Atkore (ATKR): Reassessing Valuation as Strong U.S. Footprint and Digital Edge Reinforce Normalized Earnings Power

Atkore (ATKR) is back on investors radar after fresh commentary highlighted how its dense U.S. manufacturing network and embedded digital design tools are supporting margins even as PVC spreads drift toward more normal levels.

See our latest analysis for Atkore.

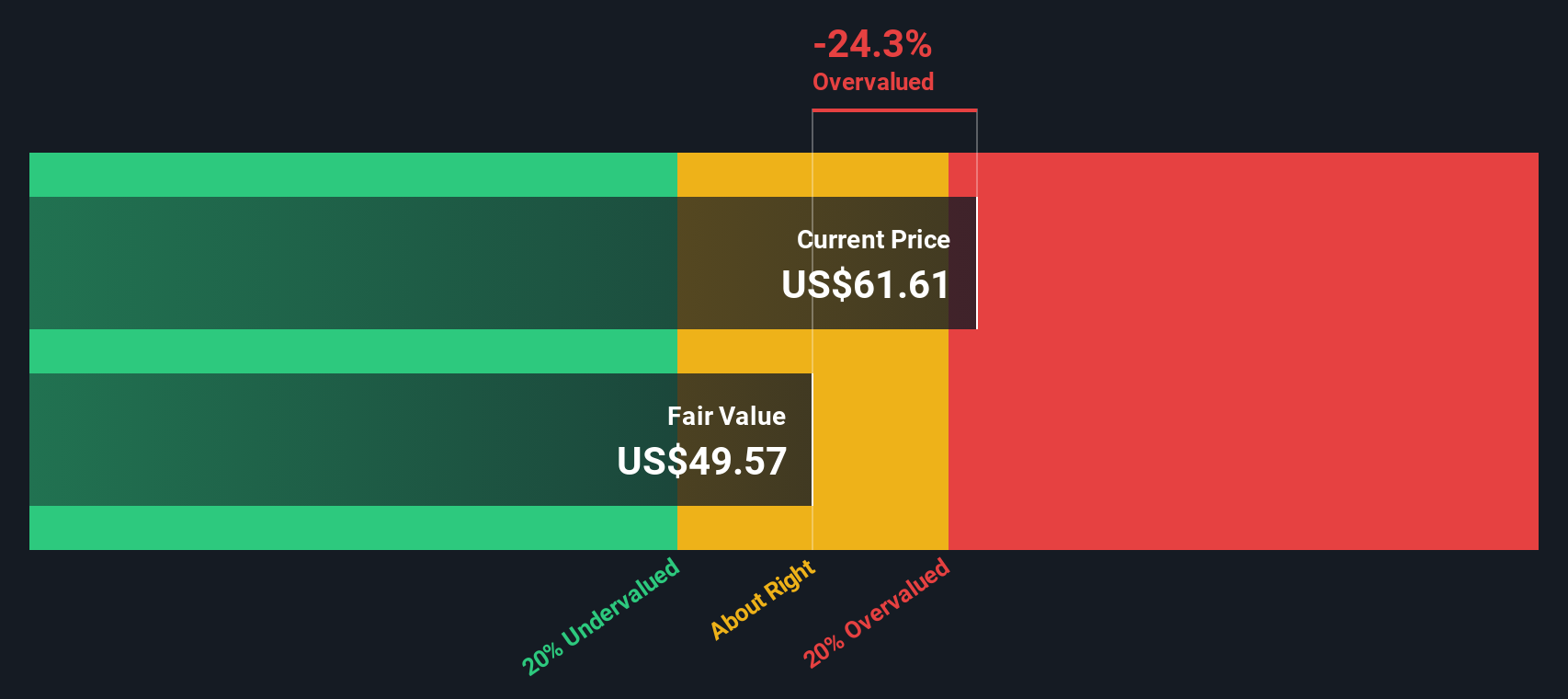

Those fundamentals are coming into focus against a choppy backdrop, with the share price at $64.58 and a year to date share price return of minus 20.69 percent. The one year total shareholder return of minus 22.13 percent highlights how sentiment has cooled even as management pay, insider selling, and shifting institutional positions keep Atkore in the spotlight.

If Atkore’s setup has you rethinking where durable advantages come from, it could be a good moment to explore fast growing stocks with high insider ownership as potential next ideas.

With earnings power holding up better than the share price and the stock trading only fractionally below analyst targets, investors now face a key question: is this a mispriced compounding story, or is the market already discounting its next leg of growth?

Most Popular Narrative Narrative: 1.5% Overvalued

With Atkore closing at $64.58 against a narrative fair value of $63.60, the story hinges on modest growth assumptions and a value style earnings profile.

In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.9 billion, earnings will come to $217.1 million, and it would be trading on a PE ratio of 11.7x, assuming you use a discount rate of 10.1%.

Curious how a slow revenue glide, expanding margins, and a sharply lower future earnings multiple can still justify today’s price? The narrative’s math may surprise you.

Result: Fair Value of $63.60 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant price pressure in PVC and steel conduit, combined with unpredictable mega project timing, could quickly undermine the current fair value narrative.

Find out about the key risks to this Atkore narrative.

Another Angle on Valuation

While the narrative fair value suggests Atkore is roughly fairly priced, our DCF model presents a very different picture. On that view, the shares at $64.58 sit well above an estimated fair value of $27.56, indicating meaningful downside risk if cash flows disappoint.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Atkore Narrative

If the consensus framing does not quite fit your view, or you would rather interrogate the numbers yourself, you can build a complete narrative in minutes: Do it your way.

A great starting point for your Atkore research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop at one opportunity. Use the Simply Wall St Screener to quickly surface fresh, data driven ideas that could reshape your portfolio’s long term returns.

- Target income potential by reviewing steady payers and growth candidates through these 13 dividend stocks with yields > 3% that can help anchor your total return.

- Spot mispriced quality by scanning these 908 undervalued stocks based on cash flows that pair solid fundamentals with attractive cash flow based valuations.

- Capture cutting edge themes by assessing these 26 AI penny stocks positioned to benefit from powerful advances in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal