3 European Penny Stocks With At Least €90M Market Cap

As the European markets navigate mixed performances, with Germany's DAX showing gains while other major indices like France's CAC 40 and the UK's FTSE 100 experience slight declines, investors are exploring diverse opportunities. Penny stocks, despite their somewhat outdated name, remain a relevant investment area for those interested in smaller or newer companies that may offer surprising value. By focusing on penny stocks with strong financials and potential growth trajectories, investors can uncover promising opportunities within Europe's dynamic market landscape.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Orthex Oyj (HLSE:ORTHEX) | €4.62 | €82.05M | ✅ 4 ⚠️ 1 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.02 | €15.15M | ✅ 4 ⚠️ 5 View Analysis > |

| DigiTouch (BIT:DGT) | €2.00 | €27.64M | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €224.21M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.10 | €65.75M | ✅ 3 ⚠️ 3 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.285 | €378.73M | ✅ 4 ⚠️ 1 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €0.92 | €74.24M | ✅ 2 ⚠️ 4 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.26 | €312.38M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.78 | €26.12M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 286 stocks from our European Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Ilkka Oyj (HLSE:ILKKA2)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ilkka Oyj, with a market cap of €99.30 million, operates in Finland and internationally by offering marketing, technology, and data services through its subsidiaries.

Operations: The company generates revenue of €36.79 million from its marketing and technology services segment.

Market Cap: €99.3M

Ilkka Oyj, with a market cap of €99.30 million, has shown recent revenue growth, reporting €9.01 million in sales for the third quarter of 2025 compared to €6.74 million the previous year. Despite a seasoned management and board, its earnings have faced long-term decline at an average rate of 30.6% per year over five years, though they grew by 30% last year. The company maintains more cash than debt and has stable short-term financial health with assets exceeding liabilities. However, its net profit margins have declined from last year and future earnings are forecast to decrease slightly annually over the next three years.

- Take a closer look at Ilkka Oyj's potential here in our financial health report.

- Evaluate Ilkka Oyj's prospects by accessing our earnings growth report.

RomReal (OB:ROM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RomReal Limited, along with its subsidiaries, focuses on property investment and development in Romania and has a market cap of NOK108.10 million.

Operations: The company generates its revenue of €0.87 million from property investments and development in Romania.

Market Cap: NOK108.1M

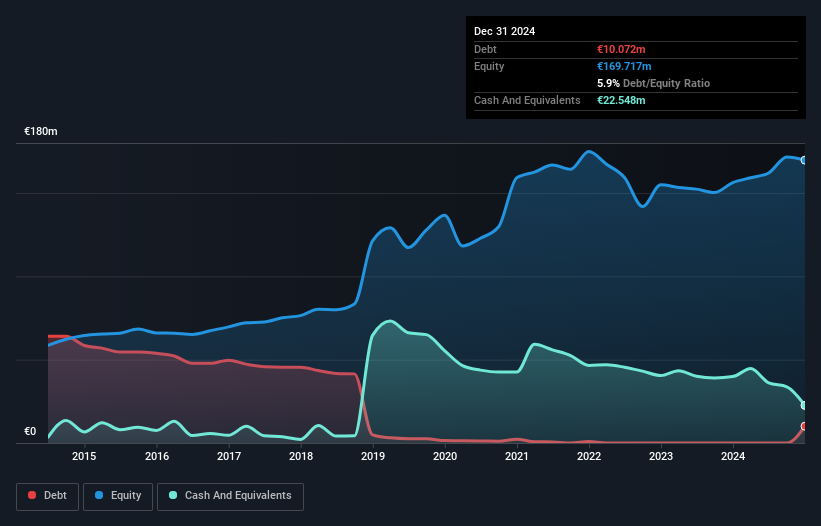

RomReal Limited, with a market cap of NOK108.10 million, focuses on property investment in Romania and remains pre-revenue with €0.87 million in revenue. Despite being unprofitable, the company has reduced losses over five years by 16.2% annually and reported a net income of €0.027 million for Q3 2025 compared to a loss last year. RomReal is debt-free, with short-term assets (€12.8M) covering liabilities (€594K), and maintains a cash runway exceeding two years if current cash flow trends persist. However, its share price is highly volatile despite stable weekly volatility over the past year.

- Get an in-depth perspective on RomReal's performance by reading our balance sheet health report here.

- Assess RomReal's previous results with our detailed historical performance reports.

Nexam Chemical Holding (OM:NEXAM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nexam Chemical Holding AB (publ) develops solutions to enhance the properties and performance of plastics across Sweden, Europe, and internationally, with a market cap of SEK306.67 million.

Operations: The company generates revenue through its Performance Chemicals segment, which accounts for SEK86.73 million, and its Performance Masterbatch segment, contributing SEK110.99 million.

Market Cap: SEK306.67M

Nexam Chemical Holding AB, with a market cap of SEK306.67 million, is focused on enhancing plastic properties through its Performance Chemicals and Masterbatch segments. Despite being unprofitable with a negative return on equity of -8.27%, it has managed to reduce its debt-to-equity ratio over five years and maintains sufficient short-term assets to cover liabilities. Recent developments include securing a significant production order in Germany for PET-based materials and advancing bioplastic technology for sustainable packaging solutions. While the company's share price remains volatile, earnings are forecasted to grow significantly at 63.23% annually, indicating potential future growth opportunities in sustainable materials markets.

- Click here and access our complete financial health analysis report to understand the dynamics of Nexam Chemical Holding.

- Examine Nexam Chemical Holding's earnings growth report to understand how analysts expect it to perform.

Make It Happen

- Unlock more gems! Our European Penny Stocks screener has unearthed 283 more companies for you to explore.Click here to unveil our expertly curated list of 286 European Penny Stocks.

- Looking For Alternative Opportunities? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal