3 Undiscovered European Gems with Strong Potential

As the European market navigates a mixed landscape, with the pan-European STOXX Europe 600 Index ending slightly lower and major stock indexes showing varied performances, investors are keenly observing how economic indicators might influence future growth. In this context of cautious optimism, identifying stocks with strong fundamentals and resilience to economic shifts can be crucial for uncovering potential opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| FRoSTA | 5.37% | 4.80% | 13.56% | ★★★★★★ |

| Dekpol | 61.42% | 9.03% | 14.54% | ★★★★★★ |

| Sparta | NA | nan | nan | ★★★★★☆ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Acinque (BIT:AC5)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Acinque S.p.A. is a multi-utility company operating in Italy with a market cap of €446 million.

Operations: The company generates revenue primarily from its multi-utility services in Italy. It has a market capitalization of €446 million.

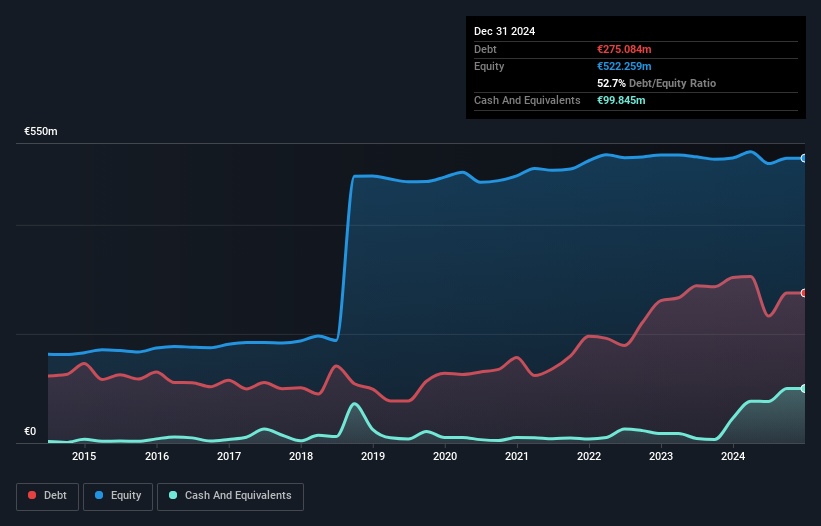

Acinque, a smaller player in the European market, showcases some intriguing financial dynamics. Over the past five years, its debt to equity ratio has risen from 28.1% to 52.7%, yet it maintains a satisfactory net debt to equity ratio of 35.4%. The company's interest payments are well covered by EBIT at nine times coverage, indicating financial stability despite earnings declining by an average of 11.9% annually over five years. Recent results for the first nine months of 2025 show sales reaching €408.86 million and net income at €18.04 million, reflecting growth compared to last year’s figures.

- Click here and access our complete health analysis report to understand the dynamics of Acinque.

Examine Acinque's past performance report to understand how it has performed in the past.

Morrow Bank (OB:MOBA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Morrow Bank ASA offers unsecured financing to private individuals across Norway, Finland, Sweden, the Netherlands, and Germany with a market capitalization of NOK 3.20 billion.

Operations: Morrow Bank generates revenue primarily from its banking segment, amounting to NOK 724.90 million. The company's net profit margin is a key financial metric to consider when evaluating its performance.

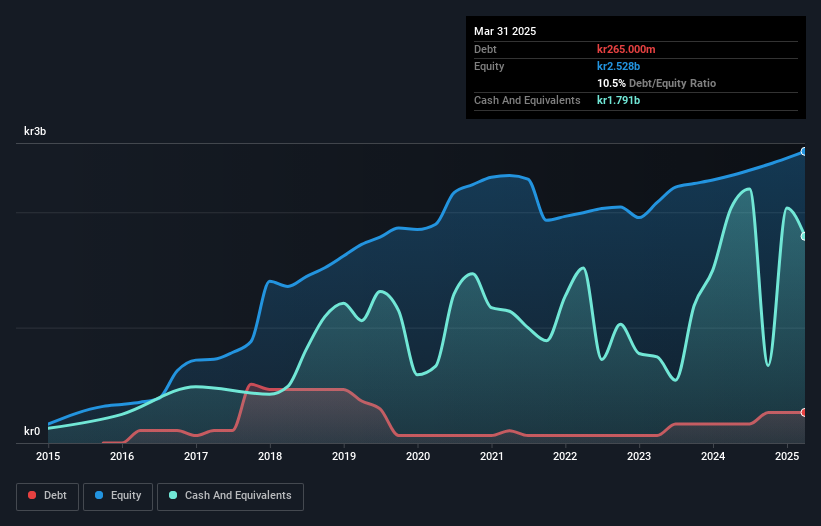

Morrow Bank, a nimble player in the Norwegian banking sector, holds total assets of NOK19.1 billion with equity at NOK2.6 billion. Its deposits amount to NOK15.9 billion against loans of NOK15.2 billion, showcasing a robust deposit base that funds its lending activities effectively. Despite high bad loans at 18.5%, earnings surged by 63% last year, outpacing industry growth of 8.4%. The bank's price-to-earnings ratio is attractively set at 13x, below the market average of 13.8x, indicating potential value for investors eyeing growth prospects amidst strategic shifts towards Sweden and scalable operations by 2028.

- Take a closer look at Morrow Bank's potential here in our health report.

Assess Morrow Bank's past performance with our detailed historical performance reports.

innoscripta (XTRA:1INN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Innoscripta SE offers software-as-a-service solutions focused on managing R&D tax incentives and project management consulting in Germany, with a market cap of €942 million.

Operations: The company's primary revenue stream is derived from its Internet Software & Services segment, generating approximately €96.19 million.

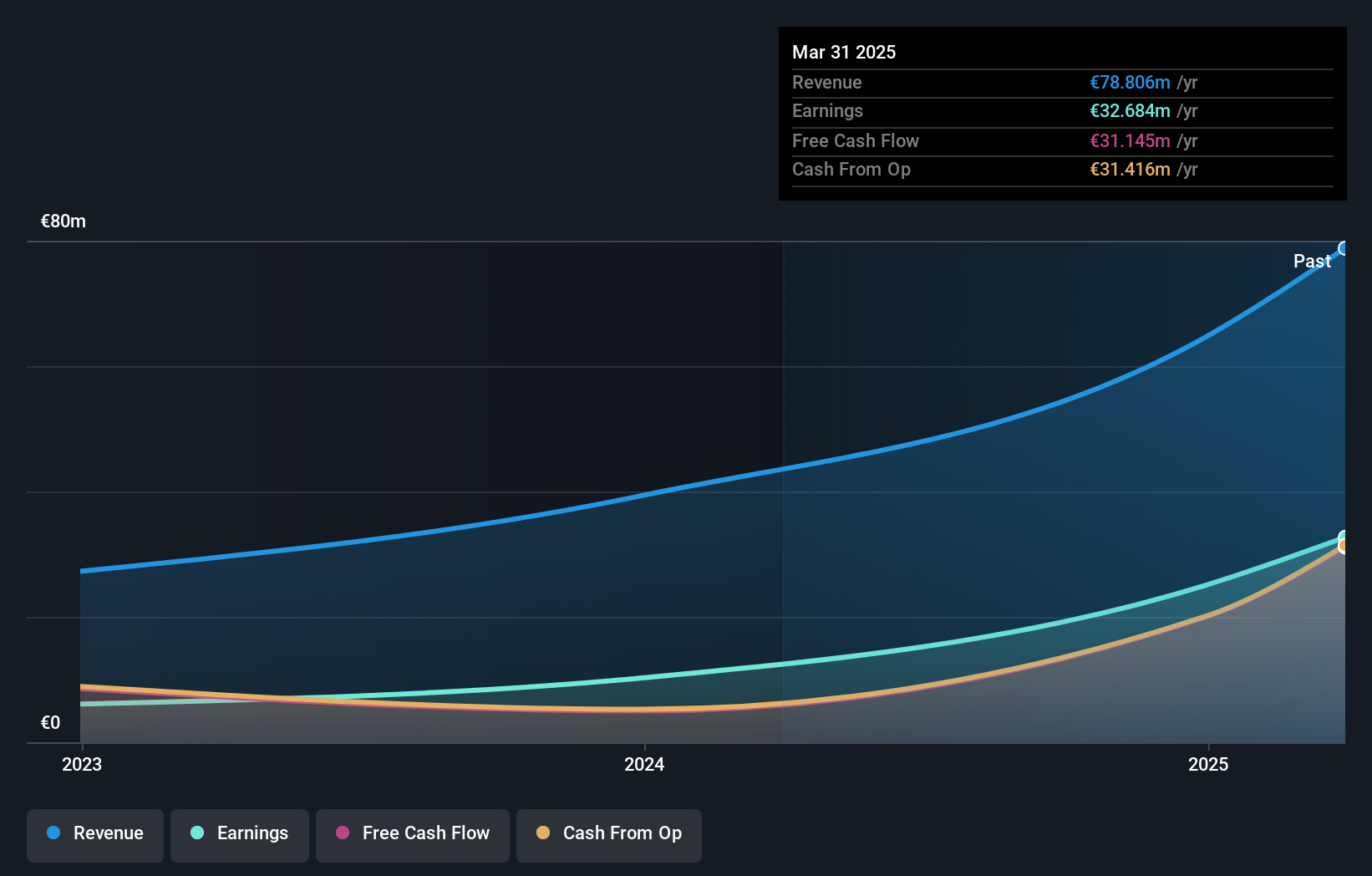

Innoscripta, a European software company, has seen impressive earnings growth of 82% over the past year, well above the industry average of 13.6%. With sales reaching €70.67 million for the first nine months of 2025 compared to €39.19 million in the same period last year, its net income also rose significantly to €27.88 million from €14.04 million. Trading at 28% below estimated fair value and with high-quality earnings, Innoscripta is positioned attractively against peers while maintaining a solid financial footing with more cash than total debt and positive free cash flow trends throughout recent years.

- Dive into the specifics of innoscripta here with our thorough health report.

Evaluate innoscripta's historical performance by accessing our past performance report.

Seize The Opportunity

- Get an in-depth perspective on all 309 European Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal