Lumentum Holdings Inc.'s (NASDAQ:LITE) P/S Is Still On The Mark Following 44% Share Price Bounce

Despite an already strong run, Lumentum Holdings Inc. (NASDAQ:LITE) shares have been powering on, with a gain of 44% in the last thirty days. The annual gain comes to 276% following the latest surge, making investors sit up and take notice.

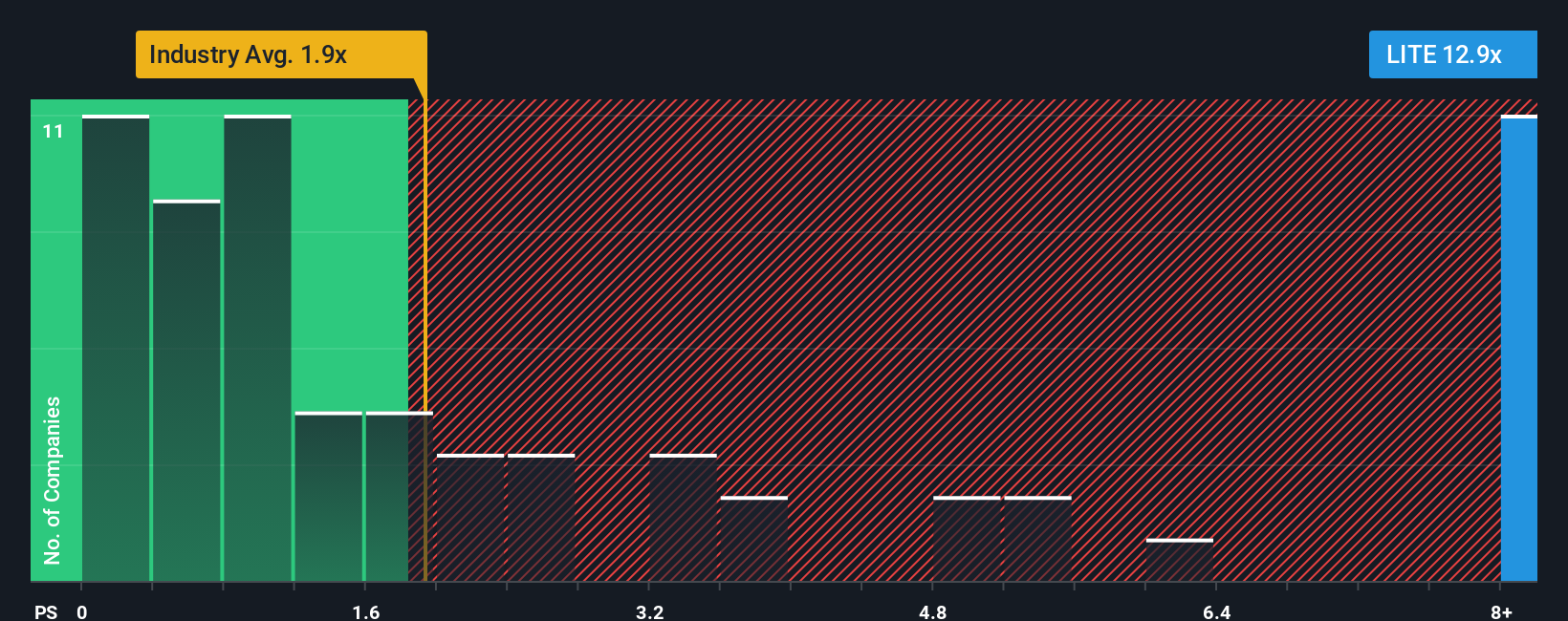

After such a large jump in price, given around half the companies in the United States' Communications industry have price-to-sales ratios (or "P/S") below 1.9x, you may consider Lumentum Holdings as a stock to avoid entirely with its 12.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Lumentum Holdings

How Has Lumentum Holdings Performed Recently?

With revenue growth that's superior to most other companies of late, Lumentum Holdings has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Lumentum Holdings' future stacks up against the industry? In that case, our free report is a great place to start.How Is Lumentum Holdings' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Lumentum Holdings' is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 34%. Although, its longer-term performance hasn't been as strong with three-year revenue growth being relatively non-existent overall. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Looking ahead now, revenue is anticipated to climb by 52% during the coming year according to the analysts following the company. That's shaping up to be materially higher than the 20% growth forecast for the broader industry.

With this information, we can see why Lumentum Holdings is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Lumentum Holdings' P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Lumentum Holdings maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Communications industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Lumentum Holdings (1 makes us a bit uncomfortable!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal