Counterpoint warns of “core shortage crisis”: AI hasn't eaten enough yet, consumer electronics may fall first

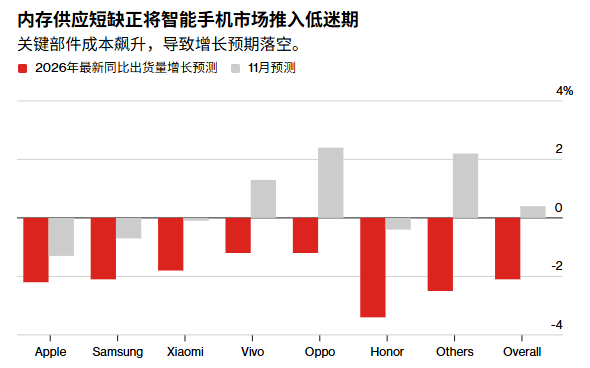

Zhitong Finance App learned that, according to industry tracking agency Counterpoint Research, global smartphone shipments may drop 2.1% next year due to rising costs and declining production capacity due to a shortage of memory chips. This marks a sharp reversal of the 3.3% increase expected this year, and the well-known research company drastically lowered the expected increase in 2026 from the 0.45% forecast previously. According to a research report released by Counterpoint on Tuesday, the average global mobile phone sales price is expected to rise 6.9% next year due to the 10% to 25% increase in the overall cost of electronic components.

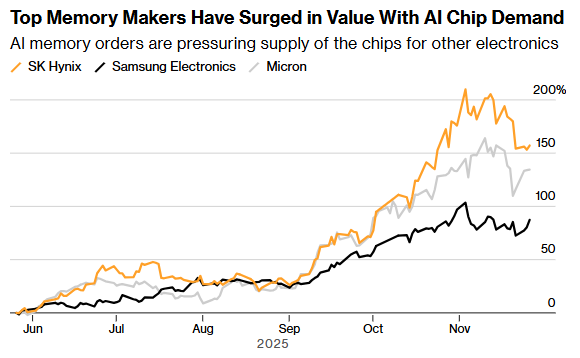

This year, the rapid development of global artificial intelligence has prompted semiconductor manufacturers to prioritize the production of advanced memory chips for Nvidia accelerators over more basic products. This in turn has exacerbated the shortage of DRAM chips, which are essential for electronic products from laptops and electric vehicles to medical devices and household appliances.

At the beginning of this month, US memory chip giant Micron Technology said it plans to stop selling storage products to individual consumers in the PC/DIY market so that the company can focus its production capacity on providing sufficient storage products for high-performance AI chip-driven computing power clusters. Micron's latest developments can be described as highlighting that the most profitable segment and pricing power in the storage product sector for a long time is shifting from a PC/smartphone growth cycle to a “storage industry supercycle” dominated by large AI data centers.

Second, SK Hynix said in October that all of its memory chip orders for next year have been sold out, and Micron expects the tight supply situation to continue until 2026. Driven by tight supply prospects, Japanese NAND flash memory manufacturer Kioxia's stock price increased several times after going public in December last year.

SK Hynix previously predicted that the memory shortage will continue until the end of 2027, which means the impact of this crisis will extend far beyond 2026. Consumers who plan to upgrade early next year are better off taking action before prices rise across the board. As the low-end smartphone market faces increasing price pressure, the prospects for slowing growth in the global smartphone market are becoming more and more obvious.

In recent months, many consumer electronics manufacturers have issued price increases warnings, while some PC manufacturers have begun to stock up on memory to cope with rising costs. For example, Dell Technologies, HP, and other technology companies warned last month that there could be a shortage of memory chips next year due to a surge in demand for memory chips brought about by the construction of artificial intelligence infrastructure. Meanwhile, Nintendo's stock price has been falling for most of December, as people are increasingly worried that the price increase will affect its flagship console, Switch 2, and its profitability.

Some low-end smartphone brands are considered more vulnerable to shocks due to lower profit margins. Counterpoint said the shortage of memory chips is likely to hit entry-level smartphones in particular. Many companies lack the scale and bargaining power of Apple or Samsung, and are therefore vulnerable to soaring memory costs. Entry-level smartphones that cost less than $300 face the most serious threat, as manufacturers are unable to offset price increases without seriously impacting sales.

According to TrendForce's December 2025 analysis report, entry-level devices bear the brunt. Smartphone memory inventory has fallen below 4 weeks of supply, and even high-end manufacturers will face pressure to pass costs on to consumers. Shortages of DRAM and NAND flash memory have arisen, and there is no way to talk about any component alternatives.

Industry analysts predict that the worst price increase will arrive in mid-2026, when the new production contract will take effect. Manufacturers with long-term agreements signed before the shortage began to face rising costs from the second quarter to the third quarter of 2026. IDC and Counterpoint Research both warned that the average price of smartphones will rise significantly in the first half of next year.

Yang Wang, senior analyst at Counterpoint, said, “Apple and Samsung are best able to get through the next few quarters. But for other companies that don't have enough room for maneuver to balance market share and profit margins, the situation will be very difficult. Over time, we'll see this particularly evident in some Chinese OEMs.”

Faced with this memory crisis, device manufacturers have few effective responses. Supply chain experts point out that chip makers are deliberately tightening supply in order to maximize profits. As demand from AI data centers dominates production allocations, manufacturers cannot simply switch vendors or use replacement memory.

According to the research company, one coping strategy is to encourage companies to guide users to buy higher-end models, so profits will be much less affected. Counterpoint notes in its report that other options include reusing old parts and other configurations such as lowering the camera.

Some companies may try to lower memory specifications—reducing memory or storage space in lower-cost models—but this approach harms competitiveness. Other companies will temporarily bear their own costs and then pass the costs on to consumers at the end of 2025 and the beginning of 2026. The smartphone industry faces an inevitable choice: either raise prices drastically or watch profit margins shrink.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal