EastGroup Properties (EGP): Assessing Valuation After Analyst Upgrades and Stronger Leasing, Demand, and 2026 Growth Plans

EastGroup Properties (EGP) is back on investors radar after a string of upbeat analyst calls tied to improving tenant demand, a clear rebound in leasing, and a fresh at the market equity program supporting 2026 growth plans.

See our latest analysis for EastGroup Properties.

Those moves and a freshly affirmed dividend backdrop have helped the stock grind higher, with a roughly 10 percent 3 month share price return and a near 12 percent one year total shareholder return signaling momentum is building rather than fading.

If EastGroup’s steady climb has you rethinking where industrial growth might show up next, this could be a good moment to explore fast growing stocks with high insider ownership.

With the shares now trading near record levels yet still sitting at a modest discount to analyst targets and intrinsic value estimates, the key question is whether EastGroup remains attractive at current prices or if the market already reflects that growth.

Most Popular Narrative Narrative: 5.3% Undervalued

With EastGroup closing at $183.49 against a narrative fair value of about $193.85, the storyline leans toward modest upside still on the table.

Persistent e commerce expansion and ongoing supply chain modernization are ensuring elevated leasing spreads and high occupancy in EastGroup's infill, last mile logistics facilities, supporting above average rental rate growth and driving resilient net margins. Industry wide constraints on new supply stemming from ongoing zoning and land scarcity are enabling EastGroup to maintain its pricing power and consistently high utilization, even in a more cautious capital environment, supporting stable and potentially accelerating earnings growth as macro uncertainty dissipates.

Curious how this industrial landlord earns a growth style valuation? The narrative leans on robust rent gains, fatter margins, and a boldly higher future earnings multiple. Want to see what kind of earnings and revenue path has to unfold to make that price tag work?

Result: Fair Value of $193.85 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower development leasing and persistent high rates limiting affordable capital could cap near term earnings scalability and pressure EastGroup’s premium valuation.

Find out about the key risks to this EastGroup Properties narrative.

Another Angle on Value

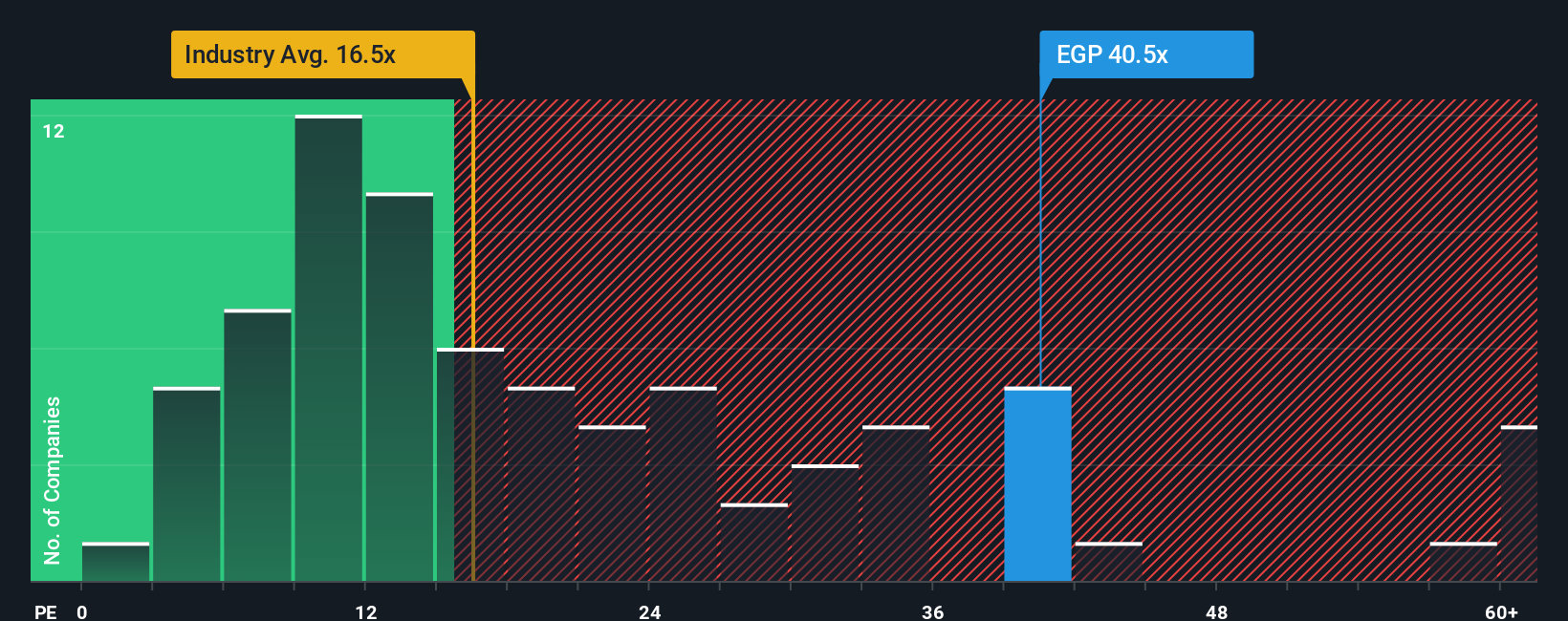

On earnings multiples, EastGroup looks much richer. The shares trade around 39.4 times earnings, far above the global industrial REIT average of 16.2 times and a fair ratio estimate of 33.5 times. This suggests limited margin for error if growth or sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EastGroup Properties Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a complete narrative in minutes: Do it your way.

A great starting point for your EastGroup Properties research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by scanning focused stock lists tailored to different strategies, so you are not relying on just one play.

- Target reliable income as you review these 13 dividend stocks with yields > 3% that can potentially strengthen your portfolio’s cash flow.

- Capitalize on mispricing by evaluating these 908 undervalued stocks based on cash flows where market expectations may not yet match future cash flows.

- Seize innovation-led growth by assessing these 26 AI penny stocks positioned at the forefront of artificial intelligence adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal