US Undiscovered Gems with Potential for December 2025

As we approach the end of 2025, major U.S. stock indexes have been experiencing some turbulence, particularly with technology stocks under pressure due to concerns about an AI bubble and looming economic indicators such as the jobs report. Amidst this backdrop, small-cap stocks often present unique opportunities for investors seeking growth potential in less crowded spaces; identifying these undiscovered gems requires a keen eye on strong fundamentals and resilience in challenging market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Southern Michigan Bancorp | 113.59% | 8.48% | 3.73% | ★★★★★★ |

| Tri-County Financial Group | 102.20% | -2.69% | -15.63% | ★★★★★★ |

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

American Coastal Insurance (ACIC)

Simply Wall St Value Rating: ★★★★★☆

Overview: American Coastal Insurance Corporation operates in the United States, focusing on commercial and personal property and casualty insurance, with a market cap of approximately $617.86 million.

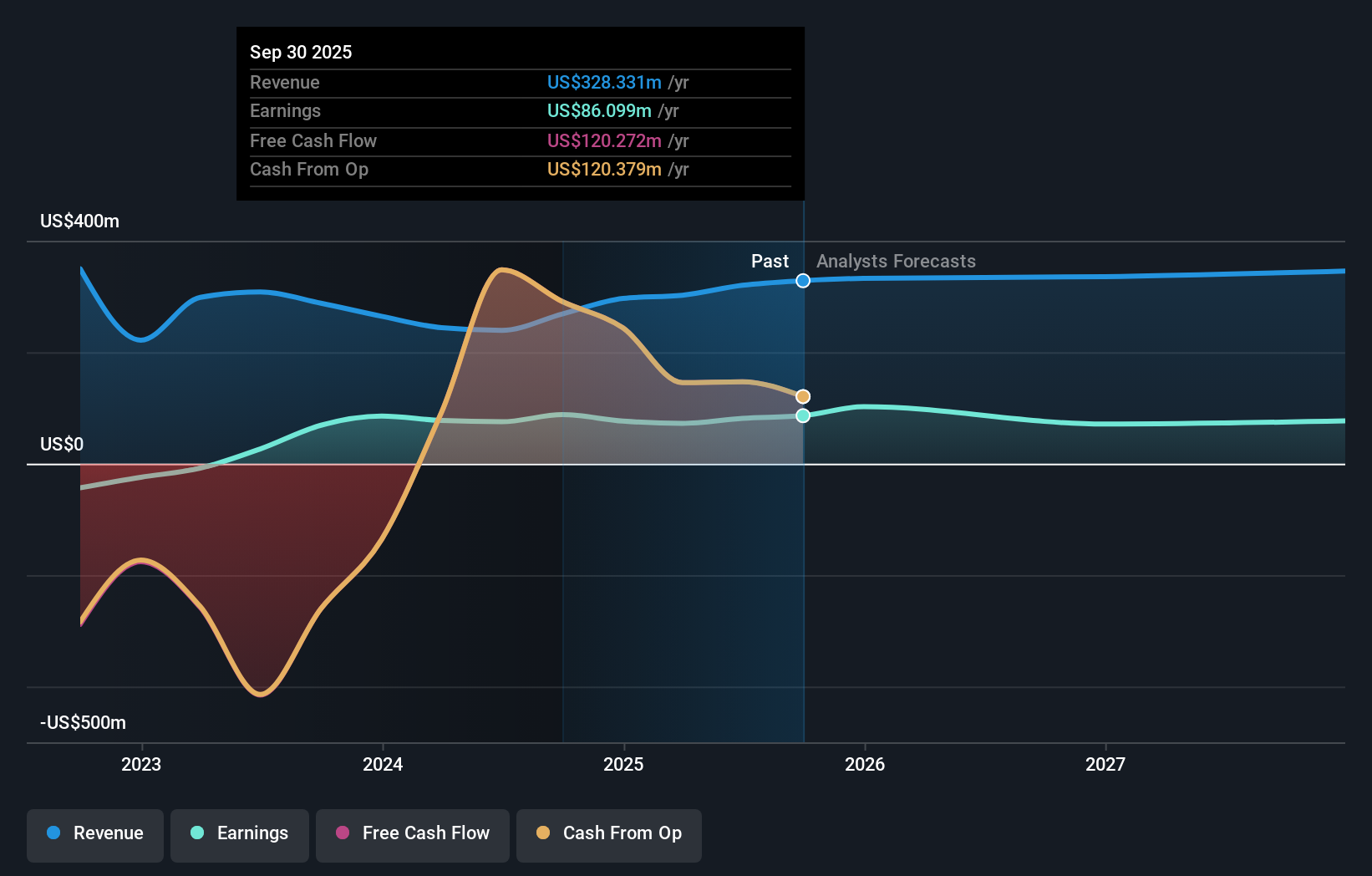

Operations: ACIC generates revenue primarily from its commercial lines business, which amounted to $328.33 million.

American Coastal Insurance, a small player in the insurance sector, is making strategic moves by expanding its footprint in Florida through Skyway Underwriters. Despite facing a challenging environment with declining profit margins expected to drop from 25.4% to 20.8%, the company reported solid revenue growth for Q3 2025, reaching US$90 million compared to US$82 million last year. Net income also improved to US$32 million from US$28 million previously. With EBIT covering interest payments 10 times over and trading at a significant discount of 67% below estimated fair value, American Coastal presents an intriguing opportunity despite industry headwinds and insider selling concerns.

Perdoceo Education (PRDO)

Simply Wall St Value Rating: ★★★★★★

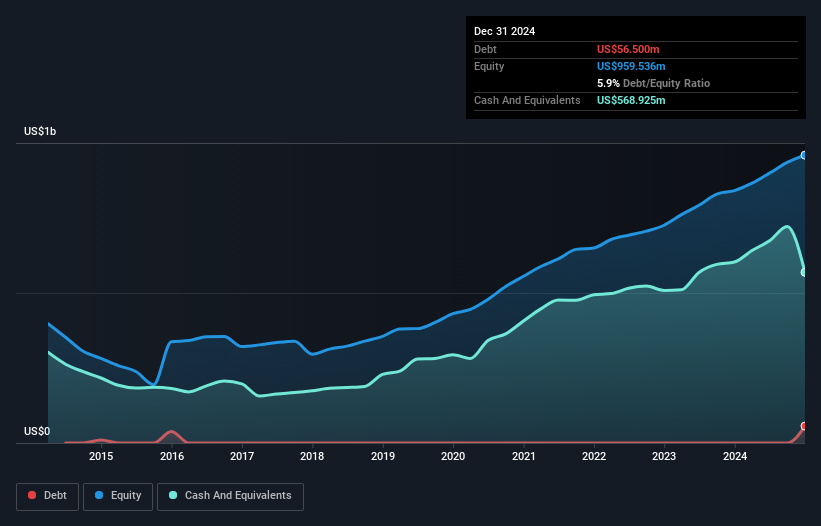

Overview: Perdoceo Education Corporation offers postsecondary education through online, campus-based, and blended learning programs in the United States, with a market cap of approximately $1.87 billion.

Operations: Perdoceo Education generates revenue primarily from its two main segments: Colorado Technical University (CTU) contributing $472.38 million and The American Intercontinental University System (AIUS) with $213.88 million.

Perdoceo Education, a smaller player in the education sector, is making waves with its strategic moves and financial health. The company has been debt-free for five years and boasts high-quality earnings. Trading at 73% below its estimated fair value, it presents an attractive opportunity relative to peers. Recent figures show a net income of US$39.85 million for Q3 2025, up from US$38.26 million last year, with basic EPS rising to US$0.62 from US$0.58. Despite facing industry competition and regulatory risks, Perdoceo's focus on technology-driven student engagement and cost management supports shareholder returns through dividends and buybacks.

Graham (GHM)

Simply Wall St Value Rating: ★★★★★★

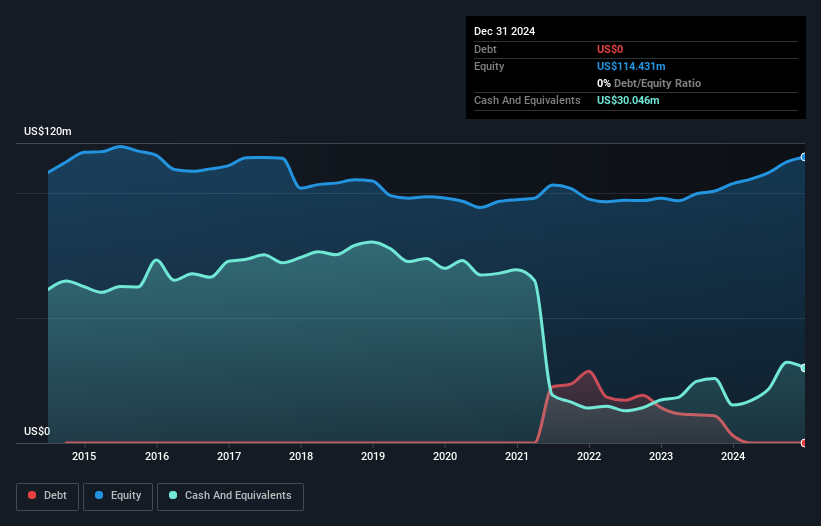

Overview: Graham Corporation designs and manufactures fluid, power, heat transfer, and vacuum technologies for industries such as chemical processing, defense, space, petroleum refining, cryogenic applications, and energy with a market cap of $691.69 million.

Operations: Graham's revenue primarily comes from its design and manufacture of heat transfer and vacuum equipment, totaling $227.90 million.

Graham Corporation, a nimble player in the machinery industry, has seen its earnings grow by 76% over the past year, outpacing industry averages. The company is debt-free and focuses on high-quality non-cash earnings. Recent orders worth US$22 million from space/aerospace sectors highlight its expanding role in next-gen space systems. For the second quarter of 2025, Graham reported sales of US$66 million and net income of US$3 million. With no free cash flow positivity yet, strategic investments in production capacity aim to bolster future growth as it navigates potential risks tied to defense contracts and energy market shifts.

Seize The Opportunity

- Navigate through the entire inventory of 293 US Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal