Transense Technologies Leads 3 Promising UK Penny Stocks

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices closing lower due to weak trade data from China, highlighting global economic uncertainties. Despite these broader market pressures, investors often find potential in smaller or newer companies known as penny stocks. While the term may seem outdated, these stocks can still offer surprising value and opportunities for growth when they possess solid financial foundations.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.145 | £475.52M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £1.95 | £157.54M | ✅ 4 ⚠️ 2 View Analysis > |

| On the Beach Group (LSE:OTB) | £2.275 | £329.66M | ✅ 5 ⚠️ 1 View Analysis > |

| Ingenta (AIM:ING) | £0.79 | £11.93M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.40 | £30.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.6325 | $367.69M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.444 | £174.89M | ✅ 3 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.475 | £71.23M | ✅ 3 ⚠️ 3 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.475 | £40.94M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.10 | £177.02M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 306 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Transense Technologies (AIM:TRT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Transense Technologies plc provides specialist sensor systems across various regions, including the United Kingdom, North America, South America, Australia, and Europe, with a market cap of £21.69 million.

Operations: Transense Technologies generates revenue through three key segments: SAWsense (£1.11 million), Translogik (£1.32 million), and Itrack Royalties (£3.11 million).

Market Cap: £21.69M

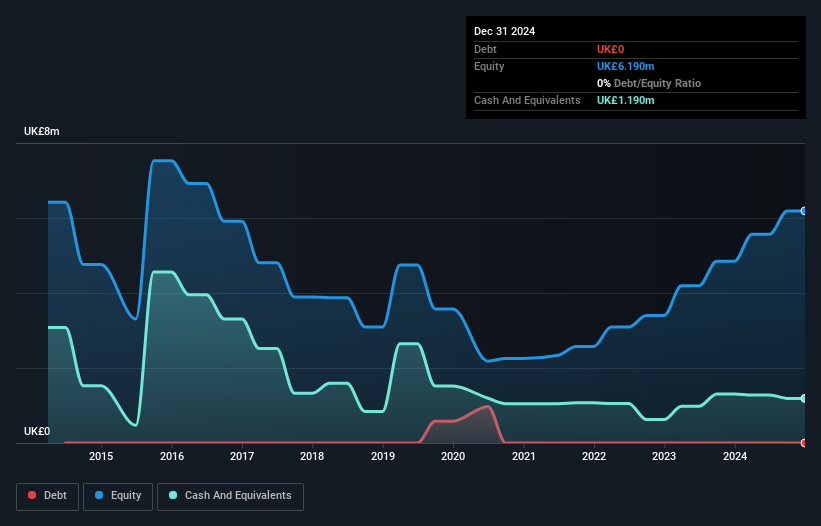

Transense Technologies, with a market cap of £21.69 million, has recently launched the Translogik TLGi Digital Handheld Tyre Inflator, enhancing its connected workshop solutions. The company reported revenue of £5.55 million for the year ending June 2025, showing growth from £4.18 million the previous year, though net income slightly decreased to £1.41 million from £1.57 million. Despite negative earnings growth over the past year and lower profit margins compared to last year, Transense remains debt-free and covers its liabilities with short-term assets while trading significantly below estimated fair value and maintaining stable volatility levels.

- Click to explore a detailed breakdown of our findings in Transense Technologies' financial health report.

- Learn about Transense Technologies' future growth trajectory here.

Bisichi (LSE:BISI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Bisichi PLC is involved in coal mining and processing operations in the United Kingdom and South Africa, with a market cap of £8 million.

Operations: The company's revenue is primarily derived from its mining operations, which contribute £52.11 million, and its property segment, which adds £1.26 million.

Market Cap: £8.01M

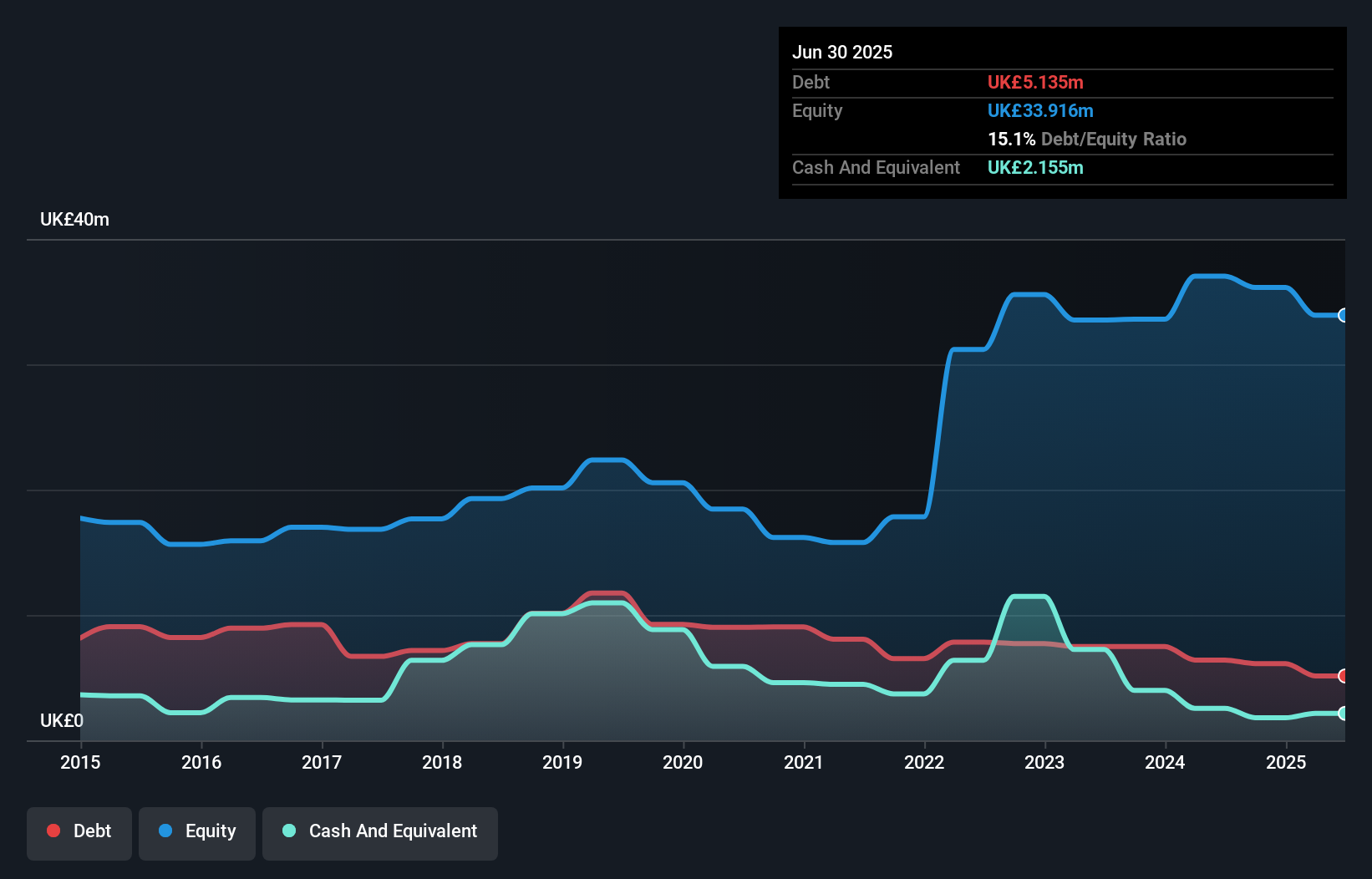

Bisichi PLC's market cap stands at £8 million, with significant revenue from its coal mining operations totaling £52.11 million. Despite being unprofitable and experiencing increased share price volatility recently, the company has made strides in reducing its debt-to-equity ratio from 48.9% to 15.1% over five years, with a satisfactory net debt to equity of 8.8%. The board is experienced with an average tenure of 5.2 years, and while short-term liabilities exceed assets by £6.1M, long-term liabilities are well-covered by short-term assets (£10.4M). Recent earnings showed a net loss of £1 million for H1 2025 amidst rising sales figures.

- Navigate through the intricacies of Bisichi with our comprehensive balance sheet health report here.

- Gain insights into Bisichi's past trends and performance with our report on the company's historical track record.

Chemring Group (LSE:CHG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Chemring Group PLC operates in the defense sector, offering countermeasures, sensors, information, and energy products across various regions including the United States, United Kingdom, Europe, and Asia Pacific with a market cap of £1.31 billion.

Operations: The company's revenue is divided into two main segments: Sensors & Information, generating £174.8 million, and Countermeasures & Energetics, contributing £322.7 million.

Market Cap: £1.31B

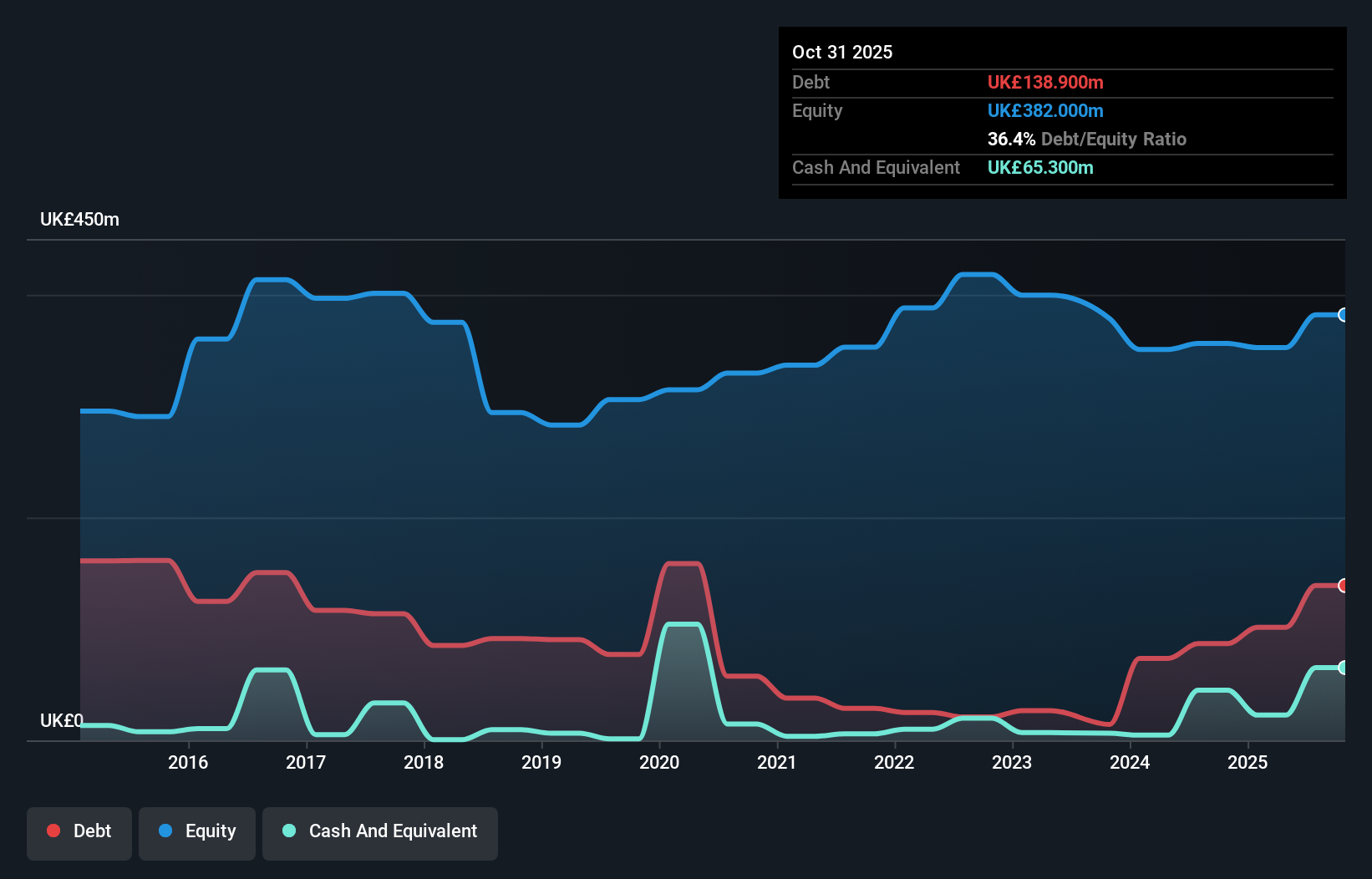

Chemring Group PLC, with a market cap of £1.31 billion, operates in the defense sector and reported an increase in sales to £497.5 million for the year ending October 31, 2025. Earnings growth accelerated significantly over the past year at 28.4%, although it matched industry performance. The company's net profit margins improved to 10.7%, supported by high-quality earnings and well-covered interest payments on debt (12.8x EBIT coverage). Despite a rise in its debt-to-equity ratio over five years, short-term assets exceed both short-term and long-term liabilities, indicating strong financial health. A dividend increase was announced alongside stable management tenure averaging 7.4 years.

- Jump into the full analysis health report here for a deeper understanding of Chemring Group.

- Gain insights into Chemring Group's future direction by reviewing our growth report.

Taking Advantage

- Investigate our full lineup of 306 UK Penny Stocks right here.

- Want To Explore Some Alternatives? Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal