Enigmo (TSE:3665) Quarterly Losses Challenge Bullish Growth Narrative Despite 7.9% Revenue Expansion

Enigmo (TSE:3665) just posted its Q3 2026 numbers, with revenue of ¥1.4 billion and a basic EPS of -¥1.21, setting up a mixed snapshot of topline resilience against bottom line pressure. The company has seen quarterly revenue move from ¥1.3 billion in Q3 2025 to ¥2.0 billion in Q4 2025, then to ¥1.5 billion in Q1 2026, ¥1.4 billion in Q2 2026 and ¥1.4 billion in Q3 2026, while EPS swung from ¥0.38 in Q3 2025 to ¥7.23 in Q4 2025 before sliding into negative territory at -¥3.18 in Q2 2026 and -¥1.21 in Q3 2026, underscoring a story of solid sales with compressed margins that investors will be watching closely.

See our full analysis for Enigmo.With the headline figures on the table, the next step is to see how these results line up against the prevailing narratives around Enigmo’s growth, profitability and long term trajectory.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Squeezed as Net Income Turns Negative

- Q3 2026 net income excluding extra items was a loss of ¥48 million, following a deeper loss of ¥126 million in Q2 2026, even though revenue held around the ¥1.4 billion level across both periods.

- Bears highlight weakening profitability, and the recent numbers back that up while also showing some nuance:

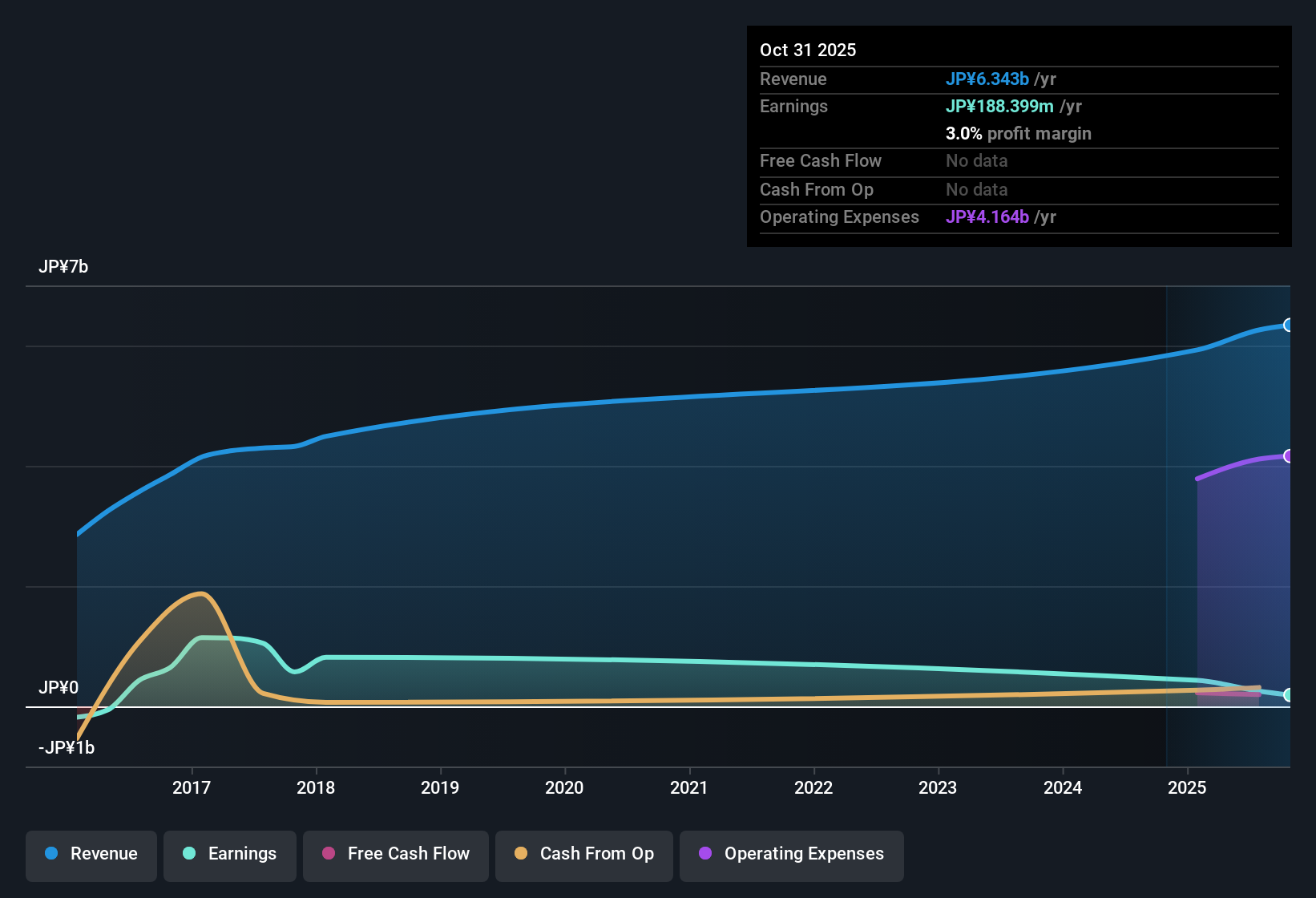

- Over the last 12 months, net profit margin fell from 7.6% to 3%, and the latest two quarters were actually in the red, which is a clear contrast to the still positive trailing margin.

- Trailing earnings are only expected to grow about 2.6% per year, so the swing to quarterly losses makes it harder to argue that margins will quickly return to earlier levels.

Revenue Growing Faster Than Profits

- On a trailing basis, revenue reached ¥6,342 million, up 7.9% over the past year, and is forecast to grow roughly 8% annually, ahead of the 4.5% growth pace cited for the broader Japanese market.

- What stands out for a bullish angle is how the healthy top line coexists with softer profitability:

- Despite that 7.9% revenue growth and a 3% trailing net margin, quarterly EPS has been negative in two of the last three quarters, including Q3 2026 at -¥1.21.

- This mix of faster than market sales growth but only modest forecast earnings growth of about 2.6% a year suggests that simply growing revenue is not yet translating into strong per share profit momentum.

Rich Valuation Versus Earnings Power

- At a share price of ¥427, Enigmo trades on a trailing P E of 89.2 times, far above the JP Specialty Retail industry average of 14.6 times and peer average of 15.6 times, and also well above a DCF fair value of ¥123.89.

- Critics argue this premium multiple is hard to justify, and the current metrics give them several talking points:

- Trailing net profit of ¥190 million on ¥6,342 million of revenue leaves only a 3% margin, noticeably below the 7.6% margin from the prior year and not clearly aligned with such a high P E.

- With earnings expected to grow about 2.6% annually and the 2.34% dividend not well covered by earnings or free cash flow, investors are paying a high price while taking on both slower profit growth and payout risk.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Enigmo's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Enigmo combines slowing earnings growth and shrinking margins with a rich valuation and a dividend that is not well covered by profits or cash flow.

If paying up for fragile payouts makes you uneasy, use our these 1930 dividend stocks with yields > 3% instead to quickly pinpoint companies offering stronger, better covered income streams right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal