Teijin (TSE:3401) Valuation Check After Recent Gradual Share Price Climb

Teijin (TSE:3401) has been quietly grinding higher, with the stock up around 1% over the past week and about 2% over the past month, even as revenue has edged slightly lower.

See our latest analysis for Teijin.

Zooming out, that modest recent climb comes after a softer year to date on a share price basis, even as Teijin’s 1 year total shareholder return is slightly positive, suggesting sentiment may be stabilising as investors reassess its earnings power.

If Teijin’s slow burn does not quite match your return ambitions, this might be a good moment to broaden your watchlist and explore fast growing stocks with high insider ownership.

With revenue drifting lower but net income rebounding and the shares trading near estimated fair value, the key question now is whether Teijin is quietly undervalued or whether the market has already priced in any recovery.

Most Popular Narrative: 5.6% Overvalued

With Teijin closing at ¥1,316 against a narrative fair value of ¥1,246, the market is leaning slightly richer than the long term model suggests.

Ongoing introduction of cost reforms including workforce realignment, impairment related fixed cost reductions, and optimization of production should support gross margin expansion and enable Teijin to partially offset industry price pressures and demand volatility, leading to improved earnings resilience.

Curious how shrinking revenues can still support a richer future earnings multiple and a stable margin profile. Want to see which long range profit assumptions make that math work.

Result: Fair Value of ¥1,246 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, structural pressure in aramid and carbon fibers, alongside ongoing healthcare pricing headwinds, could easily derail the margin recovery that this thesis leans on.

Find out about the key risks to this Teijin narrative.

Another View: Ratios Point to a Discount

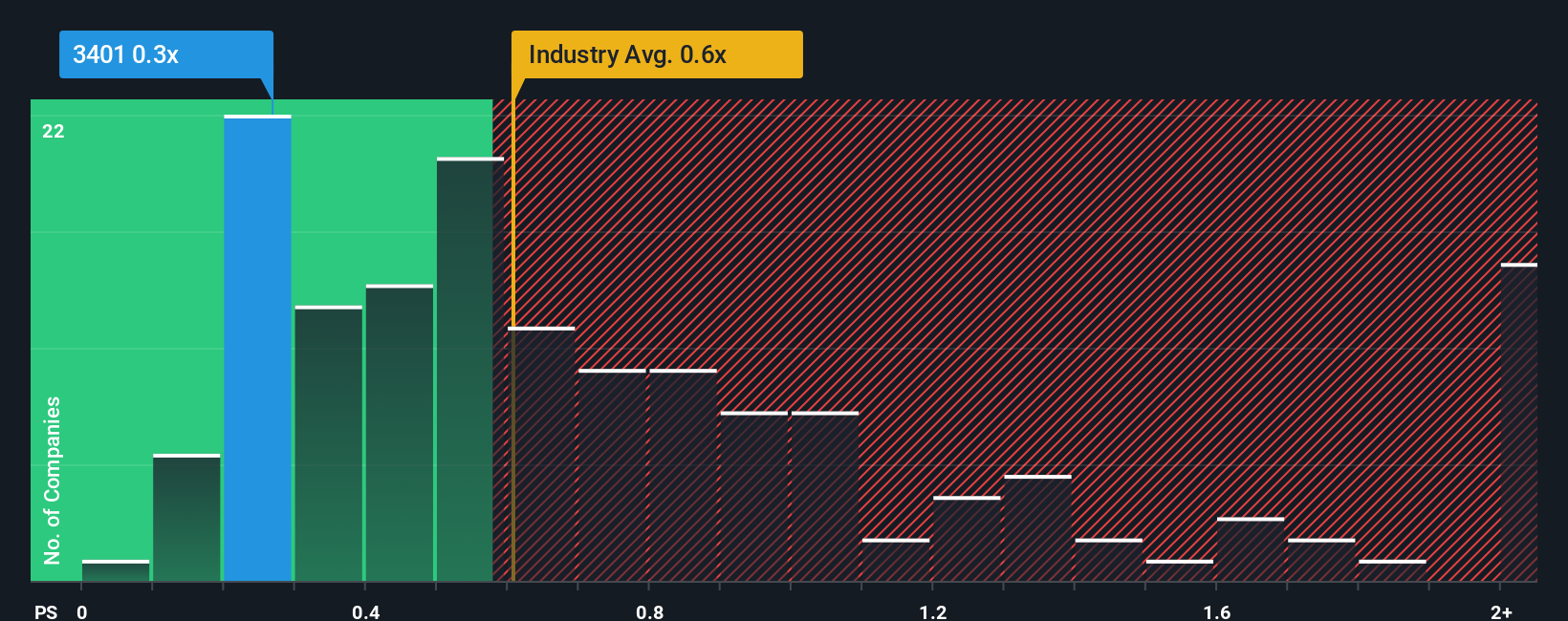

While the narrative fair value suggests Teijin is about 5.6 percent overvalued, its price to sales ratio of 0.3 times compared with 0.6 times for both peers and the industry, and a fair ratio of 0.6 times, tells a different story of marked undervaluation.

That gap implies the market is pricing in a lot of execution risk, but also leaves room for upside if earnings stabilise and sentiment turns. The question is whether this represents a value trap or an overlooked recovery play.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Teijin Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes. Do it your way.

A great starting point for your Teijin research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move

Before you move on, consider your next high conviction idea with hand picked stock lists designed to surface opportunities you may not want to miss.

- Target stronger income potential by scanning these 13 dividend stocks with yields > 3% that can help underpin your returns with reliable cash flows.

- Explore structural trends by zeroing in on these 26 AI penny stocks positioned to benefit from adoption of intelligent technologies.

- Position yourself ahead of the crowd by focusing on these 80 cryptocurrency and blockchain stocks that are building the infrastructure for digital finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal