Independence Realty Trust (IRT): Valuation Check After Dividend Declaration, Soft Q3 2025 Earnings and Analyst Downgrade

Independence Realty Trust (IRT) is back on investors radar after its Board approved a fourth quarter dividend of $0.17 per share, even as softer Q3 earnings and a recent downgrade temper the near term outlook.

See our latest analysis for Independence Realty Trust.

At a share price of $16.99, Independence Realty Trust has seen a modest pick up in short term momentum, with recent positive share price returns contrasting with a still negative year to date share price performance, while longer term total shareholder returns remain solidly positive.

If you are weighing IRT’s income profile against growthier ideas, it could also be a good moment to explore fast growing stocks with high insider ownership for other compelling opportunities on your radar.

With the stock still down double digits year to date but trading at a notable discount to analyst targets, is Independence Realty Trust quietly undervalued here, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 17.4% Undervalued

With Independence Realty Trust last closing at $16.99 versus a narrative fair value of about $20.57, the valuation hinges on powerful long term earnings assumptions.

Ongoing capital recycling selling older, higher CapEx assets to acquire newer, lower CapEx communities with higher growth profiles in high demand regions allows IRT to enhance portfolio quality, capture operating synergies, and improve overall net margins and earnings growth potential.

Curious how steady rent growth, expanding margins, and a richer portfolio supposedly add up to this valuation gap? See which specific profit and revenue assumptions are doing the heavy lifting behind that fair value call.

Result: Fair Value of $20.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent Sun Belt oversupply and aggressive concessions on new Class A rentals could cap rent growth, challenging the upside implied in current forecasts.

Find out about the key risks to this Independence Realty Trust narrative.

Another View, Market Ratio Signals Caution

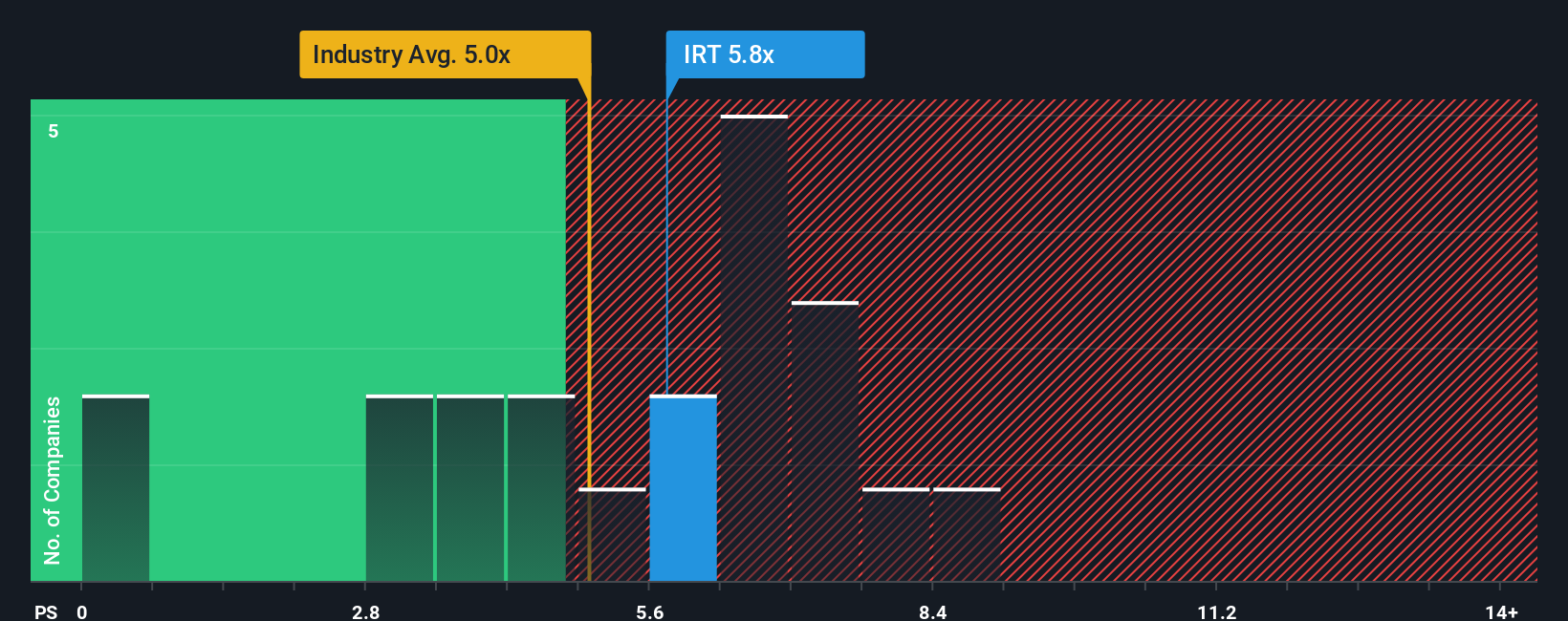

While the narrative points to Independence Realty Trust trading at an attractive 17.4 percent discount to fair value, the price to sales ratio paints a tighter picture, at 6.1 times versus a fair ratio of 4.4 times and an industry average of 5 times, implying less obvious upside and more valuation risk if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Independence Realty Trust Narrative

If you would rather review the numbers yourself and challenge these assumptions, you can build a personalized Independence Realty Trust storyline in minutes: Do it your way.

A great starting point for your Independence Realty Trust research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about sharpening your next move, use the Simply Wall Street Screener now so you are not left watching others capture the upside.

- Pinpoint high potential, mispriced businesses by checking out these 908 undervalued stocks based on cash flows and see which names the market has not fully appreciated yet.

- Capitalize on structural shifts in technology by scanning these 26 AI penny stocks that could benefit most as artificial intelligence adoption accelerates worldwide.

- Strengthen your income stream by targeting these 13 dividend stocks with yields > 3% that may offer more reliable cash returns than the broader market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal