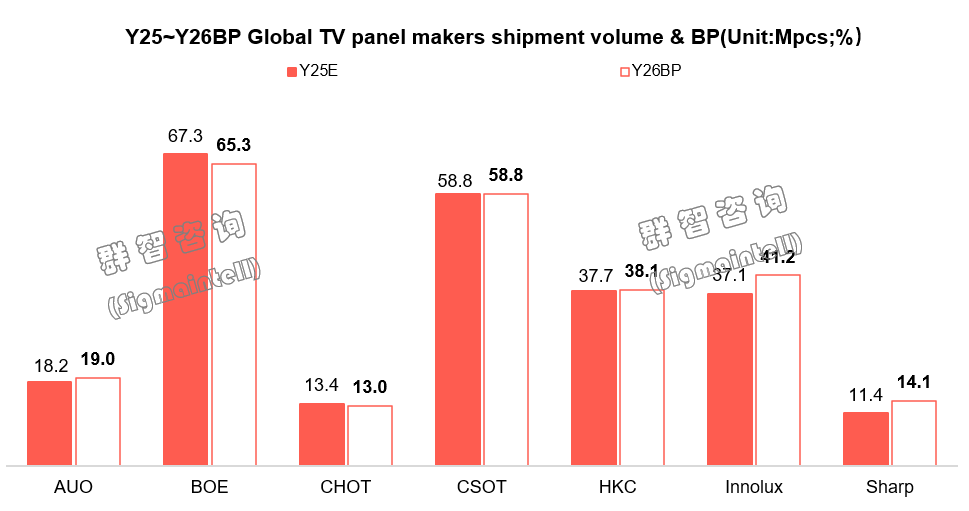

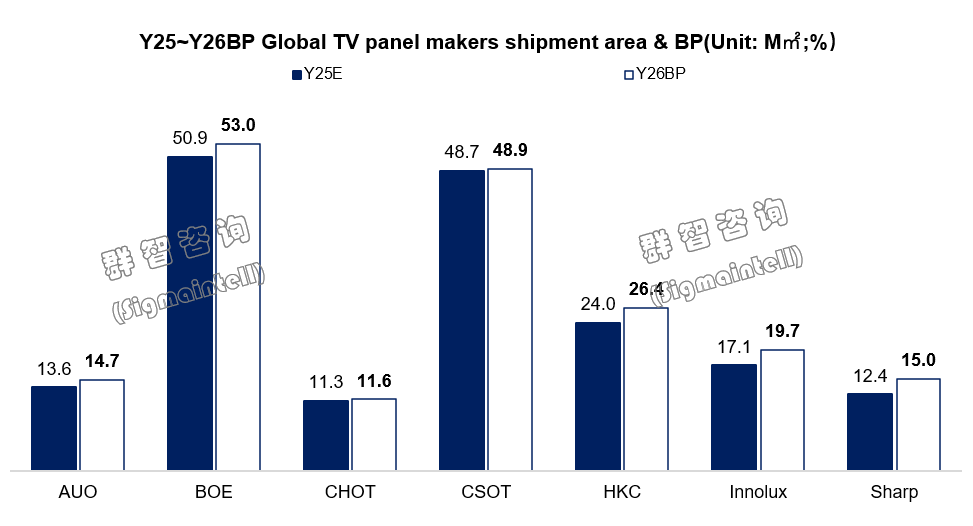

BOE (BOE) strives for excellence to form a virtuous cycle of demand and production capacity in 2026 to help steadily increase its operational strength. In 2025, supported by high operating rates and steady demand, BOE TV panel shipments reached a record high. In 2026, on the basis of a strong share, BOE will use the G10.5 depreciation advantage as an opportunity to focus on upgrading the product strategy to promote the upgrading of the size structure and further feed back the consolidation of revenue capacity and market position. As a result, BOE BP plans 65.32 million pieces in 2026, of which the proportion of medium to large sizes of 50 inches and above will exceed 50%, an increase of 7 percentage points over 46% in 2025.

TCL Huaxing (CSOT) will continue to focus on improving profitability and optimizing product structure in 2026. In 2025, with the support of additional T11 production capacity, Huaxing's shipping scale achieved a quantum leap, and the number of units shipped increased to 58.83 million pieces, an increase of more than 10 million pieces over the previous year. In 2026, profit is still the core demand of Huaxing TV's business. At the same time, internalizing production capacity pressure into supply strength is also an important goal of Huaxing. As a result, in 2026, TCL Huaxing BP plans 58.81 million pieces, and the scale is stable. Among them, the share of 55-inch panel shipments is expected to increase further from 44% to 46%, and the supply capacity for large 55-inch panels and above will be ruined.

Huike (HKC), step by step, has built a large-scale moat with a flexible production capacity strategy and diverse customer structure in 2026. In the second half of 2025, Huike's production capacity fully recovered, and the annual shipment scale steadily climbed to 37.71 million tablets, an increase of 4.4% over the previous year. Achieving steady growth in scale and revenue in 2026 and providing more reliable guarantees for the successful passage of the IPO is currently Huike's main direction. Therefore, in 2026, Huike BP plans to have 38.11 million tablets, of which oversized sizes of 50 inches and 85 inches and above are the main growth points in the product structure.

Producers' production capacity bottlenecks in Taiwan have become apparent, and they have achieved stable scale through competitive differentiation in size. AUO (AUO) has a stable customer structure. It plans 19.02 million TV panels in 2026, and continues to grow. Among them, 43 inch and 55 inch are the main products in its structure. Innolux (Innolux) plans 41.17 million TV panels in 2026, a significant increase over the previous year. The products are still mainly small to medium sizes, with 40-inch products being actively planned. After the production capacity was cleared, Sharp (Sharp)'s TV panel shipments in 2025 converged to 11.41 million pieces, but with the implementation of production line transformation and upgrading, Guangzhou's G10.5 supply capacity was greatly enhanced in 2026, so the TV panel plan increased to 14.1 million pieces. 65-inch and 75-inch are still its main sizes, and deep binding with international brands pushes its 32-inch and 55-inch panels to be mass-produced next year.

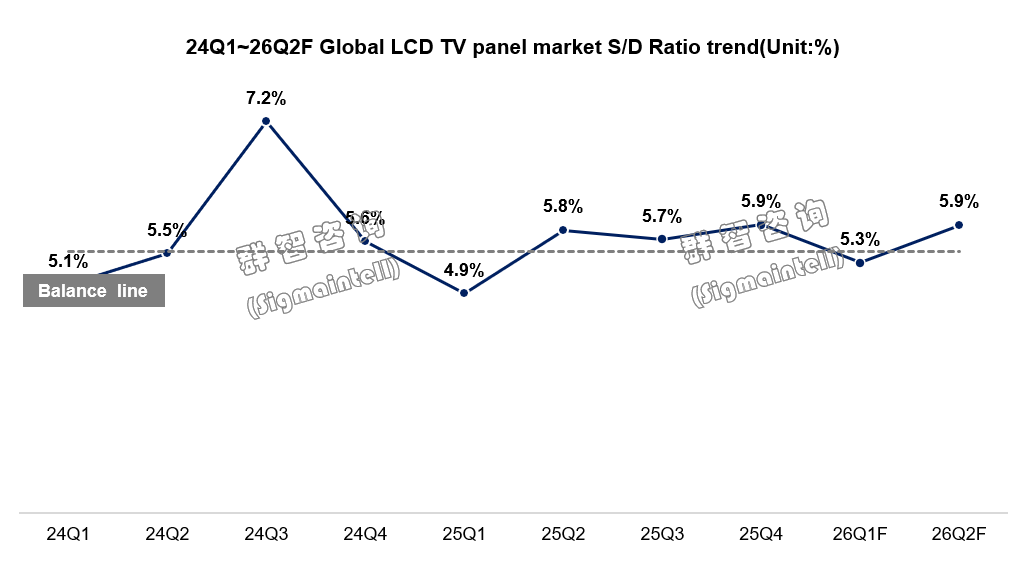

Supply, demand and price: Production control in the first quarter drove a shift in supply and demand to balance, and LCD TV panel prices may rise partially

In the first quarter of 2026, panel manufacturers' strategic production control is expected to drive the balance between supply and demand in the TV panel market. Looking at the demand level, the demand volume may decrease both year on year and month over month due to the interaction between moving demand and preparing goods for the event, but the optimization of the size structure provides some support for the demand area. From a supply perspective, leading panel manufacturers are determined to control production and stabilize prices, so it is possible to increase production control efforts during the Spring Festival to hedge against cooling demand. #根据群智咨询 “Supply and Demand Model” calculation data (area benchmark) shows that the global LCD TV panel market's supply-demand ratio in the first quarter was 5.3%, and the balance between supply and demand was slightly tight. Taken together, in the context of the high concentration of LCD TV panels giving panel manufacturers a stronger voice, panel makers' implementation of production control and price stabilization strategies and strong demands for price increases are expected to have a butterfly effect on some machine manufacturers, or may drive LCD TV panel prices to rise partially.

In the second quarter of 2026, it is still difficult to expect a recovery in terminal demand. In particular, as rising machine manufacturing costs hamper brand terminal promotion strategies, we need to be wary of overdraft risks stemming from the advance shift in panel stocking demand.

Growth core: building a balanced and steadily linked industrial growth flywheel

The “corporate growth flywheel model” developed by Jim Collins (Jim Collins) sees the growth flywheel as a company's growth engine. Qunzhi Consulting believes that it is also suitable for industrial growth. Every link in the industrial chain is a component of a flywheel. The flywheel interconnects the growth core with the components, so that the industry can accelerate growth. As far as the TV industry chain is concerned, panels are undoubtedly the core component of the growth flywheel, rather than panel devices (such as storage), backlighting and machine assembly processes, brand channels, and users, which together form the industry's growth flywheel. Qunzhi Consulting believes that the 2026 increase in storage prices and loss of machine profits are two major risks affecting the TV industry chain growth and the healthy operation of the flywheel. By establishing a collaboration mechanism based on shared value, it will be possible to build a balanced and steadily linked growth flywheel to promote the value growth of the industrial chain.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal