Uber (UBER) Valuation Check as New Robotaxi Launches and Delivery Expansion Signal Next Growth Phase

Uber Technologies (UBER) just flipped the switch on commercial robotaxi rides in Dubai and Dallas, pairing autonomous launches with fresh retail delivery partnerships, a mix that could quietly reshape how investors think about its growth runway.

See our latest analysis for Uber Technologies.

All of this is landing just as sentiment around Uber has cooled in the near term, with a 30 day share price return of negative 10.65% and a 90 day share price return of negative 11.93%. Its 12 month total shareholder return of 34.13% and three year total shareholder return of 227.96% still point to powerful long term momentum.

If these robotaxi and delivery moves have you thinking about what else could surprise the market, it is worth exploring high growth tech and AI stocks for more potential high growth beneficiaries of the same themes.

With the stock still trading roughly 37% below the average Wall Street price target and a hefty implied intrinsic discount, are investors overlooking Uber’s next growth leg, or is the market already factoring in those future gains?

Most Popular Narrative: 9.1% Overvalued

According to a widely followed narrative from YasserSakuragi, the implied fair value of Uber Technologies sits below the last close of $81.86, framing a more cautious outlook on upside.

Methodology:

Future Earnings/P-E Projection (growth stock)• 2030 Revenue Projection: $65-70B

• 2030 EBITDA: $14-15B (22% margin with autonomous vehicle benefits)

• Fair Value Range: $90-135B market cap

• Current Market Cap: $192B (significantly overvalued)

• Target Entry Price: $65-75 per share (vs current ~$95)

Curious how strong profit margins, ambitious long term revenue goals, and a future earnings multiple combine into a lower fair value than today. See what holds this line.

Result: Fair Value of $75 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained autonomous execution, stronger than expected margin expansion, or regulatory breakthroughs on robotaxis could all force a rethink of this overvaluation stance.

Find out about the key risks to this Uber Technologies narrative.

Another Lens on Value

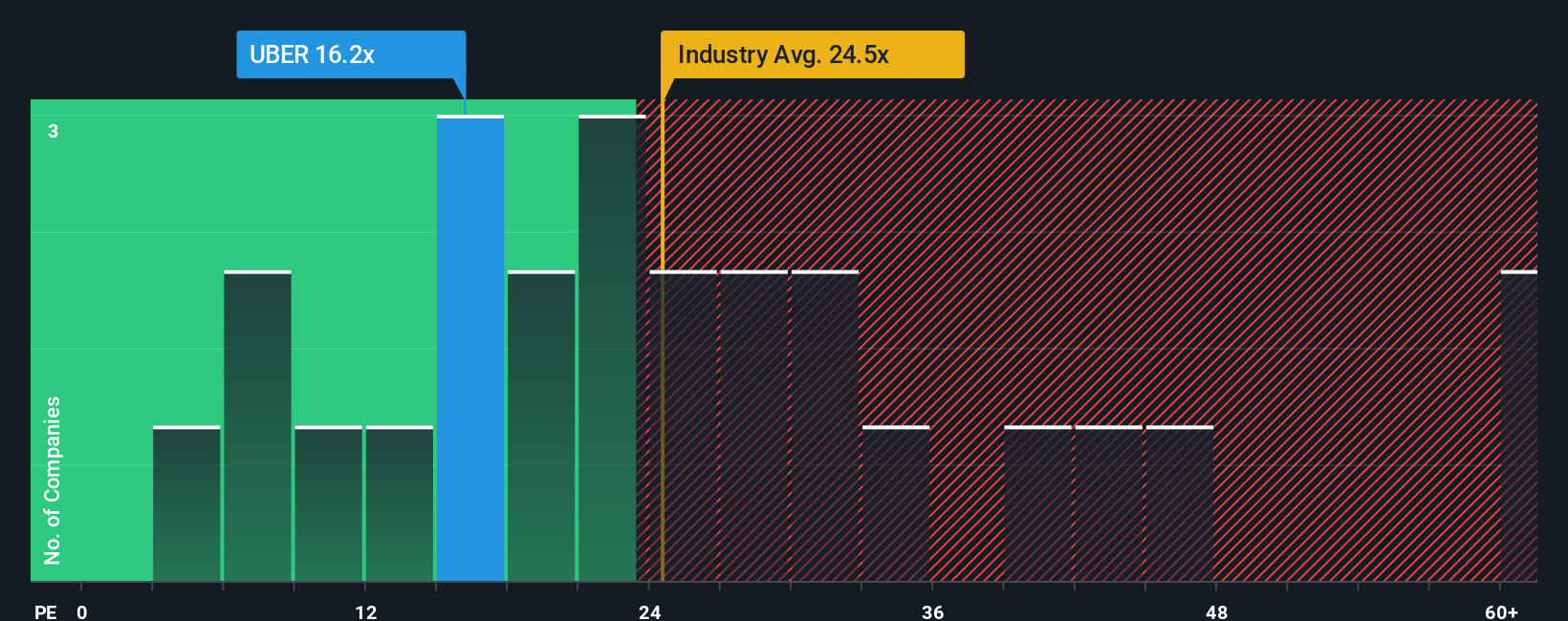

Our valuation checks paint a very different picture. Based on earnings, Uber trades at just 10.2 times earnings versus 31.8 times for the US transportation industry and 65.6 times for peers, while our fair ratio sits at 14.2 times. Is the market underpricing execution risk or underestimating upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Uber Technologies Narrative

If you see the numbers differently or want to dig into the details yourself, you can build a personalized thesis in minutes using Do it your way.

A great starting point for your Uber Technologies research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop at Uber, you could miss other powerful setups, so use the Simply Wall Street Screener to uncover fresh, high conviction opportunities waiting right now.

- Capture asymmetric upside by targeting growth stories early with these 3622 penny stocks with strong financials that already show improving financial strength and momentum.

- Position yourself at the front of the AI productivity wave by focusing on these 26 AI penny stocks reshaping software, infrastructure, and automation.

- Lock in potential mispricings by filtering for these 907 undervalued stocks based on cash flows where cash flows suggest the market may be leaving money on the table.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal