How Investors May Respond To Lennox International (LII) Dividend Stability Amid HVAC Cyclicality And Acquisition Risks

- Earlier this month, Lennox International declared a quarterly cash dividend of US$1.30 per share, payable on January 15, 2026, to shareholders of record as of December 31, 2025, while Barclays highlighted cyclical weakness in the residential HVAC market alongside concerns about a recent NSI Industries acquisition.

- While Lennox’s pricing power and dividend continuity support its income profile, questions around residential demand, inventory risks, and future return on invested capital are becoming more important for investors assessing the company’s longer-term quality.

- Next, we’ll examine how Barclays’ concerns about residential HVAC cyclicality and acquisition-related inventory risks may reshape Lennox International’s investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Lennox International Investment Narrative Recap

To stay invested in Lennox International, you need to believe that its strong pricing power, brand, and installed base can offset cyclical weakness in residential HVAC. Barclays’ concerns and the NSI-related inventory risk sharpen the focus on execution in 2026 but do not appear to alter the near term catalyst around managing demand and restocking.

The recent approval of another US$1.30 quarterly dividend reinforces Lennox’s pattern of returning cash to shareholders, even as questions grow around how the NSI Industries acquisition could affect inventory quality and future returns.

Yet investors should be aware that elevated and shifting inventories could quickly matter more if residential demand softens further and ...

Read the full narrative on Lennox International (it's free!)

Lennox International's narrative projects $6.2 billion revenue and $1.1 billion earnings by 2028.

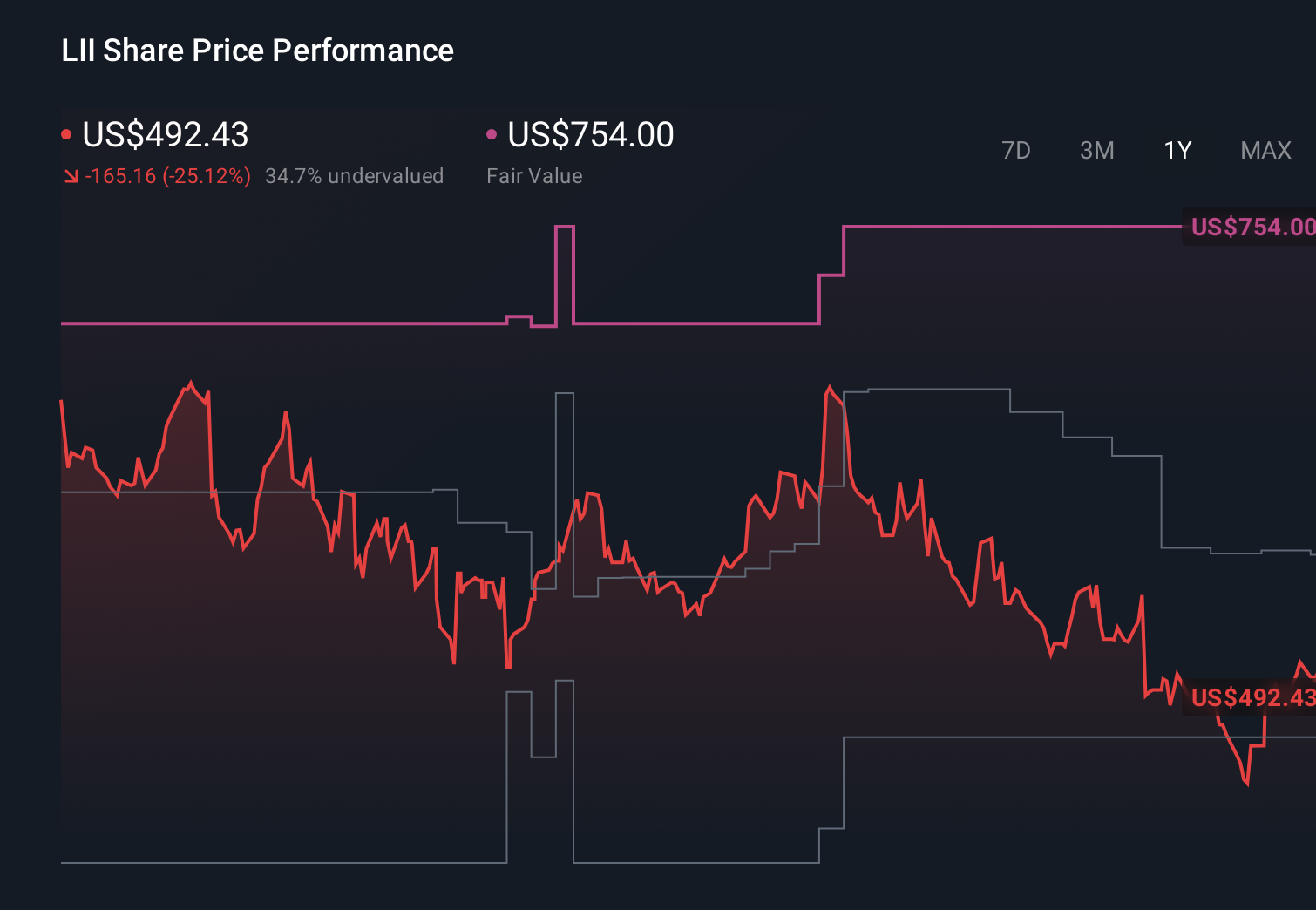

Uncover how Lennox International's forecasts yield a $571.43 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span roughly US$483 to US$571 per share, underscoring how far apart individual views can be. You may want to weigh these against concerns that a cyclical residential slowdown and acquisition driven inventory risks could pressure Lennox’s near term performance and capital efficiency.

Explore 2 other fair value estimates on Lennox International - why the stock might be worth just $483.39!

Build Your Own Lennox International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lennox International research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lennox International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lennox International's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal