3 European Stocks Estimated To Be Undervalued By Up To 49.8%

As European markets show mixed performance with the pan-European STOXX Europe 600 Index ending slightly lower, investors are closely watching the European Central Bank's potential policy moves amid economic resilience. In this environment, identifying undervalued stocks can be a strategic approach for investors seeking opportunities, particularly when economic data and central bank decisions create fluctuations in market valuations.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| YIT Oyj (HLSE:YIT) | €3.016 | €5.96 | 49.4% |

| Straumann Holding (SWX:STMN) | CHF95.76 | CHF187.84 | 49% |

| Ottobock SE KGaA (XTRA:OBCK) | €69.65 | €138.89 | 49.9% |

| Kitron (OB:KIT) | NOK67.70 | NOK135.14 | 49.9% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.395 | €0.78 | 49.2% |

| Exail Technologies (ENXTPA:EXA) | €86.70 | €170.21 | 49.1% |

| Esautomotion (BIT:ESAU) | €3.12 | €6.14 | 49.2% |

| Digital Workforce Services Oyj (HLSE:DWF) | €2.57 | €5.07 | 49.3% |

| Cyber_Folks (WSE:CBF) | PLN205.00 | PLN408.69 | 49.8% |

| CCC (WSE:CCC) | PLN126.15 | PLN250.26 | 49.6% |

Let's take a closer look at a couple of our picks from the screened companies.

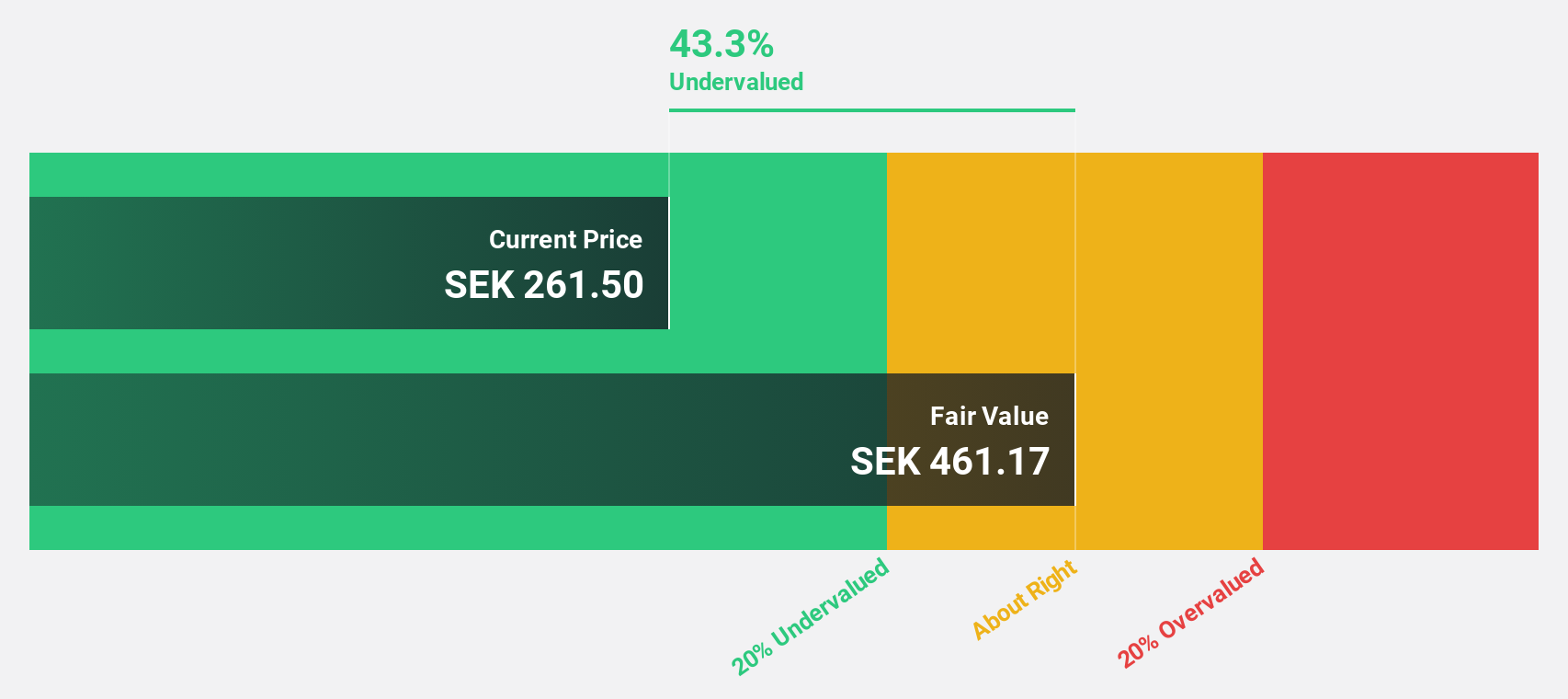

Axfood (OM:AXFO)

Overview: Axfood AB (publ) operates in the food retail and wholesale sectors primarily in Sweden, with a market cap of SEK58.60 billion.

Operations: The company's revenue is derived from several segments, including Dagab at SEK79.66 billion, Willys at SEK47.97 billion, Hemköp at SEK8.24 billion, and Snabbgross at SEK5.77 billion.

Estimated Discount To Fair Value: 41.7%

Axfood AB's recent earnings report shows stable performance with an increase in Q3 sales to SEK 22.29 billion, up from SEK 20.90 billion the previous year. Despite a slight dip in nine-month net income, Axfood remains undervalued based on discounted cash flow analysis, trading at SEK 271.4, significantly below its estimated fair value of SEK 465.23. Forecasts indicate moderate revenue growth and robust earnings expansion outpacing the Swedish market average, supporting its undervaluation status.

- Our earnings growth report unveils the potential for significant increases in Axfood's future results.

- Delve into the full analysis health report here for a deeper understanding of Axfood.

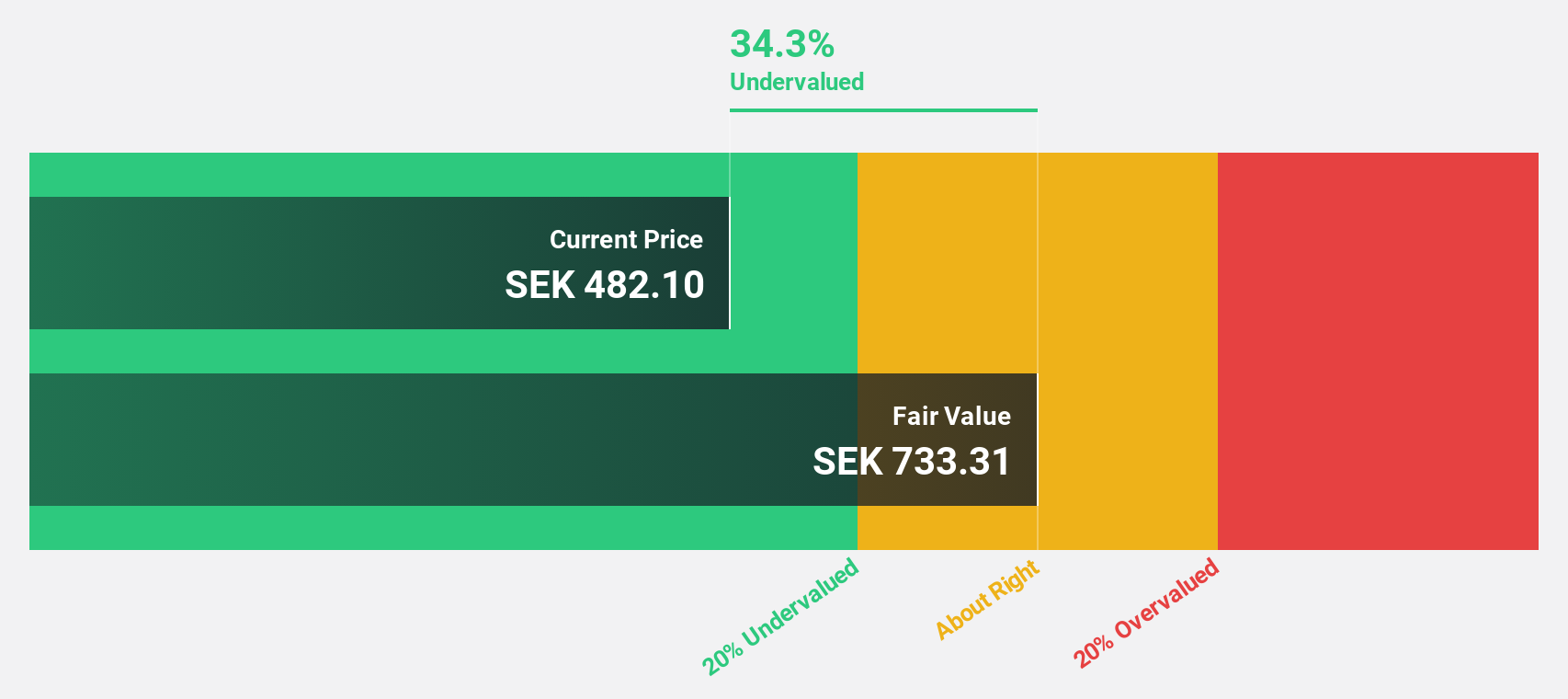

Boliden (OM:BOL)

Overview: Boliden AB (publ) is involved in the extraction, production, and recycling of base metals across Sweden, Finland, the Nordic region, Germany, the UK, Europe, North America, and internationally with a market cap of approximately SEK138.31 billion.

Operations: The company's revenue is primarily derived from its Smelters segment, generating SEK86.45 billion, followed by the Mines segment with SEK26.62 billion.

Estimated Discount To Fair Value: 33.6%

Boliden AB's recent financial results show a slight dip in Q3 sales to SEK 21.97 billion from SEK 22.19 billion the previous year, while net income remained stable at SEK 2.29 billion. Despite these figures, Boliden is trading significantly below its estimated fair value of SEK 733.26 per share, with current trading at SEK 487.1, indicating undervaluation based on discounted cash flow analysis. Earnings are expected to grow substantially over the next three years, outpacing both revenue growth and the Swedish market average.

- The analysis detailed in our Boliden growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Boliden.

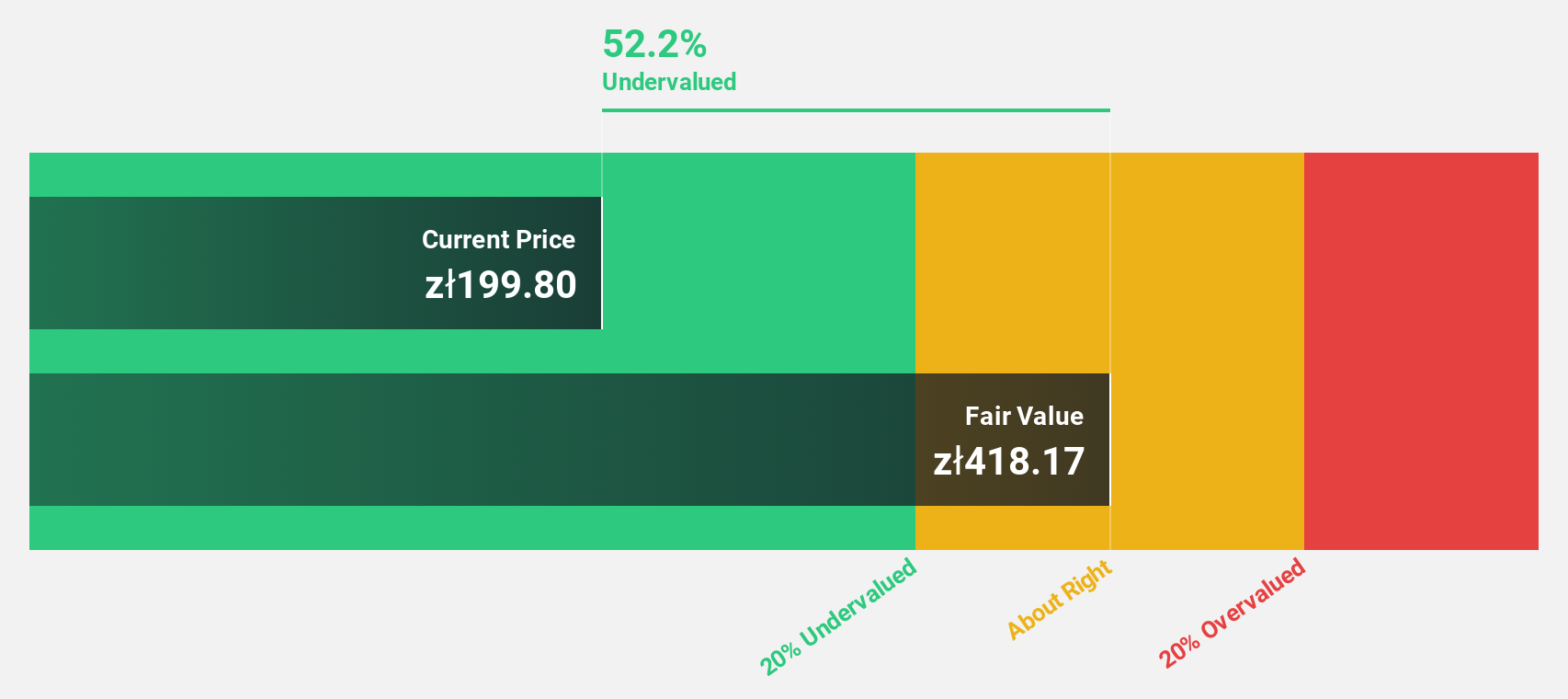

Cyber_Folks (WSE:CBF)

Overview: Cyber_Folks S.A. is a global technology company with a market cap of PLN3.13 billion.

Operations: The company's revenue segments include VERCOM at PLN472 million, Corporate at PLN1.83 million, E-Commerce at PLN144.09 million, and Cyber_Folks at PLN176.49 million.

Estimated Discount To Fair Value: 49.8%

Cyber_Folks is trading at PLN 205, significantly below its estimated fair value of PLN 408.69, highlighting its undervaluation based on discounted cash flow analysis. Despite a decline in profit margins from 19% to 7.6%, earnings are forecasted to grow substantially at 40.7% per year, outpacing the Polish market's growth rate. However, recent financial results show a decrease in net income for Q3 and nine months ended September 2025 compared to the previous year.

- According our earnings growth report, there's an indication that Cyber_Folks might be ready to expand.

- Unlock comprehensive insights into our analysis of Cyber_Folks stock in this financial health report.

Taking Advantage

- Explore the 195 names from our Undervalued European Stocks Based On Cash Flows screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal