Nagoya Railroad (TSE:9048) Valuation After Major Nagoya Station Redevelopment Delays and Project Reassessment

Nagoya Railroad (TSE:9048) has hit the brakes on its flagship Nagoya Station District Redevelopment and Meitetsu Nagoya Station Renovation projects, after a board meeting revealed delays tied to higher construction costs and contractor shortages.

See our latest analysis for Nagoya Railroad.

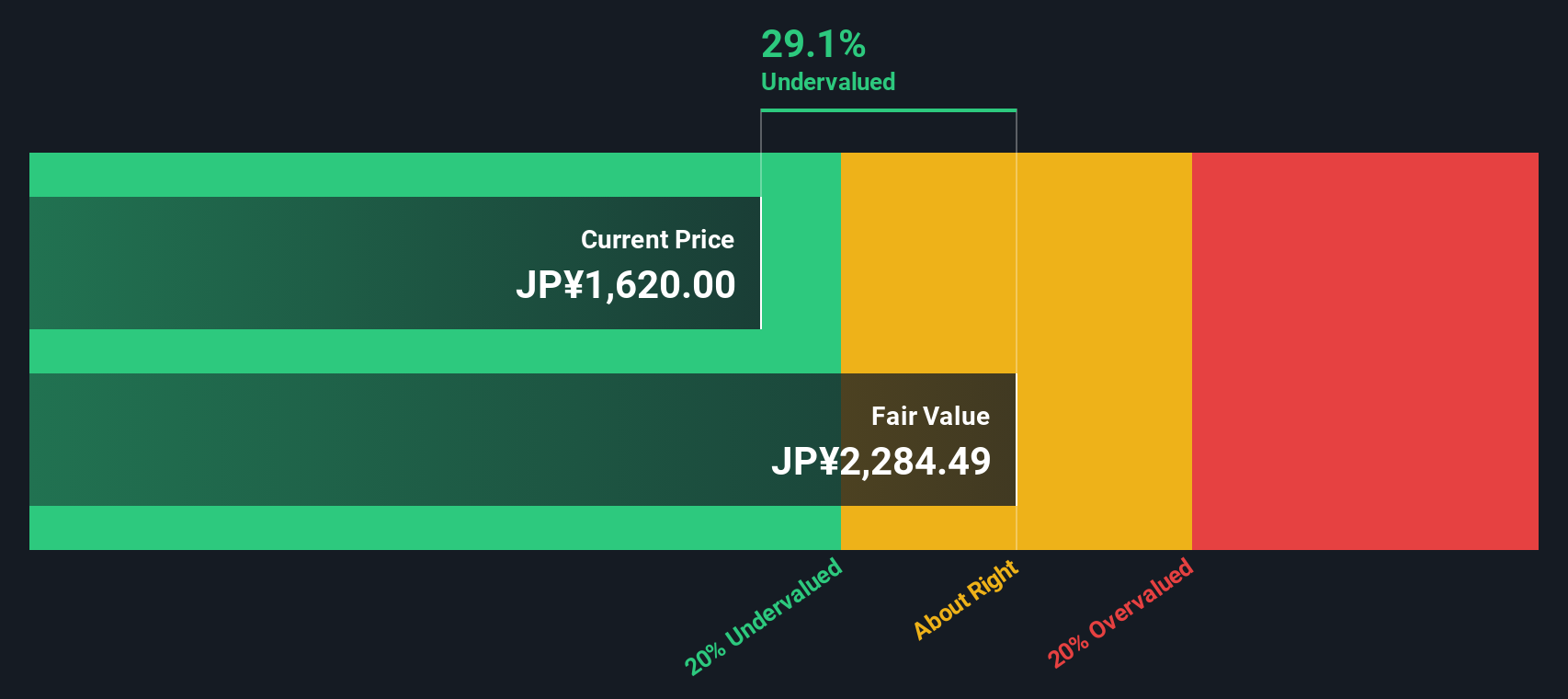

The news lands after a softer stretch for investors, with the share price at ¥1,626 and a negative 1 year total shareholder return contrasting with modest recent share price gains. This suggests sentiment is still cautious rather than excited about long term prospects.

If this kind of project risk has you thinking more broadly about where to allocate capital, it could be worth exploring fast growing stocks with high insider ownership as a source of new ideas.

With shares still below analyst targets but weighed down by years of weak returns and fresh project uncertainty, is Nagoya Railroad trading at a discount to its long term potential, or has the market already priced in its future growth?

Price-to-Earnings of 11.6x: Is it justified?

At roughly ¥1,626 per share, Nagoya Railroad is trading at about 11.6 times earnings, a level that screens as inexpensive against both the wider Japanese market and its direct transportation peers.

The price to earnings ratio compares what investors are paying today for each unit of current profit, which is especially relevant for a mature, cash-generating operator like Nagoya Railroad. With forecast earnings growth in the low double digits each year, a subdued multiple indicates that the market is hesitant to pay more for that expected improvement.

Relative to the Japanese market average of 14.2 times earnings and the transportation industry average of 11.8 times, Nagoya Railroad changes hands at a clear discount. Compared with an estimated fair price to earnings ratio of 16.1 times, the gap is even wider. This suggests the valuation could shift meaningfully if sentiment aligns with these profit expectations.

Explore the SWS fair ratio for Nagoya Railroad

Result: Price-to-Earnings of 11.6x (UNDERVALUED)

However, delays to flagship station projects and years of weak shareholder returns could signal deeper structural challenges that limit any valuation re-rating.

Find out about the key risks to this Nagoya Railroad narrative.

Another way to look at value

Our DCF model paints a starkly different picture, suggesting Nagoya Railroad is trading well above its fair value, with an estimate closer to ¥763 per share. If profits grow as expected, is the market being too optimistic today, or is the model too harsh on execution risk?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nagoya Railroad for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nagoya Railroad Narrative

If you see things differently or want to stress test these assumptions with your own inputs, you can build a custom narrative in minutes, Do it your way.

A great starting point for your Nagoya Railroad research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, put Simply Wall Street to work for you and uncover other opportunities that could reshape your portfolio’s returns this year.

- Target steady income by reviewing these 13 dividend stocks with yields > 3% that aim to balance reliable payouts with solid underlying businesses.

- Capitalize on breakthrough innovation with these 28 quantum computing stocks that could benefit from the next wave of computing power.

- Position yourself for structural growth by assessing these 30 healthcare AI stocks pushing the boundaries of diagnostics, treatment, and patient outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal