3 Stocks Estimated To Be Trading At Discounts Of Up To 21.1%

As concerns about an AI bubble continue to weigh on technology stocks, major U.S. indexes have recently closed lower, reflecting investor caution amid looming economic indicators such as the upcoming jobs report. In this climate of uncertainty, identifying undervalued stocks can be a strategic approach for investors looking to capitalize on potential market inefficiencies and secure positions in companies trading at discounts.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| UMB Financial (UMBF) | $119.11 | $232.81 | 48.8% |

| Schrödinger (SDGR) | $18.21 | $35.43 | 48.6% |

| Perfect (PERF) | $1.76 | $3.43 | 48.7% |

| Krystal Biotech (KRYS) | $242.98 | $469.98 | 48.3% |

| Freshworks (FRSH) | $12.47 | $23.77 | 47.5% |

| FirstSun Capital Bancorp (FSUN) | $38.47 | $73.32 | 47.5% |

| First Solar (FSLR) | $255.89 | $483.10 | 47% |

| DexCom (DXCM) | $65.73 | $127.53 | 48.5% |

| Columbia Banking System (COLB) | $29.16 | $57.69 | 49.5% |

| Chagee Holdings (CHA) | $14.18 | $28.32 | 49.9% |

Let's take a closer look at a couple of our picks from the screened companies.

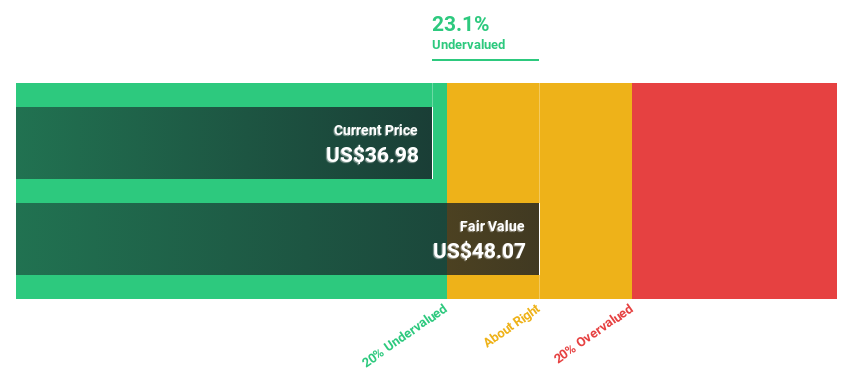

Waystar Holding (WAY)

Overview: Waystar Holding Corp. develops cloud-based software solutions for healthcare payments and has a market cap of approximately $6.23 billion.

Operations: The company generates revenue primarily from its healthcare software segment, totaling approximately $1.04 billion.

Estimated Discount To Fair Value: 21.1%

Waystar Holding is trading at US$32.56, significantly below its estimated fair value of US$41.28, indicating potential undervaluation based on cash flows. The company has become profitable this year and raised its earnings guidance for 2025, expecting revenue between $1.085 billion and $1.093 billion. Recent innovations in AI-powered healthcare solutions could enhance operational efficiency and financial resilience, although revenue growth is projected to be moderate compared to peers in the sector.

- Our expertly prepared growth report on Waystar Holding implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Waystar Holding's balance sheet by reading our health report here.

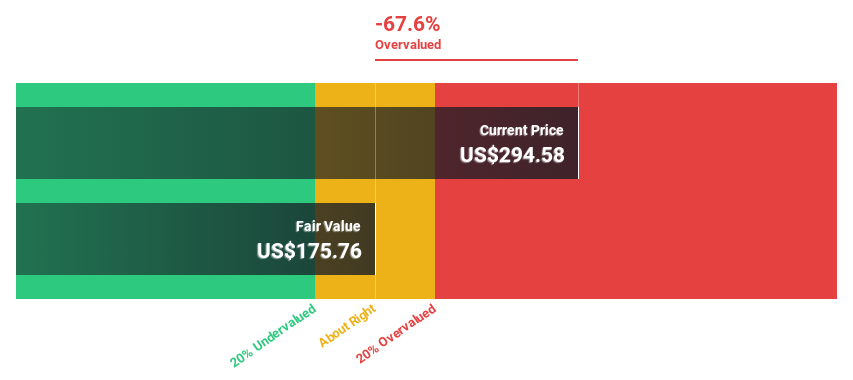

Arthur J. Gallagher (AJG)

Overview: Arthur J. Gallagher & Co. operates globally, offering insurance and reinsurance brokerage, consulting, and third-party property/casualty claims settlement services, with a market cap of approximately $65.58 billion.

Operations: The company's revenue is primarily derived from its Brokerage segment, which generates $10.58 billion, and its Risk Management segment, contributing $1.50 billion.

Estimated Discount To Fair Value: 19.7%

Arthur J. Gallagher is trading at US$256.19, below its estimated fair value of US$319.06, suggesting potential undervaluation based on cash flows. Despite a decline in Q3 net income to US$272.7 million from the previous year, earnings are forecast to grow significantly over the next three years, outpacing the broader U.S. market with a projected 20.4% annual growth rate in earnings and 18.2% in revenue growth per year.

- Our comprehensive growth report raises the possibility that Arthur J. Gallagher is poised for substantial financial growth.

- Take a closer look at Arthur J. Gallagher's balance sheet health here in our report.

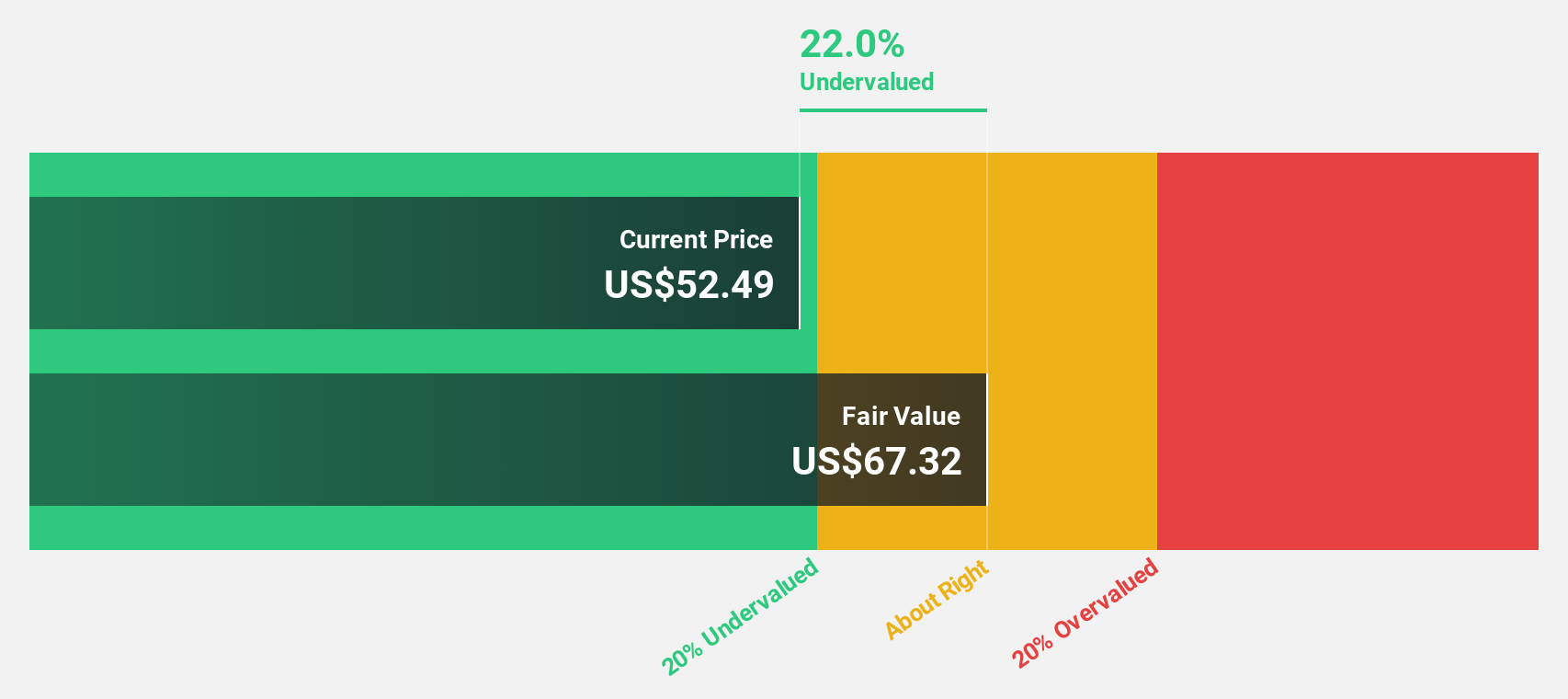

On Holding (ONON)

Overview: On Holding AG develops and distributes sports products globally, with a market cap of approximately $16.26 billion.

Operations: The company's revenue is primarily derived from its Athletic Footwear segment, which generated CHF 2.88 billion.

Estimated Discount To Fair Value: 12.7%

On Holding is trading at US$47.79, below its estimated fair value of US$54.74, indicating a potential undervaluation based on cash flows. The company's earnings grew significantly over the past year and are forecast to continue growing at 30% annually, surpassing the broader U.S. market's growth rate. Recent earnings reported net income of CHF 118.9 million for Q3 2025, with revenue expected to grow faster than the market at 17.8% per year.

- In light of our recent growth report, it seems possible that On Holding's financial performance will exceed current levels.

- Navigate through the intricacies of On Holding with our comprehensive financial health report here.

Summing It All Up

- Investigate our full lineup of 209 Undervalued US Stocks Based On Cash Flows right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal