How Positive CDKL5 Fenfluramine Phase 3 Data At UCB (ENXTBR:UCB) Has Changed Its Investment Story

- Earlier in December 2025, UCB reported positive Phase 3 data at the American Epilepsy Society meeting showing adjunctive fenfluramine significantly reduced seizure frequency in children and adults with CDKL5 deficiency disorder, meeting its primary and key secondary endpoints over 14 weeks.

- This outcome strengthens fenfluramine’s clinical profile in a rare, severe epilepsy where no approved treatments currently exist, potentially broadening UCB’s neurology footprint if regulators eventually agree.

- We’ll now examine how these positive Phase 3 fenfluramine results in CDKL5 deficiency disorder could influence UCB’s investment narrative and risk‑reward balance.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

UCB Investment Narrative Recap

To own UCB, you need to believe its focus on neurology and rare diseases can offset mounting pricing pressure on core immunology brands and upcoming patent expiries. The new positive Phase 3 fenfluramine data in CDKL5 deficiency disorder supports that specialty neurology story, but near term it does not change the main catalyst, which remains execution on BIMZELX and other key launches, nor the biggest risk from ongoing price erosion and biosimilar competition in mature franchises.

The most directly relevant recent announcement is UCB’s broader presence at the American Epilepsy Society meeting, where it highlighted 21 epilepsy related abstracts, including the GEMZ Phase 3 fenfluramine results. This reinforces UCB’s effort to deepen its rare epilepsy portfolio, which could complement existing demand and pipeline catalysts in neurology, even as the company continues to face structural pricing and reimbursement headwinds elsewhere in the portfolio.

But while these epilepsy wins look encouraging, investors should still be aware of the ongoing risk that pricing pressure and higher rebates could...

Read the full narrative on UCB (it's free!)

UCB's narrative projects €9.4 billion revenue and €2.1 billion earnings by 2028. This requires 11.3% yearly revenue growth and about a €0.8 billion earnings increase from €1.3 billion today.

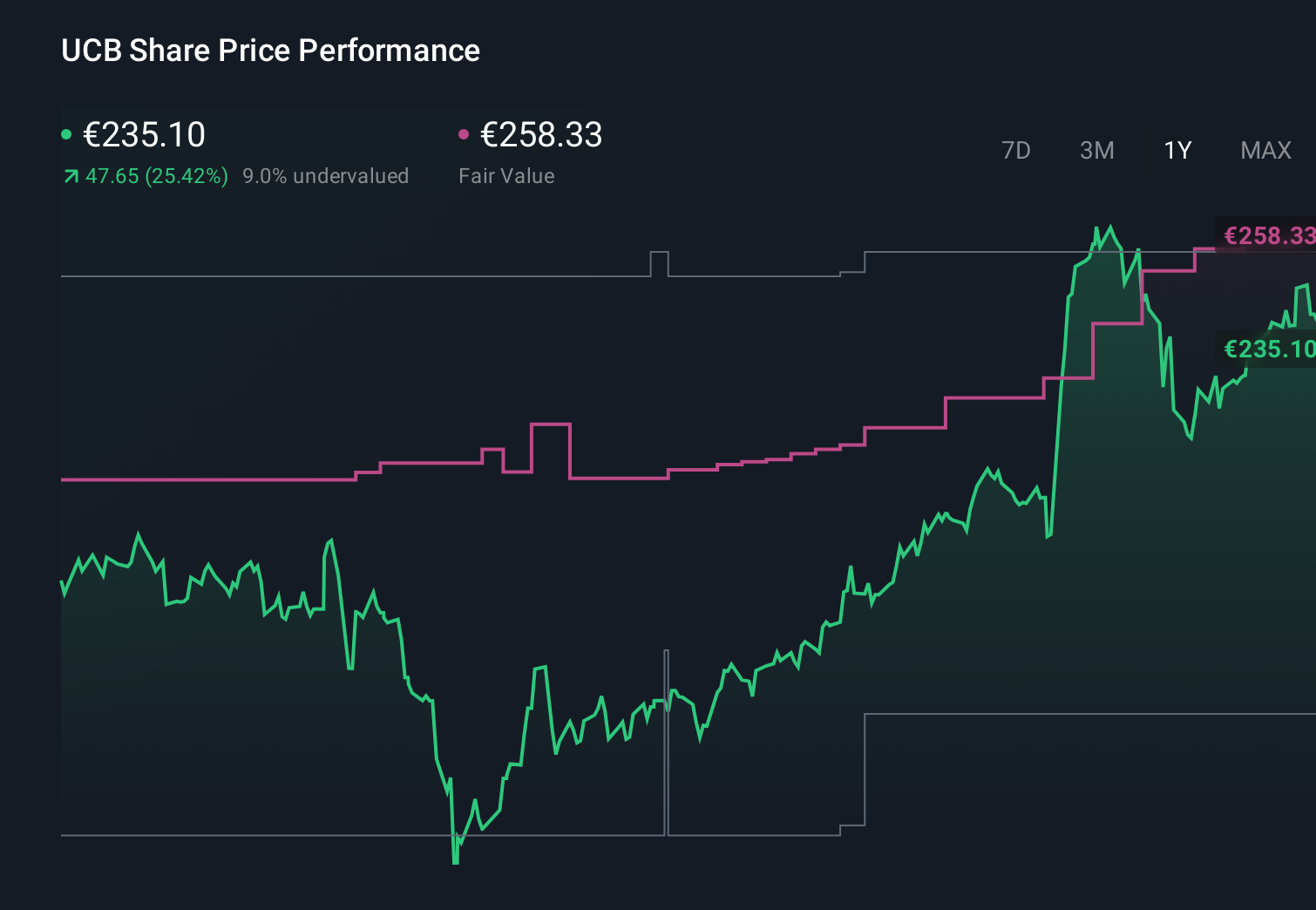

Uncover how UCB's forecasts yield a €258.33 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community span roughly €173 to €487 per share, underlining how far apart individual views can be. Against that backdrop, UCB’s reliance on premium priced neurology and immunology drugs in the face of intensifying pricing pressure gives you a clear reason to compare several viewpoints before forming your own expectations.

Explore 6 other fair value estimates on UCB - why the stock might be worth over 2x more than the current price!

Build Your Own UCB Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UCB research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free UCB research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UCB's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal