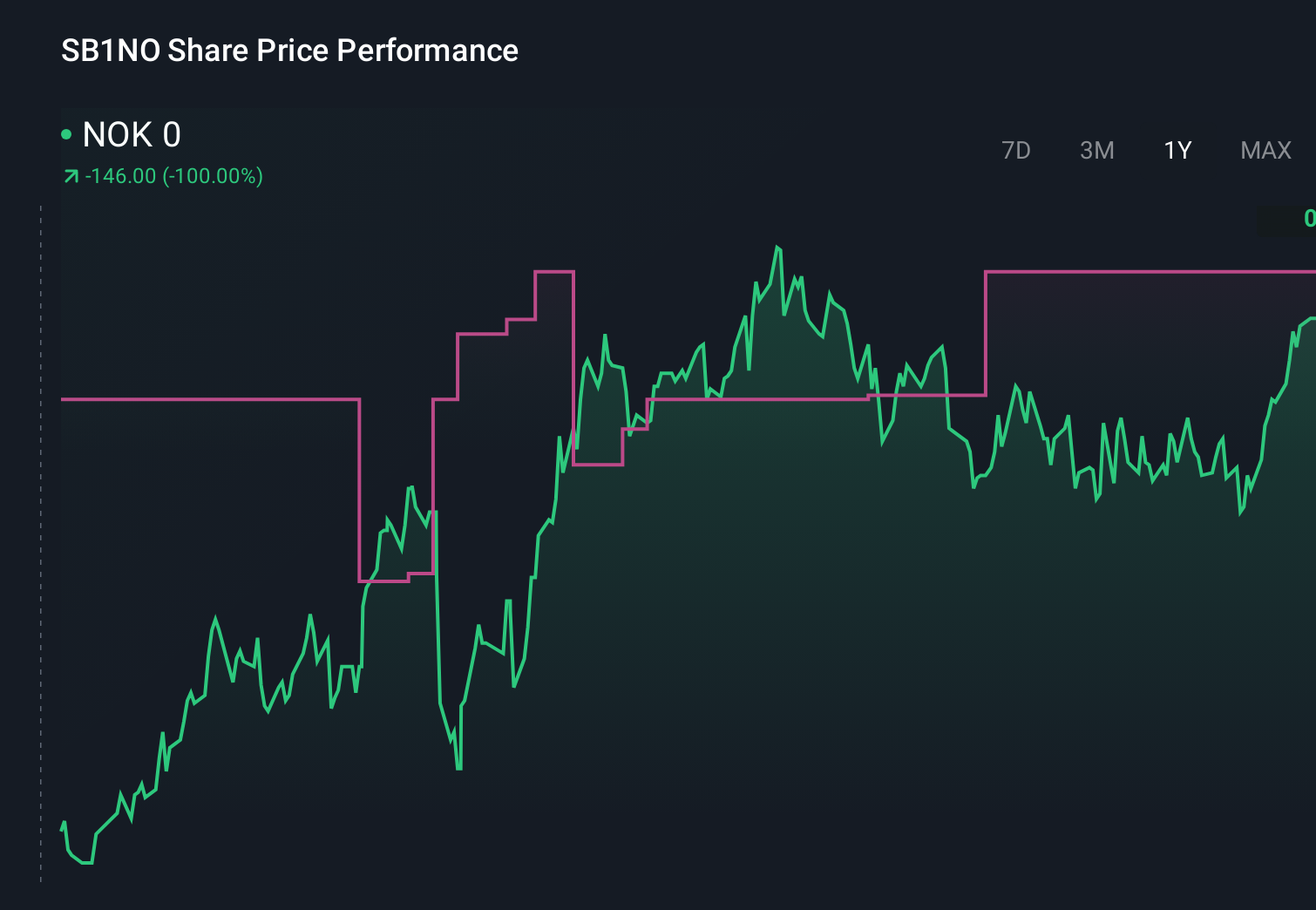

Is SpareBank 1 Sør-Norge’s Share Buy-Back And Staff Scheme Redefining Its Investment Case (OB:SB1NO)?

- SpareBank 1 Sør-Norge has recently continued its 2026 employee share savings programme, allowing staff to invest NOK 6,000–60,000 annually in discounted shares with a two-year lock-in, while also progressing a previously announced buy-back of up to 1% of its own shares.

- Together, the buy-back and discounted employee share scheme highlight management’s emphasis on ownership alignment and capital return alongside operational and growth objectives.

- We’ll now examine how the ongoing share buy-back shapes SpareBank 1 Sør-Norge’s investment narrative and its appeal for long-term investors.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

SpareBank 1 Sør-Norge Investment Narrative Recap

To own SpareBank 1 Sør-Norge, you need to be comfortable with a regional bank that is working to deploy excess capital efficiently while competing hard on margins and lending growth. The ongoing share buy-back and expanded employee share savings programme are incremental rather than transformative for the near term, and do not materially change the key catalyst of better capital utilisation or the main risk of margin pressure from intense competition.

The most relevant announcement here is the ongoing buy-back of up to 1.0% of the company’s own shares, on top of earlier, smaller repurchases. This sits alongside expectations that more efficient use of surplus liquidity and capital could support higher net interest income and future capital returns, but investors still need to weigh that against stagnant corporate lending and real estate concentration. Yet, investors should also understand the risk that heavy exposure to the property market could...

Read the full narrative on SpareBank 1 Sør-Norge (it's free!)

SpareBank 1 Sør-Norge's narrative projects NOK14.5 billion revenue and NOK7.0 billion earnings by 2028. This requires 4.8% yearly revenue growth and an earnings increase of about NOK1.1 billion from NOK5.9 billion today.

Uncover how SpareBank 1 Sør-Norge's forecasts yield a NOK188.75 fair value, in line with its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates for SpareBank 1 Sør-Norge range widely, from NOK186.30 up to NOK367.33, underscoring how differently people view its prospects. You should weigh these views against the risk of sustained margin pressure from fierce banking competition, which could influence how effectively the bank turns its capital and buy-backs into long term performance.

Explore 3 other fair value estimates on SpareBank 1 Sør-Norge - why the stock might be worth as much as 92% more than the current price!

Build Your Own SpareBank 1 Sør-Norge Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SpareBank 1 Sør-Norge research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free SpareBank 1 Sør-Norge research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SpareBank 1 Sør-Norge's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal